Overview of term insurance

Term insurance is a straightforward form of life insurance that provides coverage for a specified period. If the insured person passes away during this term, their beneficiaries receive a death benefit. It’s an essential financial safety net that offers peace of mind.lets learn about Introduction to Term Insurance and Tax Benefits.

Importance of understanding tax benefits

Knowing the tax benefits associated with term insurance is crucial. It not only provides financial security to your family but also offers attractive tax-saving opportunities. This understanding can help you effectively reduce your taxable income, ultimately saving you money.

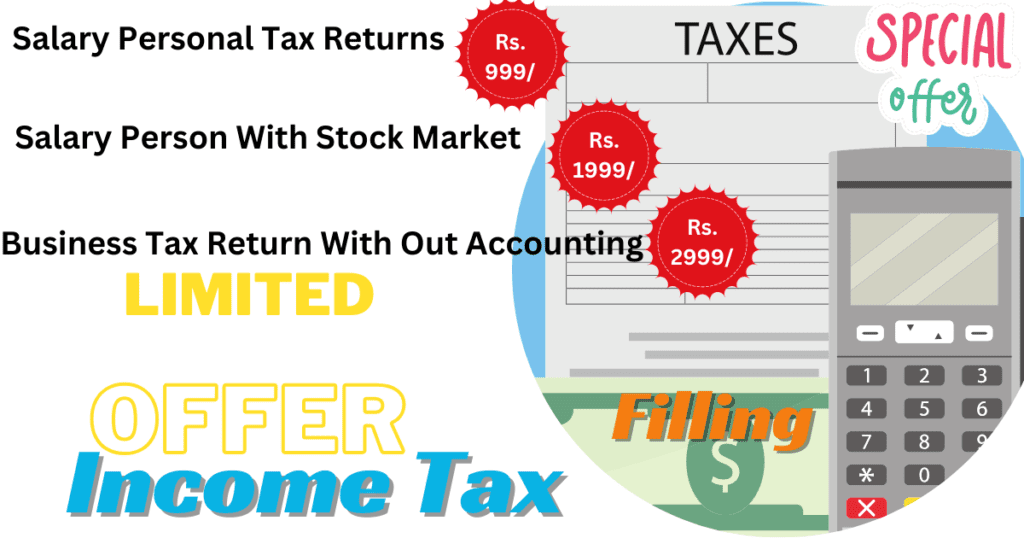

Brief explanation of Sections 80C and 80D

Sections 80C and 80D of the Income Tax Act, 1961, allow individuals to claim deductions on premiums paid for term insurance. Section 80C offers a deduction up to ₹1.5 lakh for life insurance premiums, while Section 80D provides additional benefits for premiums paid on health-related riders or separate health insurance.

Introduction to Term Insurance and Tax Benefits : under Section 80C

Eligibility criteria for tax deductions

Under Section 80C of the Income Tax Act, Indian residents can avail of tax deductions on various investments and payments, one of which includes the premium paid on term insurance policies. To be eligible for these deductions, the term insurance policy must be taken in the name of the taxpayer, their spouse, or their children. The policy must also comply with certain conditions set by the Income Tax Department. For policies issued after April 1, 2012, the premium must not exceed 10% of the sum assured to qualify for deductions.

Maximum deduction limit under Section 80C

The maximum deduction limit under Section 80C is ₹1.5 lakh in a financial year. This limit is the cumulative cap for all investments and payments qualifying under this section, which includes not just term insurance premiums but also investments in Public Provident Fund (PPF), Equity Linked Saving Schemes (ELSS), National Saving Certificate (NSC), and principal repayments on housing loans, among others.

Role of term insurance in tax savings

Term insurance plays a pivotal role in tax savings under Section 80C. When you purchase a term insurance policy, the premium you pay towards it can significantly reduce your taxable income, thus lowering your tax liability. This makes term insurance not just a tool for financial security but also an effective instrument for tax planning. Since the premium for term insurance is usually lower compared to other life insurance products, it allows policyholders to enjoy substantial coverage at an affordable cost while availing tax benefits.

Examples of possible tax savings using term insurance

– Let’s say Mr. A pays a premium of ₹20,000 annually for his term insurance policy. If his total taxable income is ₹7,50,000, the premium amount can be deducted from his income, making it ₹7,30,000, which could move him to a lower tax bracket, resulting in less tax payable.

– Similarly, if Mrs. B has a taxable income of ₹10,00,000 and pays an annual premium of ₹15,000 for term insurance, her taxable income reduces to ₹9,85,000. Depending on her overall deductions under Section 80C, she could also fall into a lower tax slab or significantly reduce her tax liability.

Examining Tax Benefits under Section 80D

Scope of tax deductions under Section 80D

Section 80D of the Income Tax Act offers tax deductions for premiums paid on health insurance policies, including medical insurance for oneself, spouse, dependent children, and parents. Unlike term insurance, which falls under Section 80C, the benefits of premiums paid towards health-related insurance products are covered under this section. This provision encourages individuals to secure health coverage while providing them with tax-saving opportunities.

Differentiating between individual and family policies

The tax deductions under Section 80D depend on whether the insurance policy is for an individual or covers family members. An individual can claim a deduction for the premium paid for themselves, their spouse, and dependent children. Additionally, an extra deduction is available for premiums paid on health policies for parents, whether dependent or not. This distinction allows for increased deductions if one opts to cover more family members under health insurance policies.

Maximum deduction limit under Section 80D

For the financial year 2021-2022, the maximum deduction limit under Section 80D is ₹25,000 for premiums paid for self, spouse, and dependent children. An additional deduction up to ₹25,000 is allowed for premiums paid for parent(s). If the parents are senior citizens (aged 60 years and above), the deduction limit increases to ₹50,000. Therefore, a taxpayer can potentially claim a total deduction of up to ₹75,000 (₹25,000 + ₹50,000) under this section. For senior citizens purchasing health insurance for themselves, the deduction limit is also ₹50,000.

How term insurance complements health insurance for tax savings

While term insurance and health insurance serve different purposes, together, they create a comprehensive financial safety net for individuals and their families. From a tax-saving perspective, these two types of insurances complement each other beautifully under the Income Tax Act. A taxpayer can enjoy the dual benefit of securing their family’s future and health while optimizing their tax savings.

By investing in both term and health insurance, one can avail of deductions under both Section 80C and Section 80D, maximizing their tax-saving potential. For instance, if an individual pays ₹20,000 towards term insurance (under Section 80C) and ₹24,000 towards health insurance (under Section 80D for self and family), they can reduce their taxable income by ₹44,000, leading to substantial tax savings.

In summary, understanding and utilizing the tax benefits offered under Sections 80C and 80D for term and health insurance, respectively, is a smart strategy for financial planning. Not only do these provisions incentivize securing one’s financial future and health, but they also provide relief from tax liabilities, enhancing one’s overall financial well-being.

Exploring Other Tax Saving Options

While term insurance offers significant tax benefits under Sections 80C and 80D of the Income Tax Act, it’s wise to compare it with other tax saving options available. Investments like Public Provident Fund (PPF), National Savings Certificate (NSC), Equity Linked Savings Scheme (ELSS), and traditional life insurance policies also provide tax advantages. Each of these options comes with its own set of features, benefits, and limitations. For example, PPF offers a secure investment route with tax-free interest but has a lock-in period of 15 years, whereas ELSS has a shorter lock-in period but involves a higher risk due to its link to the equity market.

Comparing term insurance with other tax saving investments

When comparing term insurance to other tax-saving investments, it’s essential to consider factors like the lock-in period, the potential return on investment, the risk involved, and the liquidity of the investment. Term insurance, being a pure protection plan, primarily offers a death benefit but stands out for its lower premium and significant tax benefits. On the other hand, investments like PPF and ELSS not only provide tax savings under Section 80C but also grow your investment over time, though they come with their own set of conditions regarding lock-in periods and risk factors.

Advantages of term insurance over traditional tax saving schemes

Term insurance offers several advantages over traditional tax saving schemes. Firstly, it provides a high sum assured at a low premium, making it a cost-effective way to secure your family’s financial future. Secondly, the premiums paid towards term insurance are eligible for a deduction under Section 80C up to Rs. 1.5 lakh, similar to many savings schemes but with the added benefit of life cover. Additionally, the maturity benefits from term insurance with return of premium plans and the death benefit are generally tax-free under Section 10(10D), providing a tax-efficient return on investment.

Additional benefits of term insurance apart from tax savings

Apart from substantial tax savings, term insurance offers several other benefits. It provides financial security to the policyholder’s family in the event of their untimely demise, ensuring their future is secure even in their absence. Many term plans also come with riders or additional cover options like critical illness cover, accidental death benefit, which enhance the protection offered by the policy. Plus, the simplicity and flexibility of choosing the term length, coverage amount, and premium payment options make term insurance a versatile financial tool.

Tips for Maximizing Tax Savings with Term Insurance

To leverage the full potential of term insurance for tax savings, it’s crucial to consider various factors while selecting the right policy. Besides looking at the tax benefits, one should also assess the coverage, premium, and policy terms to ensure that it meets their financial goals and family’s security needs.

Factors to consider while choosing term insurance for tax benefits

When selecting term insurance for maximum tax savings, consider the insurer’s reliability and claim settlement ratio, as these indicate the ease with which your family can claim the insurance. The coverage amount should be adequate to cover your family’s future financial needs, keeping in mind inflation and lifestyle changes. Additionally, policy terms should be aligned with your long-term financial goals. Opting for plans that offer additional benefits like terminal illness cover or premium waivers can also enhance the value you get from your term insurance policy.

Optimal coverage and premium payment options

Choosing the right coverage amount is vital—it should be enough to cover your debts, provide for your family’s lifestyle needs, and support any future expenses like children’s education. A thumb rule often used is to have a cover that is 10 to 15 times your annual income. Premium payment flexibility is another consideration; insurers offer various payment options like single premium, regular pay, or limited pay, where you can choose based on your financial planning. Some policies allow altering the premium payment term and frequency, offering further convenience and adaptability.

Importance of maintaining proper documentation for tax assessment

Proper documentation is key to claiming the tax benefits offered by term insurance without hassle. Ensure you keep the policy document, premium receipts, and any other related documents safely and accessible for when you file your income tax returns. In case of queries or audits from the income tax department, these documents will serve as proof of the term insurance policy and the premiums paid. Digital copies of these documents can also be handy, provided they are kept secure and backed up.

In conclusion, term insurance not only provides a financial safety net for your family but also offers significant tax savings under Sections 80C and 80D. By understanding and comparing it with other tax-saving options, assessing its advantages, and following tips to maximize tax savings, you can make an informed decision that secures your family’s future and optimizes your tax situation. Always remember, the goal is to balance the tax benefits with the coverage needs, ensuring that tax savings do not come at the cost of inadequate protection. Proper documentation and a thorough understanding of the policy you choose will help you make the most of the tax benefits available through term insurance.

Common Misconceptions about Term Insurance Tax Benefits

Navigating through the twists and turns of tax benefits associated with term insurance can often lead to misunderstandings and misconceptions. It’s like trying to find your way through a dense fog without a clear map. Let’s lift that fog and shine a light on the truths behind some common myths to ensure you’re fully equipped to make the most of your term insurance and its tax-saving capabilities.

Debunking myths and misconceptions

A prevalent myth is that the tax benefits of term insurance are too complex and not worth the effort. However, this couldn’t be farther from the truth. In reality, understanding the tax benefits under Section 80C and Section 80D for term insurance is quite straightforward once you get the hang of it. Simply put, premiums paid towards term insurance can reduce your taxable income, leading to substantial tax savings. It’s a case of the right knowledge unlocking potential benefits that might otherwise go unclaimed.

Another widely held belief is that only the policyholder can avail of the tax benefits. This isn’t accurate. If you’re paying the premium for a policy on the life of your spouse or children, you’re equally eligible for tax deductions under Section 80C. The inclusivity of the policy allows for a broader application of benefits, providing financial relief to more individuals.

Addressing doubts regarding eligibility and deductions

When it comes to eligibility and deductions, many individuals find themselves at a crossroads, uncertain about how much they can claim or who in their family qualifies for these benefits. It’s important to understand that the amount deductible under Section 80C, including your term insurance premium, is capped at 1.5 lakh INR per annum. This cap includes other investments and expenses eligible under the same section, so planning is key to maximizing your tax savings.

Regarding the eligibility, it’s essential to remember that only the premiums paid for policies in the name of the taxpayer, their spouse, or their children are eligible for deduction. This inclusivity encourages individuals to secure their family’s financial future while also benefiting from tax savings.

Clarifying misconceptions about term insurance premiums

There exists a common confusion that higher term insurance premiums always lead to better tax benefits. This is not necessarily true; the premium amount that qualifies for a deduction under Section 80C has an upper limit. Investing in a policy that suits your financial needs and goals, rather than one with the highest premium for the sake of tax deductions, is a wise approach.

Furthermore, it’s key to note that to remain eligible for these tax benefits, the premium must not exceed 10% of the sum assured for policies issued after April 1, 2012. This threshold ensures that policies remain an instrument for protection rather than tax evasion.

Additionally, it’s worth mentioning that any payouts or sum assured received upon maturity or death of the policyholder are also exempt from tax under Section 10(10D), provided certain conditions are met. This makes term insurance not only a tool for saving on taxes but also a means to provide financial security to your loved ones without adding to their tax burden.

By understanding and debunking these common misconceptions, you can navigate the tax benefits of term insurance with greater confidence and clarity, ensuring you make informed decisions that optimize your and your family’s financial well-being.

Conclusion

Summary of key points discussed in the blog

In this blog, we explored how term insurance offers significant tax benefits under Sections 80C & 80D. We saw that premiums paid for term insurance are deductible from your gross income, leading to substantial tax savings. Also, we touched on the additional health-related benefits under Section 80D when you opt for riders or a health component in your term insurance.

Importance of understanding tax benefits of term insurance

Understanding these tax benefits is crucial because it not only reduces your tax liability but also encourages the culture of saving and planning for the future. Being well-informed can help you make smarter financial decisions and leverage term insurance for both protection and tax-saving benefits.

Encouragement to explore term insurance as a tax-saving option

We encourage everyone to consider term insurance not just as a protective measure for their loved ones, but also as an efficient tax-saving tool. With the dual benefits it offers, term insurance stands out as an attractive option for those looking to save on taxes while securing their family’s financial future. So, don’t wait; explore term insurance today and make it a part of your financial planning.