how to apply credit card with Paisabazzar

Are you dreaming about that piece of plastic magic called a credit card but don’t know where to start? Oh boy, are you in for a treat! Paisabazaar, a one-stop shop for all your credit card desires, is here to transform that dream into reality. Whether you’re after the perks of cashbacks, looking for those miles to fly high, or simply want to manage your finances better,how to apply credit card with Paisabazzar is as easy as pie.

With an online application platform that’s as friendly as your neighborhood barista, you’re only a few clicks away from getting your hands on some splendid credit card benefits. So, buckle up and let’s dive into the world of easy, breezy, and beneficial credit card applications with Paisabazaar.

Benefits of Applying for a Credit Card with Paisabazaar

When you’re in the market for a new credit card, the process can sometimes feel overwhelming. With so many options and offers out there, how do you know which one is right for you? This is where Paisabazaar steps in, making the credit card application process not just easier, but also more beneficial for applicants. Let’s dive into some of the standout benefits of applying for a credit card through Paisabazaar.

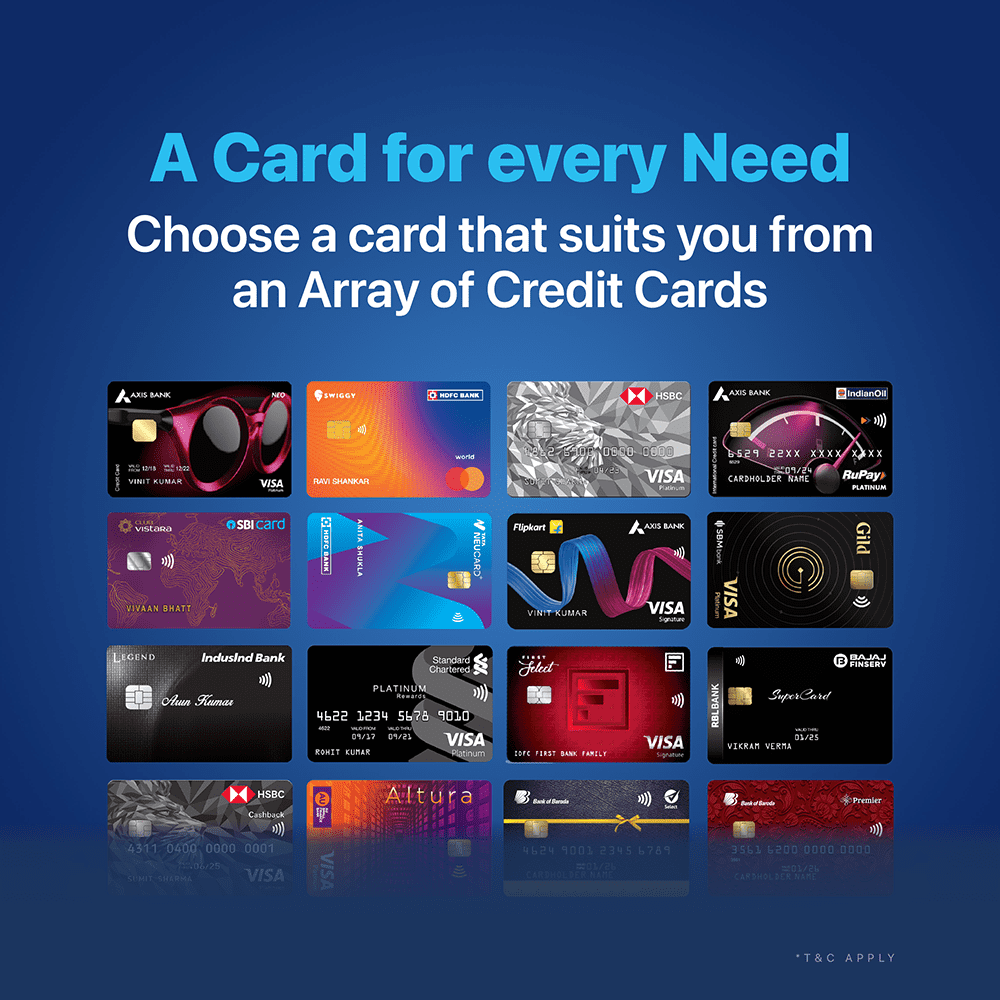

Wide Range of Options

One of the most compelling reasons to use Paisabazaar for your credit card needs is the broad spectrum of options available. Whether you’re looking for a card that offers the best travel rewards, cash back on purchases, or low interest rates, Paisabazaar aggregates offerings from multiple banks and financial institutions. This comprehensive approach enables you to compare cards side-by-side, ensuring you find one that fits your spending habits and lifestyle perfectly. Instead of visiting several banks or their websites individually, you get a one-stop-shop experience that saves you time and energy.

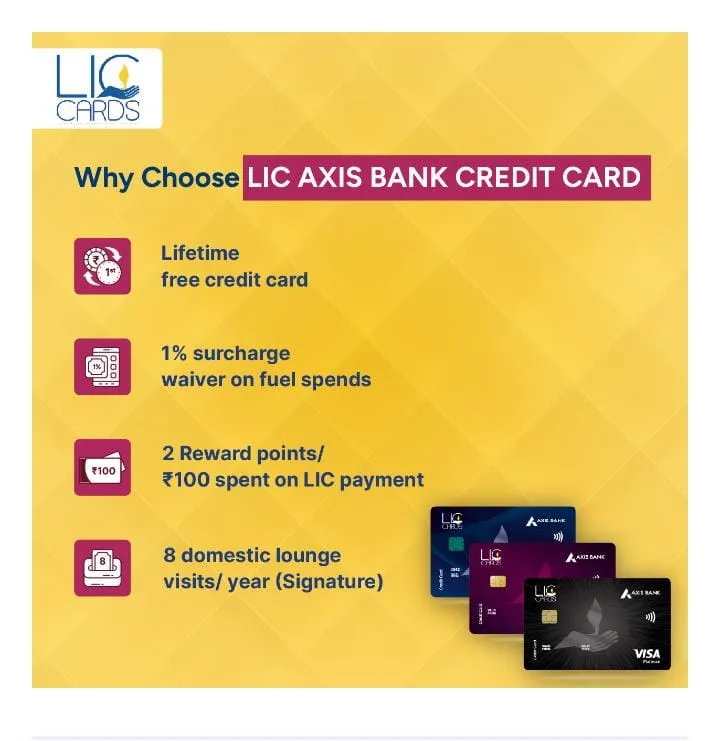

Exclusive Offers and Rewards

Another fantastic perk of applying through Paisabazaar is access to exclusive offers and rewards that you might not find anywhere else. Because of the partnerships and collaborations that Paisabazaar has with a variety of banks and credit card companies, they often feature deals that are tailored to suit the needs and preferences of a broad array of customers. From additional points or cashback bonuses upon signing up to waived annual fees, these exclusive deals enhance the value of your credit card from the get-go. It’s like getting VIP access to the best possible rewards and benefits just by choosing to apply through their platform.

Steps to Apply for a Credit Card with Paisabazaar

Now that we’ve gone over some of the advantages of using Paisabazaar for your credit card application, let’s walk through the steps involved in the process. Applying for a credit card through Paisabazaar is straightforward, user-friendly, and can be done entirely online from the comfort of your home.

Creating an Account

The first step in your journey to getting a new credit card is to create an account on Paisabazaar’s website. This is a simple process that requires you to provide some basic personal information. You’ll need to enter your name, phone number, and email address, and set up a password. Once your account is created, you’ll have access to a personalized dashboard where you can view and compare different credit cards, track your application’s status, and explore exclusive offers.

Selecting the Right Card

After your account is set up, the next step is to select the right credit card. This might initially seem daunting due to the plethora of options available, but Paisabazaar makes it easy for you. Utilize their comparison tools and filters to narrow down your choices based on your preferences for annual fee, rewards type, interest rates, and more. If you’re unsure about what’s most important to you in a credit card, Paisabazaar also offers helpful guides and articles to educate you on different aspects of credit cards, helping you make an informed decision.

On the platform, you can also find user reviews and ratings for different cards, which can provide valuable insights from actual cardholders. Taking the time to research and select the card that best fits your needs will ensure you’re not only approved but also happy with your choice in the long run.

Filling Out the Application Form

Once you’ve chosen the credit card that best suits your needs, the final step is to fill out the application form. This process has been designed to be as hassle-free as possible. Paisabazaar will prompt you to enter more detailed personal information, including your employment status, annual income, and any existing bank relationships. It’s important to be as accurate and truthful as possible during this step to ensure that your application is not delayed or rejected.

After submitting your application, Paisabazaar will process it and forward it to the respective bank or credit card issuer for approval. You can track the status of your application through your Paisabazaar account, and in most cases, you’ll receive an update within a few days. Once approved, your new credit card will be mailed to you, and you’ll be ready to start enjoying its benefits.

Applying for a credit card doesn’t have to be an intimidating or time-consuming process. With Paisabazaar, you have a user-friendly, efficient, and beneficial way to find and apply for the perfect credit card. From the wide range of options and exclusive offers to the straightforward online application process, Paisabazaar simplifies what could otherwise be a complicated journey. So why wait? Explore your credit card options with Paisabazaar today and unlock a world of financial possibilities and rewards.

Documents Required for Credit Card Application

Applying for a credit card through Paisabazaar is not just about clicking a few buttons. You need to have the right documents handy to ensure a smooth process. Let’s dive into what you’ll need to gather before starting your application.

Proof of Identity

First up, you’ll need something that unmistakably proves you are who you say you are. Here are the items that can serve as your proof of identity:

– A valid passport: This is perhaps the most widely accepted form of identification across the globe.

– Aadhaar card: For Indian applicants, this serves as a handy form of identification.

– Voter ID card: Another document that’s easily accessible for most people.

– PAN card: Though primarily for tax purposes, it’s accepted as proof of identity for credit card applications.

– Driver’s License: This not only proves your identity but also your legal age and address in some cases.

Make sure whichever document you choose is current and all the details are clearly visible.

Proof of Address

Next, you’ll need to prove where you live. This is crucial for banks and financial institutions to have on record. Consider using one of the following documents:

– Recent utility bills: A bill for your electricity, water, or gas that’s not older than three months can work well.

– Bank account statements: If it has your address, a bank statement can serve dual purposes.

– Aadhaar card: Yes, it’s here again because it also serves as proof of residency.

– Passport: If your current residence address is the one mentioned in your passport, it’s valid here too.

– Lease agreement: For those renting their homes, a lease agreement can be provided as proof of address.

Ensure that the document you choose has your name and current address clearly mentioned.

Income Proof

Lastly, financial institutions will want to know if you have the means to pay back any credit you use. Here are the documents you can use:

– Salary slips: The most common proof, usually for the last three months.

– Income Tax Returns (ITR): Providing your ITR from the last two years can give a good indication of your financial health.

– Bank statements: Showing consistent income over the past six months can also be helpful.

– Form 16: Issued by your employer, it provides a summary of the taxes deducted from your salary.

These documents help lenders assess your financial stability and decide on your credit limit.

Key Factors to Consider Before Applying

Before you dash off to fill in your application, there are a few crucial factors you should consider. These will not only impact your chances of approval but also affect your overall credit card experience.

Credit Score

Your credit score is like a financial report card that lenders look at when you apply for credit. Here’s what you need to know:

– A high credit score (above 750) usually means you’re a low-risk borrower, which can lead to better credit card offers with lower interest rates.

– If your credit score is lower, consider steps to improve it before applying, like paying off existing debts or correcting any inaccuracies in your credit report.

Checking your credit score periodically can help you stay on top of your financial health.

Fees and Charges

Nobody likes nasty surprises when it comes to fees, so here’s what to look out for:

– Annual fees: Some credit cards charge a yearly fee just for having the card. Weigh if the benefits outweigh these fees.

– Over-the-limit fees: Spending more than your credit limit can lead to hefty charges. Knowing these fees can help avoid them.

– Late payment fees: Late payments not only incur fees but can also negatively impact your credit score. Always strive to pay on time.

– Foreign transaction fees: If you travel abroad or shop from international websites, knowing the foreign transaction fees is crucial.

Understanding all possible fees can help you choose a credit card that fits your financial situation best.

Interest Rates

The interest rate, or Annual Percentage Rate (APR), can greatly affect how much you pay for carrying a balance:

– Look for cards with competitive interest rates. Sometimes, cards with lower interest rates might have fewer benefits or rewards, so balance your needs.

– Understand the difference between fixed and variable rates. Fixed rates stay the same, while variable rates can change based on the prime rate.

– Some cards offer introductory rates, which are lower rates for a set period at the start of your account. Just make sure to check what the rate will jump to after the promotional period.

By considering these factors, you’re not just applying for any credit card; you’re applying for the right credit card. Taking these steps ensures you make an informed decision that benefits your financial health in the long run. With your documents in order, a clear understanding of your financial position, and knowledge of what to look out for, you’re well on your way to applying for a credit card via Paisabazaar that suits your needs.

Tips for a Successful Credit Card Application

Applying for a credit card can feel a bit like trying to solve a puzzle. With so many pieces like income, credit score, and various card benefits to consider, it’s no wonder some of us scratch our heads wondering where to begin. However, the process doesn’t have to be daunting. By paying attention to a few key areas, you can navigate the application process with ease, especially through an efficient platform like Paisabazaar. Here, we’ll dive into some vital tips that can help ensure your credit card application not only gets accepted but also lands you a card that fits your financial lifestyle perfectly.

Maintain a Good Credit Score

Your credit score is like your financial report card, summarizing your creditworthiness to potential lenders. It plays a pivotal role in not just whether you get approved for a credit card, but also in the kind of deals and interest rates you’ll receive. A good credit score typically starts from 700 upwards, though this can vary slightly between credit bureaus. Maintaining a score in this range or higher essentially tells lenders you’re responsible with your financial obligations, making them more likely to offer you credit.

So, how do you keep your credit score in the green? Here’s a quick checklist:

– Pay your bills on time, every time. Late payments can significantly dent your credit score.

– Keep your credit utilization low. This means you shouldn’t max out your credit lines. A good rule of thumb is to use less than 30% of your available credit.

– Regularly check your credit report for errors. Sometimes, inaccuracies can pull down your score, and correcting them can give your score a boost.

Review and Compare Cards

Not all credit cards are created equal, and what works for your best friend might not necessarily be the best option for you. Before applying, spend some time reviewing and comparing different credit cards on Paisabazaar. Consider what matters most to you. Is it a low interest rate, rewards points, cashback, or maybe travel benefits?

Paisabazaar makes this comparison easy by listing cards from various banks, along with their benefits, rewards program details, fees, and interest rates. By comparing these factors side by side, you can narrow down your options to cards that align with your spending habits and financial goals.

Understand Terms and Conditions

Terms and conditions can often feel like they’re written in another language, with their fine print and financial jargon. However, understanding them is crucial to making an informed decision. This includes being clear about the interest rates, annual fees, penalty charges, and reward redemption conditions.

For example, a card might offer an attractively low-interest rate as an introductory offer, but this rate could skyrocket after the initial period. Similarly, a rewards card might come with a high annual fee, making it less worthwhile if you’re not a big spender. Reading the terms and conditions on Paisabazaar before applying can help you avoid such pitfalls and ensure you choose a card that’s truly beneficial.

By keeping these tips in mind – maintaining a good credit score, reviewing and comparing card options thoroughly, and understanding the terms and conditions – you’re setting yourself up for a successful credit card application through Paisabazaar. The right credit card not only makes your financial management easier but can also bring you a host of benefits tailored to your lifestyle. Happy applying!

Conclusion

Deciding to apply for a credit card through Paisabazaar can be a smart move that sets you up for financial flexibility and the potential to enjoy a myriad of benefits. The online application process offers you the convenience of exploring, comparing, and selecting the best credit card options from the comfort of your home.

Whether you’re aiming to earn rewards, cash back, or enjoy special discounts and offers, Paisabazaar‘s platform helps you navigate the complex world of credit cards with ease. Remember, a good credit card not only complements your spending habits but also aids in building your credit score when used responsibly. Dive into the world of credit cards with Paisabazaar and find the perfect match for your wallet!