iSelecting the perfect credit card can be challenging. All of us are searching for the “Top 15 Credit Card,” one that would provide us with lots of rewards, cashback, insurance coverage, and our favorite extras, like access to lounges at airports and train stations and golf lessons. Many of us would like to be able to use all of these services for free. This is an unrealistic expectation, though, as card issuers cannot afford to charge a small or no cost for a credit card that offers such rewards.

Rather, they provide credit cards with several categories of rewards to accommodate people’s different spending patterns. There is no one credit card that is ideal for everyone because everyone has different preferences based on their own needs and spending habits. As a result, we have put up a list of the top credit cards on the Indian market to cater to various societal groups. Whether you’re searching for a premium or budget card, a lifetime free card or one with modest fees, or a card for online shopping or gas, these top 15 cards can be used for a variety of spending types. The finest credit cards available are those on our list of the greatest credit cards.

India’s Top 15 Credit Card List

Prior to applying for a credit card, think about the advantages you hope to receive. Do you want to sign up to save money on everyday expenses or, if you travel frequently, do you want to accrue more AirMiles and improve your trip by getting free access to airport lounges? As was previously noted, different credit card categories target distinct customer demographics, therefore having clear answers to these concerns is essential.

This list allows users to choose the credit card that best suits their needs when searching for a new, rewarding credit card.

AU Bank Credit Card

Get free insurance while making mobile purchases, get exciting and unlimited cashback, and receive prizes for milestones and welcomes. Access to airport lounges (limited versions)

AU SwipeUp Card

🤩 Get a Free Credit Card for Lifetime 💳Upgrade your current credit card’s features 🎖Get more reward points and a larger credit limit 💰Get special cashbacks

HDFC Shoppers Stop

🛍 ₹500 Retailers Once ₹3,000 is spent, stop the voucher 🤩 Free membership to Shoppers Stop 💳 Rupay Credit Card – UPI ♽️ Waiver of 1% fuel surcharge 💁🏻♀️ For every ₹150 spent, you can earn six First Citizen Points.

HDFC Credit Card

Benefits to be welcomed 🏁 Gift cards for monthly expenses ✈️ Free entrance to the airport lounge ✽ Waiver of fuel surcharge

IDFC First Bank credit card

Apply now for the best-in-class IDFC First Bank credit card, which offers lifetime free advantages and incentives.

Axis Bank credit card

Acquire thrilling incentives and cashback advantages 💳 Select from a variety of credit card choices ✈️ Receive free admission to airport lounges (certain options) ♽ Fuel surcharge waiver (certain versions)

LIC Axis Bank credit card

🎖 Two reward points for every ₹100 spent on LIC payments 💳 Free credit card for life ✈️ Eight trips to domestic lounges per year (Signature) ♰️ Waiver of 1% fee on fuel purchases

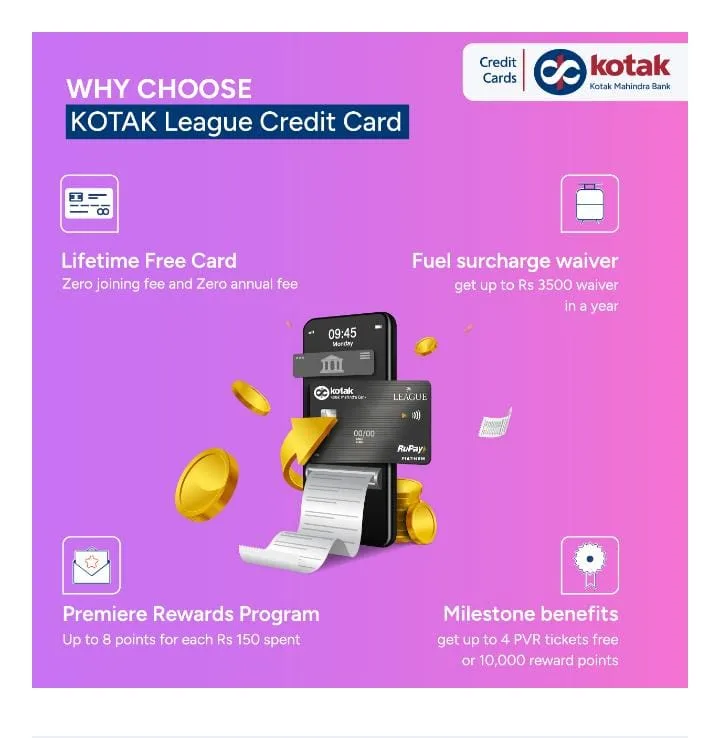

Kotak League Platinum card

🆓 Lifetime Free Card: no yearly or joining fees Enjoy up to 8 points in the Premiere Rewards Program for every ₹150 spend! 😊 Get a ₹3500 waiver on fuel surcharges per year 🎟 Milestone benefits: receive up to four complimentary PVR tickets or ten thousand reward points after spending ₹1,25,000 every six months.

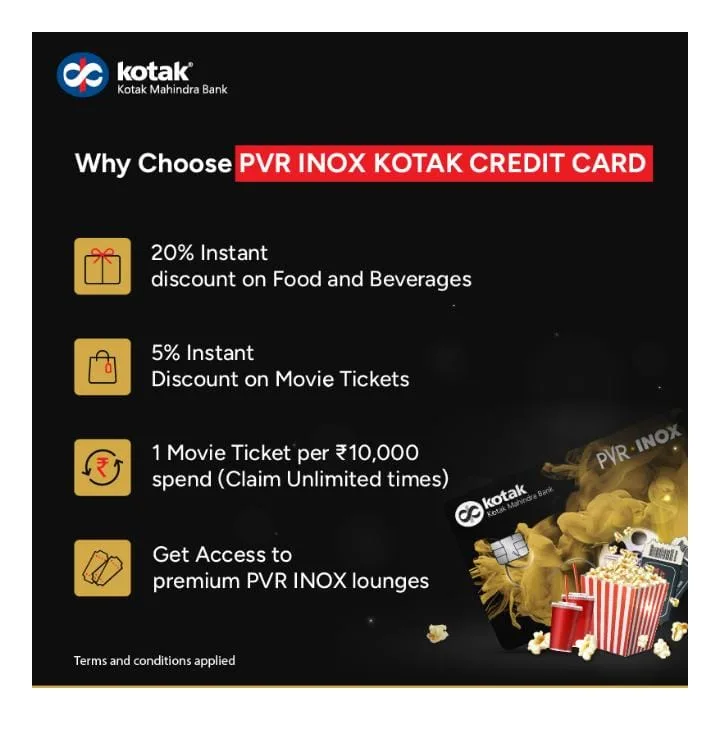

PVR Inox Kotak card

👌🏻 There is no joining charge 🍼 Get 20% Off on Food and Beverages Instantly 🎬 Get 5% instant discount on movie tickets 🎞 Purchase an unlimited number of tickets* – Get 1 movie ticket for every INR 10,000 spent 🏺 Gain entry to exclusive PVR INOX lounges.

Kotak India Oil Card

🤩 Earn reward points on transactions by connecting to UPI. Get 2% in rewards points on purchases made for groceries and dining. 1000 reward points are yours to enjoy upon paying ₹500. 🏆 Spend 5% less on petrol for Indian Oil.

Induslnd Credit Card

Get cashback and attractive reward points. 🏆 Points for rewards that never expire, redeemable at any time 🆓 ✈️ Indus Easy Credit Card: a free card for life Take advantage of free admission to airport lounges ♽ Waiver of fuel surcharge at all gas stations

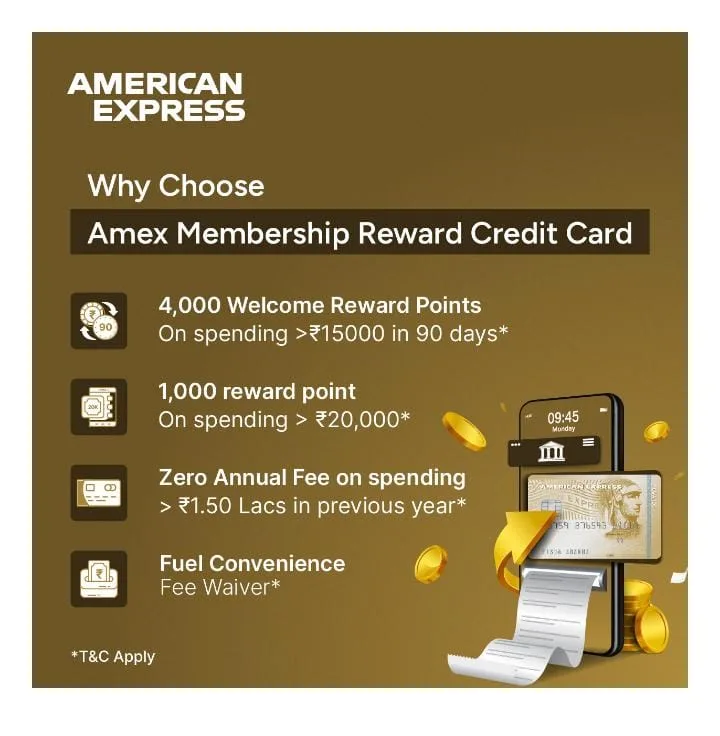

Amex Membership Card

4,000 Welcome Reward Points can be earned by spending ₹15,000 within 90 days. 1,000 reward points for ₹20,000 spent ♽️ Waiver of Fuel Convenience Fee: 0️⃣ 0 Annual Fee based on ₹1.50 Lacs spent the year prior

SBM Rupi Card

💯 100% Guaranteed Credit Card 🆓 Lifetime Free Credit Card 7️⃣ Get interest on fixed deposits of up to 7% p.a. 🛍 Savings on shopping, restaurants, lifestyle, and much more

Bajaj Finance RBL bank Card

🏅 Up to 800 reward points each month when spending ₹100 online (maximum cap) ✈️ Two domestic lounge visits annually (maximum 1) 📺 On any day of the month, get 1+1 on BookMyShow (up to 200 per month).

YES BANK Credit Card

Waiver of Fuel Surcharge 📱 A journey entirely digital and paperless 🙍 Earn cashback on groceries and shopping 🤩 incentives for paying bills

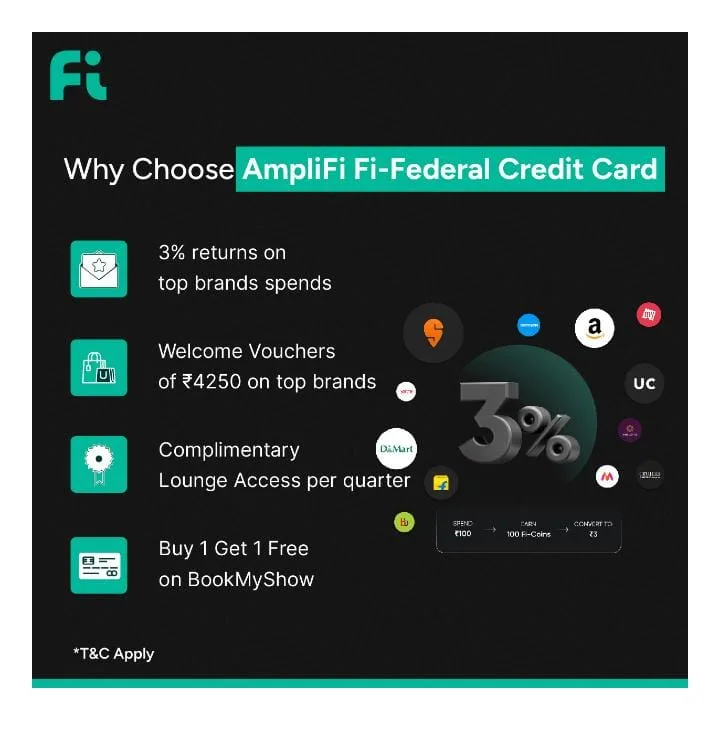

Amplifi Federal card

Waiver of Fuel Surcharge 📱 A journey entirely digital and paperless 🙍 Earn cashback on groceries and shopping 🤩 incentives for paying bills

CSB Bank Credit Card

💳 UPI Rupay Credit Card – Link to any UPI-app 💰 Lifetime Free Credit Card 2% guaranteed reward on certain category UPI purchases 👈 0.4% flat fee on all non-UPI expenses 🎁 A ₹250 welcome voucher

Things to Remember When Submitting a Credit Card Application?

Prior to applying for a new credit card, you need to have a specific set of requirements in mind. Depending on a person’s needs, financial habits, income, and—most importantly—why they are applying for the card, the requirements may vary. You can evaluate the top credit cards available in India in this way and select one for yourself.

Your Expenses

Consider the scenario when you are looking for a credit card that can help you cut down on your travel expenses. In that instance, you will value travel-related perks such as free airline tickets, frequent flyer club membership, and AirMiles more highly. If you care about enjoying your trip as much as possible, think about taking advantage of free lounge access at airports. On the other hand, you may not care as much about other amenities like free golf or discounts on restaurant bills.

Annual Fees

An additional crucial feature to consider when selecting a credit card is the yearly membership cost. While many credit cards are free for life, other premium credit cards have annual fees that can reach over Rs. 50,000; the American Express Platinum Credit Card, for instance, has an annual cost of Rs. 60,000. Instead of searching for a credit card that has no annual cost or one that is free for life, you should think about if and by how much the benefits of a certain card outweigh the annual charge.

Rewarding

When applying for a new credit card, this should be your first and most obvious consideration. It’s important to know if a credit card gives you Reward Points or cashback, which is deducted from your card’s statement balance later. In the latter scenario, redeeming reward points becomes an additional crucial factor.

The Method Used to Choose the Best Credit Cards in India

To create a list of the best credit cards in India, the CardInsider team has worked very hard to investigate the various cards that issuers and banks in the nation are offering. The top credit cards for the general public, fuel credit cards, and high-income credit cards are all on our list.

The most well-liked and, quite literally, the greatest cards in the nation have been handpicked by us. We have a card on our list that will work for everyone.

In summary

Selecting the finest credit card in India might be difficult if you don’t know just how much you need to spend. If that’s not the case, though, you need to assess your spending patterns first. To do that, you need to figure out what percentage of your credit card statement is accounted for by the different spend categories. You will find it easy to select the greatest credit card with the help of this info. Obviously, choosing a card that maximizes your benefits in your preferred spending category is preferable.