Savings accounts have long been seen as the “go-to” choice for storing money securely and accessing it when needed. People who are interested in building their investment portfolios also think that using a savings bank account is a solid and dependable option. Top Online Bank for savings accounts in India?

Both public and private sector banks in India give its clients the option to open a variety of savings accounts that are tailored to their individual needs. The interest rate on savings accounts varies from 2.50% to 7.00% annually, depending on the bank.

You should be aware of the many additional features and terms and conditions of your chosen bank on different savings accounts before opening an account. This article will allow us to highlited India’s Top Online Bank for Savings Accounts in india 2024 . So,Keep reading.

Top Online Bank for Savings Accounts : Open Your Account Online

I will share few bank they are provideing online account opening in india, So, Lets check below-

AU Bank Saving Account

Take action now! Open an AU Digital Savings Account to receive high interest rates up to 7.25%* annually. 🎁 225+ deals on the brands you love. 🆓 Unrestricted free online payments 🖥 With Video Banking, experience things like being at a branch.

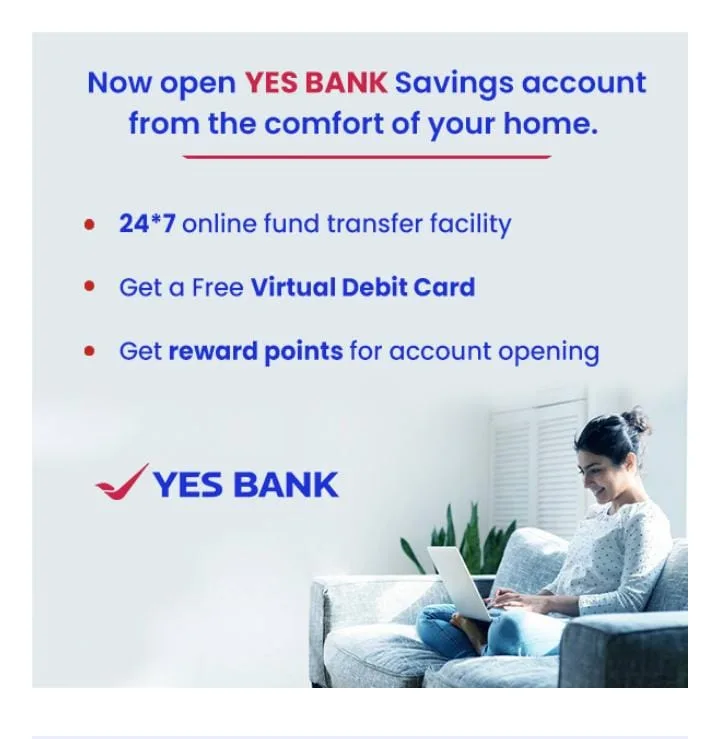

Yes Bank Savings account

Open a savings account with Yes Bank right now from the convenience of your own home. ☑️Free virtual debit card when opening an account ☑️Reward points for opening an account ☑️24/7 online fund transfer capability To continue, click below 👇

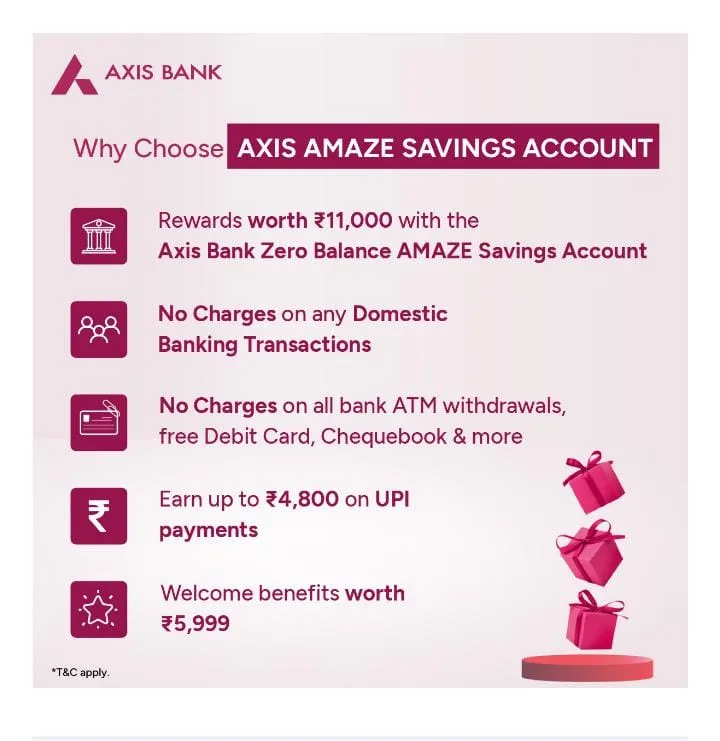

Axis Amaze Saving Account

0️⃣ Account with No Balance @ ₹200/pm 🎁 Welcome Benefits on Uber, Swiggy, BookMyShow, and Amazon Prime worth ₹5999 🏧 Free debit card, checkbook, and ATM withdrawals from any bank 🏦 All domestic banking transactions are free of charge 🤩 20,000 Rupees is worth 2000 Edge Rewards points every month.

AU Current Account

Instantaneously open an AU digital current account. 0️⃣ Account with Instant Zero Balance ⏰ Enhanced cash deposit limit 💳 and extended banking hours until 5 PM AU Business Debit card for free

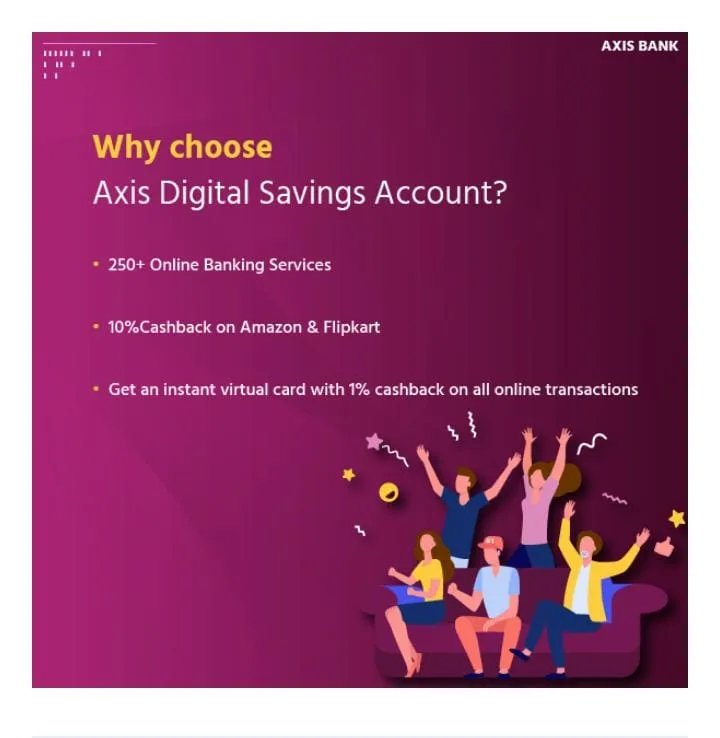

Axis Digital Saving Account

💰 Up to 10% cashback on Flipkart, Amazon, and 20% cashback on Zomato and Tata 1 mg ✔️ Customers can access more than 250 online services without having to visit the branch. Quick Virtual Debit card with 1% reward on internet purchases 💳 Obtain up to ₹1 crore in accidental insurance coverage.

Tide Business Account

🎉February Tide Cashback Dhamaka!🎉 Simply using your Tide card to make purchases in February can earn you up to ₹3,500 in rewards 💸 and the opportunity to win an iPhone 15 Pro Max 📱! ⏱Fast account opening online Create invoices that are GST compliant at no cost 📒Receive a complimentary physical card and earn rewards for your purchases. 👉🏻 Utilize the app to directly control debits Gain a lifetime free prepaid card by using the referral code TBA123. T&C Utilize

Indusland Saving Account

1. Completely digital journey. 2. Up to 6% interest. 3. 20% off on Bigbasket & Swiggy. 4. Up to ₹10,000 off on EMI with Debit Card.

Kotak 811 Saving Account

Your key to financial flexibility with zero balance requirements.

Fi Federal Saving Account

It’s true that you can start a savings account with no balance from the comforts of home: No minimal amount due 🤘 Numerous Offers with Various Advantages. ✨ Make an ATM withdrawal 💳 No additional costs 🔎 Insurance coverage for up to ₹5 lakh

IndusInd Savings Account

Hello! IndusInd Savings Account: Your key to financial flexibility with zero balance requirements.

AU Small Finance Bank

Hello! Get up to 7 percentage p.a* interest on AU Bank Savings Account.

requirements for opening a savings account

In order to open a best savings bank account, customers must often fulfill certain requirements:

- Age: Generally, accounts can be opened by people who are older than 18.

- Residency: Present documentation attesting to your local address, such as a utility bill or Aadhar card.

- Identity Proof: A legitimate document issued by the government, such as a driver’s license, passport, or Aadhar card.

- Income Proof: You may be asked to provide pay stubs, IT returns, or an official letter from the firm.

- Photography: Images the size of a passport.

- Initial Deposit: An initial deposit may be required by some banks.

- KYC paperwork: In order to verify an individual’s identification, KYC (Know Your Customer) documentation is necessary.

- Application: Complete the request form provided by the Bank accurately.

paperwork required to start a bank account for savings

The greatest savings bank account often requires the opening of the following paperwork.

- Proof of Identity (PoI): Please show a valid ID from the government, such as a passport, driver’s license, or Aadhar card.

- Proof of Address (PoA): You can submit an Aadhar card, tenancy agreements, or utility bills.

- pictures: To open accounts and verify identity, passport-sized pictures are needed.

- PAN Card: It’s common to require a Permanent Account Number (PAN) card.

- Completed Application Form: Ensure that the bank’s application form is accurately and completely filled out.

- Initial Deposit: An initial deposit may be required by some banks.

- KYC Documents: Confirm that every Know Your Customer (KYC) requirement for confirming identification has been satisfied.

Opening a Savings Account Has Its Advantages

Creating a savings account with the highest interest offers several advantages.

- Interest Earnings: Interest is payable on deposits made.

- Safety and Protection: To safeguard your funds, make use of the Bank’s security safeguards.

- Convenience: Using ATMs, online banking, or mobile apps, you may easily access funds.

- Financial Self-Control: Establish a routine of saving money from a certain account.

- Overdraft Protection: A few accounts offer protection against unexpected overdraft fees.

- Online Transactions: Pay bills and conduct transactions online with ease.

- Direct Debits: Establish automatic payments for subscriptions and bills.

- Debit Card: To facilitate simple cashless transactions, get a debit card.

- Accessibility: You may conduct transactions and view account information from any location.

- Loan Eligibility: You may be able to obtain loans if you continue your banking relationship.

In summary

To put it briefly, getting the greatest savings bank account is a necessary first step toward convenience and financial security. An accessible, safe, and interest-bearing savings account is one of the greatest in India. It is also a safe place to keep money. It facilitates internet transactions, encourages financial restraint, and enhances the banking experience. As the cornerstone of your financial management, your money is safeguarded with the greatest savings bank account. It is an essential tool for anyone looking to make wise financial planning decisions because it serves as a platform for future financial activities.