A range of lifetime free credit cards are available from HSBC, catered to the needs of every kind of customer. The cards include a ton of incredible features and advantages, such credit limits, significant cashback, and no annual or signup fees. Apply now to receive a Rs. 1000 cashback coupon *. Lets, find out Best HSBC credit cards list in 2024.

Best HSBC credit card list in 2024

Apply now by clciking on below list card name| Card Name | Annual Fee | Best For | |

|---|---|---|---|

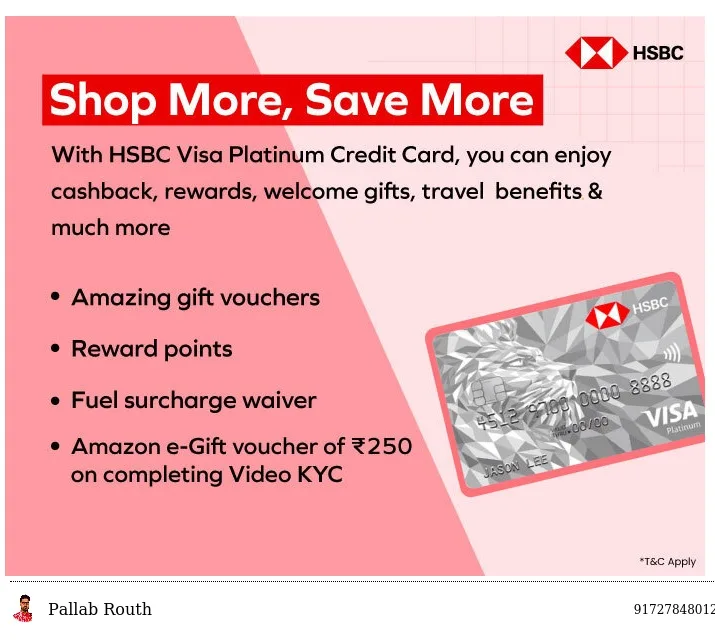

| HSBC Visa Platinum Credit Card | Nil | Travel | |

| HSBC Smart Value Credit Card | Nil | Lifestyle & Cashback | |

| HSBC Premier Mastercard Credit Card | Nil | Travel & Lifestyle | |

| HSBC Advance Visa Platinum Credit Card | Nil | Travel | |

| HSBC Cashback Credit Card | Rs. 999/- (reversed on annual total spend above Rs. 2 Lakh | Cashback & Shopping | |

| HSBC Premier Credit Card | Rs. 20,000 (waived for Premier-qualified customers) | Lifestyle |

Features of Best HSBC credit card list in 2024

- Balance transfer option: You can apply for an HSBC Credit Card at a reduced interest rate by transferring balances from other bank cards. Interest rates vary according on the chosen tenure, from 10.99% to 15%.

- Conversion to EMI: Large credit card purchases may be paid for in installments by conversion to EMI.

- Instant replacement of lost card: You can cancel your lost card by calling the HSBC helpdesk or Visa Global Assistance service, and an emergency replacement card will be sent to you anywhere in the world in three days.

- Credit card loan: HSBC provides quick credit card loans. You can get a quick cash advance with the least amount of paperwork.

- No responsibility for misplaced cards: No responsibility for purchases made following disclosure and

Advantages of HSBC Credit Cards

Apply for an HSBC credit card now to take advantage of the following advantages:

- No enrollment costs

- No yearly costs

- Transfer of Balance on EMI

- Loan-on-Phone Cash-on-EMI

- VISA Paywave technology is supported on HSBC cards, enabling contactless credit card payments.

HSBC Credit Card Qualifications

Qualifications for the Platinum Credit Card from HSBC

- The candidate must be between the ages of 18 and 65.

- For those who are salaried, the minimum yearly income should be Rs. 4,00,000.

- The applicant must be an Indian national living in Bangalore, Hyderabad, Chennai, Mumbai, Pune, New Delhi, Gurgaon, or Noida.

- The candidate’s credit score ought to be high.

HSBC Smart Value Credit Card Eligibility

- The candidate must be between the ages of 18 and 65.

- ought to have a consistent source of income.

- The applicant must be an Indian resident.

- The applicant should have a high credit score.

Qualifications for Credit Card: HSBC Premier Mastercard

- The card can only be obtained by Premier Customers.

- The customer must keep a Total Relationship Balance of Rs. 4,00,000 on a quarterly basis in order to maintain the HSBC Premier relationship.

- The candidate must either have an account with a net monthly salary credit of Rs. 3 lakhs under the HSBC Corporate Employee Program or have a mortgage relationship with HSBC India with a disbursal of Rs. 1,15,00,000 or more.

Qualifications for the Platinum Credit Card from HSBC Advance Visa

- Only customers of HSBC Advance are eligible for this card.

- The customer must retain a Total Relationship Balance of Rs. 5,00,000 per quarter in order to be eligible for the Advance Customer relationship.

- HSBC Cashback Credit Card Eligibility

- The applicant must be between the ages of 18 and 65.

- Candidates who are salaried must make at least Rs. 4,00,000 annually.

- The applicant must be a resident of Bangalore, Chennai, Hyderabad, Mumbai, Gurgaon, New Delhi, Noida, or Pune, or they must be an Indian national.

Requirements for HSBC Credit Card Documents

What you need to apply for an HSBC credit card is these documents:

- a recent, self-attested passport-sized photo

- Most recent pay stub, self-attestation salary certificate, ITR, and Form 16: If you work for a multinational company (MNC),

- Provide a copy of the front and back of any other credit cards you may have, together with your most recent credit card statement.

- a copy of your most recent pay stub, or, if you work for a private limited company, bank statements from the previous three months that include salary credits.

- Form 60 and PAN card

- A copy of any proof of residency, self-attested:

- Voter’s passport or Election ID

- enduring driver’s license

- Utility bills, phone bills, water bills, or gas bills (exclusively for pipeline connections)

- Outgoing bills from societies (only from those that are registered)

- The property tax bill

- Municipal Corporation provided a certificate of domicile with the address listed.Registered rent or lease agreement (registered with state government/ similar registration authority)

- Aadhaar card

- Defence ID card

- Government employee ID card

- NREGA job card

- Copy of any one identity proof (self-attested):

- Passport

- Voter’s/ Election ID

- Permanent driving licence

- PAN card

- Aadhaar card

- NREGA job card

HSBC bank Credit card Fee & Charges

HSBC bank Credit card Fee & Charges Details| Type of charge | Amount | |

|---|---|---|

| Financial charges on extended credit and cash advances | 3.3% p.m. from the date of the transaction | |

| Duplicate statement | Rs. 100 for statement older than 3 months | |

| Cheque bounce charges | Rs. 350 | |

| Transaction fee for cash advance against your Credit Card | 2.5% of the transaction with a minimum of Rs. 300 | |

| Over limit fee | Rs. 500 | |

| Late payment fee | 50% of the minimum payment due with a minimum of Rs. 500 and a maximum of Rs. 750 per month. | |

| Sales slip retrieval | Rs. 225 per month | |

| Out of station cheque collection charges | Rs. 50 per instrument up to Rs. 10,000 | |

| Rs. 100 per instrument above Rs. 10,000 up to Rs. 1 Lakh | ||

| Rs. 150 per instrument above Rs. 1 Lakh | ||

| Credit Card replacement charges | Rs. 100 | |

| Currency conversion charges for foreign currency charges | 3.50% | |

| Balance enquiry on Credit Card in other bank ATM | Nil | |

| Handling charges for the redemption of rewards | Rs. 50 per redemption | |

| Charges for cash payment made for the card at HSBC branches and HSBC drop box | Rs. 100 | |

| Copy of credit information report | Rs. 50 |

Best Credit card website in india in 20204

HSBC Bank Credit Card FAQs

✅ How can I apply for a credit card from HSBC?

Applying for an HSBC credit card can be done via phone banking, in-person at the closest location, online, or by submitting the necessary paperwork.

✅ How long is the HSBC Credit Card interest-free period?

For 52 days, there is no interest on the HSBC Credit Card. If the entire amount owed is not paid, this interest-free term is not applicable.

✅ How much interest is assessed on the unpaid credit card balance?

3.3% interest is assessed each day. on the balance due according to the statement.

✅ What are the requirements to be eligible for an HSBC credit card?

For the HSBC Credit Card, the following requirements must be met:

- The candidate must fall within the age range of 18 to 65.

- The applicant’s income must be at least Rs. 4 lakh per year.

- The candidate must be an Indian resident.

- The candidate should have an excellent credit score—ideally 750 or higher.

✅ What paperwork is needed in order to apply for an HSBC credit card?

The following paperwork is needed in order to apply for an HSBC credit card:

- a recent, self-attested passport-sized photo

- Proof of income (self-attested)

- Provide a copy of the front and back of any other credit cards you may have, together with your most recent credit card statement.

- Form 60 and PAN card

- A copy of your identification and evidence of residency (self-attested)

✅ How much does the HSBC Credit Card cost for cash withdrawals?

With a minimum of Rs. 300, the HSBC Credit Card charges 2.5% of the transaction as a cash withdrawal fee.

✅ In the event of a credit card loss, what happens?

Contact the bank’s customer service line right away to report the theft of the card. Your current card will be blocked, and a new one will be issued and sent to the address you have on file with the bank.

✅What are the available methods for paying credit card debt?

Payments for credit cards can be made using NEFT, internet banking, mobile banking, online auto-debit instructions, demand drafts or checks, cash, or checks.