Introduction to SEBI’s New F&O Rules on Retail Traders

The Securities and Exchange Board of India (SEBI) has issued new regulations that affect Futures and Options (F&O) trading. The move could affect retail investors in a significant way. It is vital to understand these changes for everyone working in the market for stocks. Lets read about New F&O Rules on Retail Traders.

Background of SEBI and Its Role

SEBI is the authority that regulates for the market of securities in India. Its primary goal is to safeguard investor interests and to ensure the integrity of markets. Through the years, SEBI has introduced various regulations to ensure the integrity of trading.

With the increase in the participation of retail investors in F&O trade, SEBI aims to implement measures to shield the investors from any potential risk.

Details of the New F&O Rules

The SEBI’s recent announcement introduces two major changes to F&O trading. The changes are intended to improve transparency and decrease speculation-based trading on the market.

First Rule: Increased Margin Requirements

One of the major changes is the rise in the margin requirement to F&O trades. That means traders will have to put down a an amount of collateral in order to take part to participate in F&O trading.

* More collateral is needed

* Lower leverage

Low risk of default

By imposing higher limits on margins, SEBI aims to ensure that only well-funded and serious traders are involved with F&O trading, thus reducing the chance of manipulation in markets.

Second Rule: Restriction on Intraday Trading

Another significant change is the ban on intraday trading within F&O segments. The traders will no longer be able square their positions the exact day. Instead they will have to hold their positions for the duration of the night.

* Positions that are held over the course of the night.

* Reduction in the amount of speculative trading

* Encourages long-term investments

This policy is designed to reduce speculation over the top and ensure a steady trading environment.

Impact on Retail Traders

The new rules are expected to have an impact on retailers. While the intent is to protect them the immediate impact could be unintentional.

Reduced Participation

The higher margin requirements mean that a lot of retail traders might be unable to meet the collateral requirements. This may result in lower participation from investors of smaller size.

* Less retail traders

* Barriers to entry that are higher

* Potential decline in trading volumes

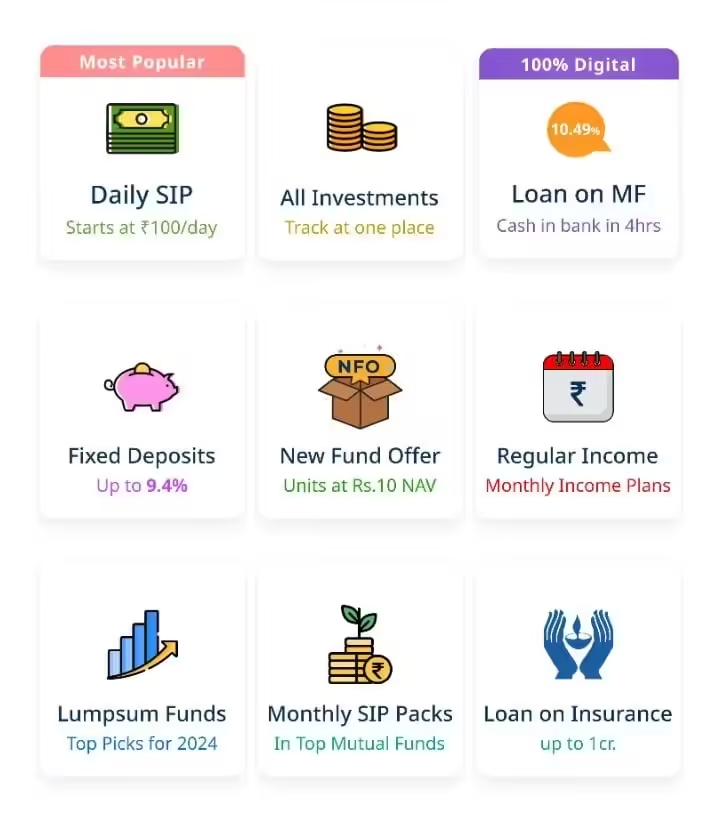

Shift to Other Investment Avenues

Due to the limitations for intraday trading in place, retailers may change their focus to different investment options. Mutual funds, equity as well as other financial instruments may be attracting more interest.

* More investment opportunities in mutual funds

* Accrorated equity trading

* Study of alternative investment options

Potential Benefits

Despite their challenges they pose, these rules can benefit retailers over the long term. In reducing speculative trading SEBI hopes to establish a more secure market.

* Less risk of losing money

* Promotion of long-term investments

* Increased market stability

Market Reactions and Expert Opinions

The reaction of the market to SEBI’s changes have been diverse. While some experts are supportive of the decision for helping to promote stability in the market, others are concerned that it will thwart retail participation.

Positive Reactions

Many market experts believe these rules will create more stable trading conditions. By reducing speculation, SEBI aims to protect the retail investor from market volatility.

* Promotes market integrity

* Reduces the risk of manipulations in the market

* Ensures that traders make informed choices

Concerns Raised

On other hand, a few experts believe that these rules could discourage retail investment. The higher margin requirements and restrictions on intraday trading can be seen as barriers to smaller investors.

* Potential decline in retail participation

* Greater barriers to entry for smaller investors

* Concerns over market liquidity

Steps Retail Traders Can Take

For retailers, adjusting to the new regulations is essential. Here are a few ways they can be able to navigate these changes successfully.

Assess Financial Position

Retail traders need to examine their financial situation in order to determine whether they are able satisfy the higher margin requirements. This will allow them to make educated decisions regarding their trading operations.

* Review financial resources

* Determine margin capacities

* Develop trading strategies in accordance with the needs

Explore Alternative Investments

Due to the limitations on trading intraday, retail traders could consider looking at different investment options. Equity mutual funds, mutual funds as well as other financial instruments, can provide a variety of investment options.

* Take into consideration mutual funds

* Look into equity investments

* Look into alternative financial instruments

Stay Informed

Being aware of the latest developments in the market and changes to regulations is vital for retail traders. By staying up-to-date, they are able to adjust their strategies to be in line with the new regulations.

* Keep track of market information.

* Keep abreast of SEBI rules

* Adapt trading strategies accordingly

Conclusion

SEBI’s latest F&O rules represent a significant change in the Indian market for shares. While they’re designed to safeguard investors who are not retail however, their immediate effect could appear restricting. Through understanding the changes and adjusting how they approach their business, retailers will be able to make sense of this new environment.

These rules were created to provide a more secure and transparent trading environment that will benefit all market participants over the long term.

Disclaimer We do not endorse any selling or buying through this blog. Always consult your Financial advisor before investing.

Do you want to begin your journey to investing and trading in the stock market? Join our Stock Market Class to become an experienced to a novice trader! We will cover everything from basics of trading through to advanced strategies for selecting stocks. We’re also offering a discount specifically for students and women. Don’t delay – sign up now to begin your journey towards success on the stock exchange!

Explore the new world Stock Market by Opening a Demat Account with your favorite brokerage firm and receive an effective trading strategy that is worth Rs.15,000!

Here to create a Free Demat Login.

Frequently Asked Questions

+Are there any new requirements for margins that were introduced by SEBI for F&O trading?

SEBI has raised the margin requirements to F&O trading, which means traders are now required to put down more money as collateral. This is to ensure only serious and capital-stretched traders take part and reduce the risks of market manipulation.

+What are the implications of the new rules? affect intraday trading in F&O segment?

According to the latest SEBI rules, trading intraday within the F&O segment is prohibited. Market participants must keep their positions open overnight in order to limit speculation that is excessive and encourage long-term investment.

+What are the implications of SEBI’s latest rules on traders who trade retail?

The new SEBI regulations could lead to lower participation of retail traders because of higher margin requirements and trading restrictions for intraday traders. The changes could lead to lower numbers of retail traders, higher entry barriers, and possibility of a decrease in trading volumes.

+What is the reason SEBI made these changes to the F&O market?

SEBI’s new rules were designed to improve market stability and safeguard retail investors from risks. Through increasing the requirements for margins and limiting intraday trading, SEBI is aiming to curb speculation and create better trading conditions.

+What other options will Retail traders face under newly-enacted SEBI rules?

Retail traders who are affected from the latest SEBI rules may consider other ways to invest, such as equity mutual funds, mutual funds and other financial instruments. These options could offer a range of options for investing and help mitigate the effects on the new F&O trade restrictions.