Best Personal Loan In India with NBFC Partner

In today’s fast-paced world, financial needs can arise unexpectedly, requiring quick access to funds. Best Personal Loan In India with NBFC Partner have emerged as a popular solution for individuals seeking immediate financial assistance. This comprehensive guide will delve into the world of personal loans, covering everything from understanding the concept to choosing the best option for your needs.

What is a Personal Loan?

A personal loan is an unsecured loan provided by banks, financial institutions, and online lenders to individuals in need of immediate funds. Unlike secured loans that require collateral, personal loans do not necessitate any asset as security. This makes personal loans accessible to a broad range of individuals, including those who do not possess valuable assets.

Key Features of Personal Loans

Personal loans offer several key features that make them an attractive option for borrowers:

Quick Approval: One of the primary advantages of personal loans is their swift approval process. In contrast to traditional loans, personal loans are often approved within a matter of hours or days, providing borrowers with the funds they need promptly.

Flexibility in Usage: Personal loans are incredibly versatile and can be used for various purposes. Whether you need to consolidate debt, cover medical expenses, finance a wedding, or undertake home renovations, a personal loan can provide the necessary financial support.

Fixed Interest Rates: Personal loans typically come with fixed interest rates, meaning the interest remains constant throughout the loan tenure. This enables borrowers to plan their finances effectively, as they know the exact amount they need to repay each month.

Repayment Flexibility: Lenders offer various repayment options for personal loans, allowing borrowers to select a tenure that suits their financial capabilities. Longer tenures result in lower monthly installments, while shorter tenures lead to quicker repayment and reduced interest paid over time.

How To Get a Personal Loan: Things To Keep In Mind

Obtaining a personal loan involves a systematic process that requires careful consideration and planning. To ensure a smooth application and approval process, here are some essential factors to keep in mind:

1. Check Your Eligibility

Before applying for a personal loan, it is crucial to assess your Loan eligibility criteria. Lenders typically consider factors such as age, income, employment stability, credit score, and existing financial obligations when evaluating loan applications. Ensure that you meet the lender’s eligibility requirements before proceeding with the application.

2. Determine the Loan Amount

Evaluate your financial requirements to determine the loan amount you need. It is advisable to borrow only the necessary amount to avoid unnecessary debt. Consider your repayment capacity and opt for a loan amount that aligns with your financial capabilities.

3. Research and Compare Lenders

Thoroughly research and compare different lenders to find the most suitable option for your personal loan. Consider factors such as interest rates, repayment tenures, processing fees, customer reviews, and overall reputation. This will help you choose a lender that offers favorable terms and conditions.

4. Gather Required Documents

Lenders typically require specific documents to verify your identity, income, and address. Commonly requested documents include identification proof (such as Aadhaar card or passport), address proof (such as utility bills or rental agreement), income proof (such as salary slips or income tax returns), and bank statements. Ensure that you have all the necessary documents ready before starting the application process.

5. Apply Online or Offline

Personal loan applications can be submitted online or through physical branches, depending on the lender’s offerings. Online applications provide convenience and ease of use, allowing you to complete the process from the comfort of your home. Offline applications involve visiting the lender’s branch and submitting the required documents in person.

6. Complete the Application Form

Whether applying online or offline, fill out the application form accurately and provide all the necessary details. Any discrepancies or incomplete information may lead to delays or rejection of your application. Double-check the form before submission to ensure accuracy.

7. Await Approval and Disbursement

After submitting your application, the lender will assess your eligibility and review your documents. If approved, you will receive a loan agreement specifying the terms and conditions. Read the agreement thoroughly, and if you agree to the terms, sign and return it to the lender. Upon receipt of the signed agreement, the lender will disburse the loan amount into your designated bank account.

8. Repay the Loan

Once you receive the loan amount, it is essential to manage your monthly repayments diligently. Set up automatic payments or reminders to ensure timely repayment. Avoid defaulting on payments, as this can negatively impact your credit score and future borrowing capabilities.

Best Personal Loan In India: 10 Best Options

India offers a wide range of personal loan options from various banks and financial institutions. Here are ten leading lenders renowned for their competitive interest rates, flexible repayment options, and excellent customer service:

These institutions have established a strong presence in the personal loan market, offering borrowers a wide range of options to choose from. When selecting a personal loan provider, consider factors such as interest rates, loan amount, repayment flexibility, and customer reviews to ensure the best fit for your needs.

Top Providers of Personal Loans: 10 Providers In India

When seeking a personal loan, it is crucial to choose a reputable lender that offers competitive interest rates and favorable terms. Here are ten of the top providers of personal loans in India:

- State Bank of India (SBI)

- HDFC Bank

- ICICI Bank

- Axis Bank

- Bajaj Finserv

- Kotak Mahindra Bank

- Standard Chartered Bank

- Indusland Bank

- Citibank

- Yes Bank

These lenders have a proven track record of providing reliable and customer-friendly personal loan options. Compare their offerings, interest rates, and repayment terms to choose the provider that best aligns with your financial needs.

Earn money from Gromo

Hi,Earn with me by joining GroMo app today! 💸

Earn over ₹1 Lakh every month by selling financial products like Credit Cards, Insurance, Demat Accounts, Saving Account and more with GroMo.

Download now with my referral link: Partner Registration or enter my Referral code on signup: TB3U0128

20 Lakh+ people along with me are already using GroMo and earning lakhs of rupees every month. Get upto ₹3,000+ commission on every sale.Have never sold anything before?Don’t worry, get free training by the best trainers in the finance industry on GroMo anytime you want! Are you ready to earn?

Top Providers Of Instant Loans: 24 Instant Loan Providers

In today’s digital age, instant loans have gained immense popularity due to their quick approval process and minimal documentation requirements. Here are 27 leading providers of instant loans in India:

- weRize

- PolicyBazar

- KreditBee

- Prefr

- InCred Finance

- PaySence

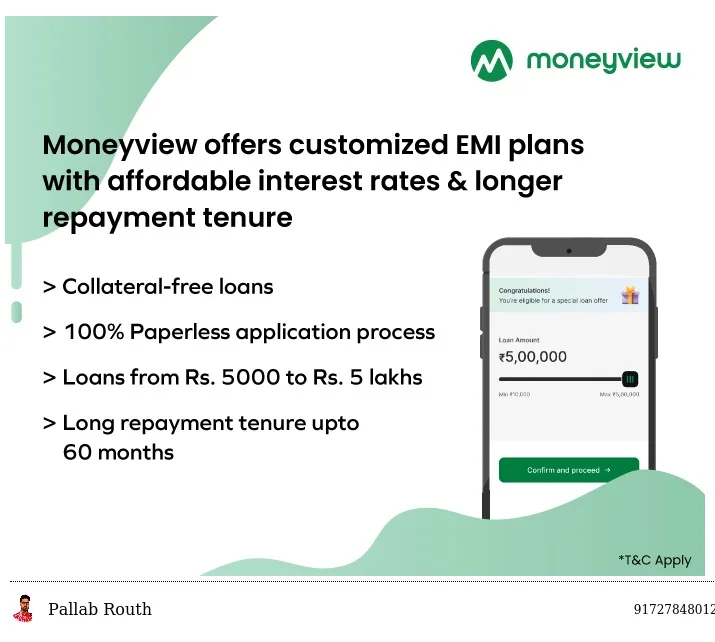

- MoneyView

- Fibe

- Privo

- L&T Finance

- LindingKart

- Uydog Plus

- SMFG

- IIFL Finance

- TATA Capital

- Olyv

- Insta Money

- Nira Finance

- Zype

- StuCred

- India Leads

- StashFin

- UNI Paycheck

- Rupyy

These instant loan providers offer a convenient way to access funds quickly, making them ideal for emergencies or urgent cash needs. However, carefully review the terms, interest rates, and repayment options before selecting a provider.

Conclusion

Personal loans can serve as a valuable financial tool, providing individuals with immediate access to funds and flexibility in managing their expenses. When considering a personal loan, it is crucial to understand the intricacies of the loan, compare different lenders, and carefully evaluate the terms and conditions.

Remember to assess your eligibility, determine the loan amount needed, and research the interest rates and repayment options offered by various lenders. By making informed decisions and ensuring timely repayments, you can leverage personal loans to meet your financial goals effectively.

Always prioritize responsible borrowing, maintain a good credit score, and adhere to the repayment schedule to build a healthy financial future. Whether you opt for a traditional personal loan or an instant loan, weigh your options, and choose the best fit for your specific needs.

If you require further guidance or assistance, consider consulting with financial advisors or utilizing reputable online platforms like GroMo. These resources can provide expert insights and personalized recommendations to help you navigate the personal loan landscape with confidence.

Apply Loan With GroMo today and explore a world of financial possibilities and earning potential! Reach out to me for free financial consultation of your Insurance needs. Click Now for free Consultant

Disclaimer: The information provided in this guide is for educational purposes only and should not be considered as financial advice. Always consult with a professional advisor before making any financial decisions.