Introduction

Have you ever found yourself scratching your head over whether to stash your savings in a fixed deposit or to get a little adventurous with a credit card? It seems like a no-brainer to go the traditional route with fixed deposits, right? Well, before you make your move, let’s dive into the intriguing world ofCredit card advantages and disadvantages . From offering unmatched convenience to rewarding you simply for spending, credit cards can be a game-changer in how you manage your finances and enjoy life’s little perks.

Credit card advantages and disadvantages

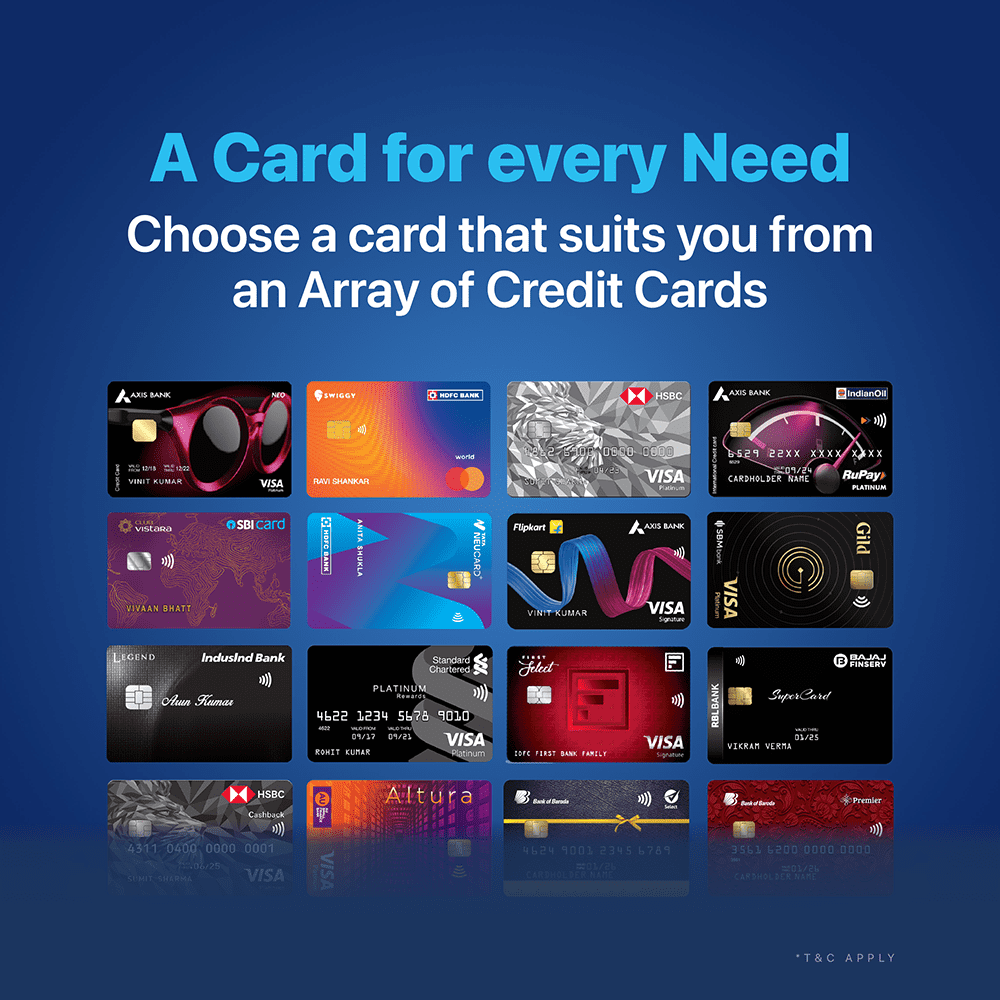

When it comes to managing our finances, the instruments we choose can significantly impact our flexibility, convenience, and the rewards we receive. While fixed deposits have been a traditional favorite for those looking for a safe investment, credit cards are becoming increasingly attractive for their multifaceted benefits. Let’s dive into some of the advantages that credit cards offer over fixed deposits.

Flexibility

One of the most significant advantages of credit cards is their flexibility. Unlike fixed deposits, where your money is locked in for a specific period, credit cards offer you the freedom to access funds whenever you need them. This flexibility is crucial in emergencies or unforeseen expenses, providing a financial cushion that doesn’t disrupt your investments.

Convenience

Credit cards score high on the convenience scale. They allow you to make purchases online or in-person seamlessly, without the need to carry cash. Moreover, managing credit cards is incredibly user-friendly, with online accounts and apps where you can track your spending, make payments, and even freeze your card in case it’s lost or stolen, all from the convenience of your smartphone.

Rewards and Perks

Credit cards are renowned for the rewards and perks they offer. From cashback on everyday purchases to points that can be redeemed for travel, dining, or shopping, credit cards turn your expenses into opportunities to save or receive benefits. Additionally, many credit cards come with complimentary insurances, such as travel or rental car insurance, which can provide considerable savings and peace of mind.

Flexibility

The flexibility offered by credit cards extends well beyond just the ease of accessing funds. It encompasses various aspects of financial management that can make your life easier and more comfortable. Let’s explore further.

Easier access to funds

With credit cards, the ease of accessing funds cannot be overstated. Whether you’re faced with unexpected expenses or you simply want to make a large purchase without depleting your savings, a credit card provides an immediate solution. This immediate access to funds without the need to break a fixed deposit makes managing unexpected financial situations less stressful.

Credit limit increases purchasing power

Another facet of the flexibility credit cards offer is the increase in your purchasing power. Your credit limit, which is often a multiple of your monthly income, allows you to make substantial purchases that would otherwise require saving over time. Whether it’s buying the latest electronics or booking a dream vacation, credit cards make it possible without immediately impacting your liquid assets.

Option to pay only minimum amount due

Credit cards also offer the flexibility of payment options. If you’re tight on cash one month, you can choose to pay only the minimum amount due instead of the full balance. This feature can be particularly useful in managing cash flow, ensuring that you stay financially fluid even during leaner times. It’s important, however, to use this feature judiciously to avoid accumulating interest that could challenge your financial health in the long run.

In conclusion, the advantages of using credit cards over fixed deposits are numerous and comprehensive, covering aspects from flexibility and convenience to rewards and perks. While fixed deposits offer security and a guaranteed return, credit cards offer an array of benefits that cater to the dynamic needs of modern consumers.

From providing an emergency financial cushion to enhancing your lifestyle through rewards and perks, credit cards stand out as a versatile financial tool. However, it’s crucial to use credit cards responsibly, keeping an eye on spending and managing payments to avoid falling into debt. When used wisely, credit cards can be a powerful ally in your financial arsenal, offering more than just a way to spend but also a way to enhance your financial well-being.

Convenience

One of the standout benefits of using credit cards over fixed deposits is the sheer convenience they offer. Let’s dive into some specifics that highlight why credit cards are often the go-to choice for everyday transactions and more.

Accepted worldwide

Credit cards truly shine when it comes to universal acceptance. Whether you’re travelling abroad or shopping from international websites, your credit card is a gateway to a seamless transaction. Unlike with fixed deposits, where your money is locked away, credit cards give you the freedom to access funds virtually anywhere in the world, anytime. This global acceptance not only makes credit cards ideal for travel and online shopping but also ensures that you’re covered in almost any financial situation you might find yourself in.

Online and offline payments

The digital era has made it clear: flexibility in how and where we can make payments is key. Credit cards excel in this area, offering the ability to make both online and offline payments with ease. This contrasts starkly with fixed deposits, where your funds are tied up and not readily available for such transactions. With a credit card, you can effortlessly transition from swiping at your local grocery store to clicking through an online checkout, all without having to move money around or worry about liquidity.

Automatic bill payments

In today’s busy world, convenience is not just preferred; it’s required. Credit cards answer this call by offering the ability to set up automatic bill payments. This feature allows you to link your monthly recurring bills—think utility bills, subscriptions, and even loan payments—to your credit card, ensuring they’re paid on time without any manual intervention. This is a stark contrast to managing finances through fixed deposits, where each withdrawal or transfer requires planning and potentially waiting for maturity dates. Automatic bill payments via credit cards not only save time but also help in maintaining a good credit score by ensuring timely payments.

Rewards and Perks

Beyond the convenience of transactions, credit cards offer an array of rewards and perks that fixed deposits simply can’t match. These benefits cater to a wide range of lifestyles and spending habits, making credit cards an attractive financial tool for many.

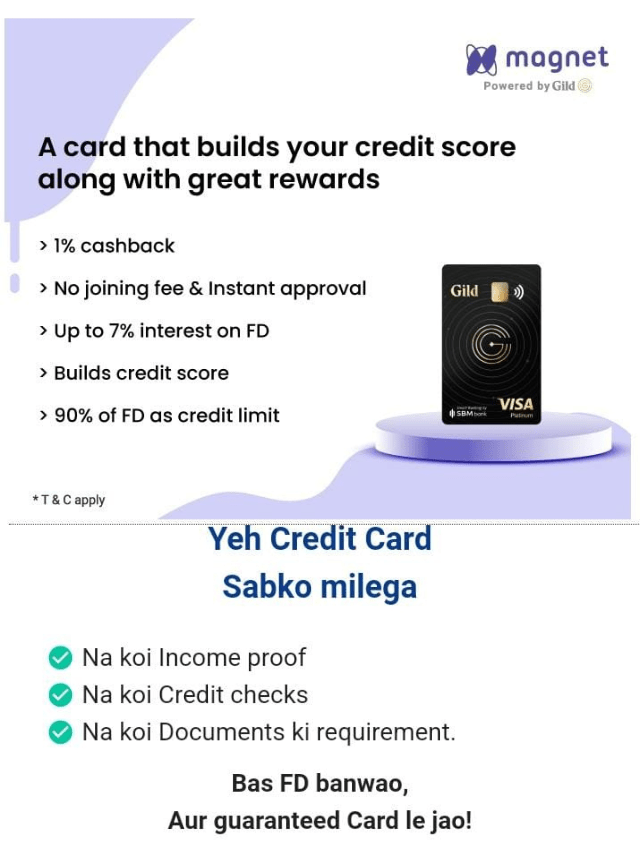

Cashback

Who doesn’t love getting money back on their purchases? Cashback credit cards return a percentage of the amount spent back to the cardholder. Depending on the card and the categories of spending, you could be getting a significant amount of cashback on groceries, fuel, dining out, and more. This feature essentially offers you savings every time you spend, a perk that fixed deposits can’t offer since they don’t involve daily transactions. Over time, these cashback rewards can add up to a considerable amount, effectively reducing the cost of your purchases.

Travel rewards

For those bitten by the travel bug, credit cards can be your best companion. Travel rewards credit cards accumulate points or miles on every purchase, which can then be redeemed for airline tickets, hotel stays, car rentals, and other travel expenses. Additionally, many of these cards offer extra perks like free airport lounge access, travel insurance, and no foreign transaction fees, enhancing your travel experiences while providing significant savings. Fixed deposits, while secure, don’t offer direct advantages for travelers or ways to make your travel cheaper and more comfortable.

Purchase protection

Another compelling reason to use credit cards over keeping your money in fixed deposits is purchase protection. Many credit cards come with built-in insurance coverage for items bought using the card. This can include protection against theft, loss, or accidental damage within a certain period after the purchase. Furthermore, if you encounter a problem with a purchase that the merchant refuses to resolve, some credit card companies offer dispute resolution services that can help you get a refund. This layer of consumer protection offers peace of mind that fixed deposits don’t provide, making credit cards an excellent tool for securing your purchases.

In conclusion, while fixed deposits have their place in financial planning, especially for long-term savings and investments, credit cards offer a range of advantages that cater to the dynamic and varied needs of modern consumers. From the convenience of worldwide acceptance and seamless online and offline transactions to the financial benefits of cash backs, travel rewards, and purchase protection, credit cards stand out as a versatile financial tool. By making wise choices in credit card usage, it’s possible to not only manage your finances efficiently but also enjoy a variety of perks that enhance your spending and lifestyle.

Absolutely, let’s dive deeper into the world of personal finance by comparing two popular financial instruments: credit cards and fixed deposits. Both have their unique advantages and cater to different needs. By looking at interest rates, liquidity, and return on investment, we can understand why you might choose one over the other.

Financial Comparison: Credit Cards vs Fixed Deposits

When trying to decide where to put your money, it can feel like navigating a maze of rates, terms, and benefits. Both credit cards and fixed deposits offer unique advantages, but understanding their specifics can help you make the best decision for your financial health.

Interest rates

Interest rates are a critical factor when comparing credit cards to fixed deposits; however, they work quite differently across these two options.

– Credit Cards: The interest rates on credit cards generally relate to the cost of borrowing money. If you don’t pay off your balance in full each month, you’ll be charged interest on the remaining balance. These rates can be quite high, often reaching into the double-digit territory. The key advantage here is not savings growth, but the flexibility and the grace period given for payments before interest is applied.

– Fixed Deposits: In contrast, fixed deposits offer you interest in return for depositing your money with the bank for a predetermined period. The rates here are typically lower than the interest rates charged on credit cards but are guaranteed for the term of the deposit. The interest rate on a fixed deposit is a sign of your money growing over time without the risks associated with variable rate products like credit cards.

Liquidity

Liquidity refers to how quickly and easily an investment can be converted into cash without significant loss in value. It’s an essential consideration for managing your finance effectively.

– Credit Cards: Credit cards excel in terms of liquidity. They provide instant access to funds up to your credit limit, making it ideal for emergency expenses or unexpected opportunities. Moreover, responsible credit card use (paying off your balance regularly) can improve your credit score, potentially leading to higher limits and better terms in the future.

– Fixed Deposits: Fixed deposits, on the other hand, lock in your money for a set period. While this encourages saving and guarantees a return, it makes your funds less accessible. In most cases, withdrawing your money early leads to penalties or forfeited interest, reducing the benefit of the fixed deposit. This makes fixed deposits a less ideal option for those who may need quick access to their funds.

Return on investment

The return on investment (ROI) is a crucial aspect to consider, especially for those looking to grow their wealth over time.

– Credit Cards: While credit cards themselves do not offer a return through interest like fixed deposits, they come with rewards and benefits that can be valuable. Cashback, points towards travel, and other perks can provide a significant “return” on spending, especially if you pay off your balance each month to avoid interest charges.

– Fixed Deposits: Fixed deposits provide a clear, often guaranteed return on your investment in the form of interest. Although the rates might not be as high as potential returns from other investments, the safety of a fixed deposit can be appealing for risk-averse savers. Over time, this guaranteed interest can compound, leading to noticeable growth of your initial deposit.

By considering the interest rates, liquidity, and return on investment, you can better understand the role of credit cards and fixed deposits in your financial strategy. Remember, the best choice depends on your current financial situation, goals, and lifestyle.

Conclusion

In wrapping up, comparing credit cards to fixed deposits reveals a distinct advantage in favor of credit cards when it comes to flexibility, convenience, and the additional perks they bring to your financial life. Affording you easy access to funds, rewarding your spending habits, and offering protection, credit cards emerge as the more dynamic tool for those looking to manage their finances with ease while enjoying the journey. Remember, the key lies in using them wisely to harness their full benefits.