The only lunch that is free for finance professionals is diversification. Harry Markowitz

What is the significance of the statement from The Nobel Prize laureate and pioneer of the Modern Portfolio Theory in today’s world? Diversification of portfolios is the core of any successful investment strategy. When you spread investments across a variety of kinds of assets, you can take advantage of the peaks and valleys of the investment process and get decent returns. Whether you want to create wealth or save capital, having a balanced portfolio is essential. Fixed-income securities specifically offer a sense of safety and security. When they are included in an portfolio of investments, they provide the foundation of financial investments.

If you are an investor you’re presented with a many options in the building of your portfolio. Each instrument is not superior to the other or can guarantee extraordinary returns by itself. By combining instruments in the appropriate proportions and combining them, you can lower the risk of your portfolio being exposed to market risk. In fact, your portfolio’s concentration is directly tied to the investor’s view of the financial markets.

If you are looking to build an diversified portfolio It is crucial to not ignore the significance of including government and corporate bonds. These bonds are among the biggest of fixed-income securities. This article does not intend to analyze the pros and cons, but to provide an in-depth review on these types of instruments. This will help you to make a better decision in deciding on the best investment mix to your portfolio like Government Bonds vs. Corporate Bonds.

What are Government Bonds?

Government bonds, also called Government securities ( gsecs) are issued by the Reserve Bank of India (RBI). Indian government, central and state require funds to fund its fiscal expenses. By putting your money into these bonds, you are loaning your funds to the state for a predetermined time frame in exchange for interest payments. Their unshakeable reliability, which comes from the backing of the government, makes them a safe haven for investors who are cautious about risk.

They can be considered as risk-free instruments on the Indian market for financial instruments and act as a benchmark for pricing various debt-related instruments. Banks, financial institutions mutual funds, as well as pension funds also hold the government securities. Some examples of government bonds that are issued in India comprise Dated Government Securities, Treasury Bills, Cash Management Bills, State Development Loans, Sovereign Gold Bonds (SGB) and others.

What are Corporate Bonds?

Businesses issue bonds to raise money for expansion of operations and other business requirements. If you purchase corporate bonds that is, you are lending money directly to a business. The yields on corporate bonds typically outperform those on government bonds due to the higher risk. The careful assessment of creditworthiness of businesses that issue these bonds are essential for making prudent investment decisions.

One of the major advantages when investing in bonds for corporate purposes is the possibility for higher yields than bonds issued by government. Since corporate bonds come with the risk of credit, investors want more in return to make up for the risk. This is why corporate bonds generally have greater yields, which makes them attractive to investors seeking income. These include NCDs, securities that are issued by MFIs, HFCs, NBFCs and more.

Bonds issued by the Government Bonds vs. Corporate Bonds – Clash of Titans

The government is the backer and backed by the government, these bonds are regarded as to be among the most secure investments for fixed income in India that provide regular interest payments. Some kinds (including non-taxed bonds) offer tax-free interest. G-secs tend to be very liquid, allowing simple buying and selling on an auction market. They are ideal for investors who are cautious about the preservation of capital and stable returns and also long-term investors who are seeking financial goals, such as retirement planning. However corporate bonds are available in various options to satisfy the diverse needs of investors and preferences.

They are classified according to the credit rating of the company that issues them or industry sector, maturity date and coupon structure. The investment in corporate bonds comes with certain risks, including credit risk. This is potential for the company issuing the bond in default on the debt obligation. Other risks include liquidity risk, interest rate risk threat and market risk that could impact the value of bonds and their performance over time.

To reduce these risks, investors tend to diversify their portfolios of bonds by acquiring bonds issued by companies in different industries as well as credit rating. In addition, conducting a thorough due diligence regarding the financial health of the company issuing the bond along with its business fundamentals and the outlook for the industry will assist investors in making educated decision-making regarding investments.

Conclusion

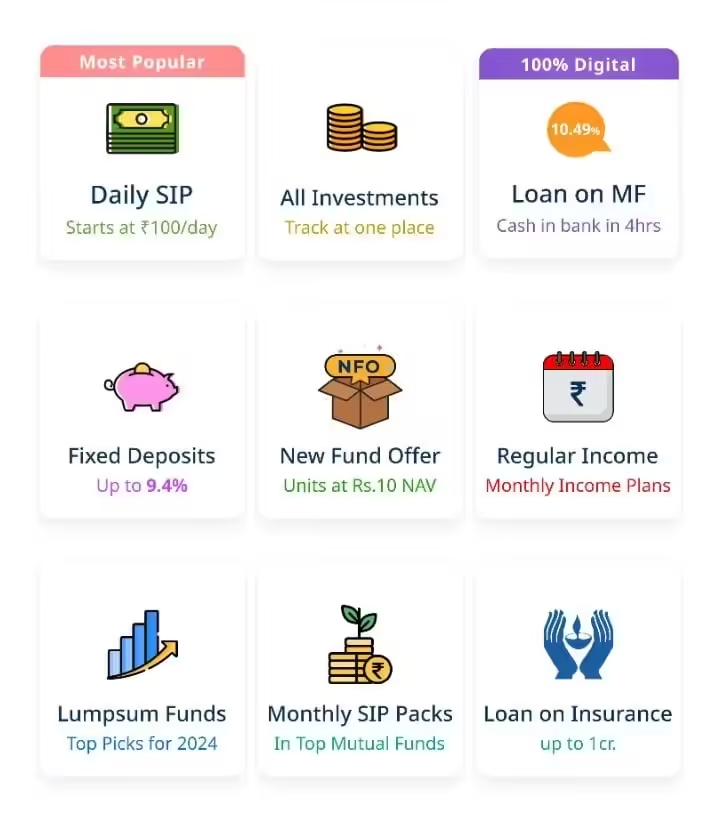

We are at an era of technology that has changed the way we invest. Thanks to the development of seamless technology that is cutting-edge, people can create their own portfolios on the internet and consult a financial advisor if needed. In addition, with this flexibility, investors are able to make sure that their bond portfolios are in line with their personal risk tolerance, goals for investment, and income needs. The ultimate security of government bonds with the high yields of corporate bonds can yield a risk-free, inflation-adjusted return.

If you are focusing on a single asset class or investing on the basis of “tips” or any plan exposes your capital to a variety of risk. However, making sure you have an mix of assets that matches your financial objectives and time period is essential to investing successfully. It’s not only about asset classes, but investors also have the option of diversifying across different sectors, geographic regions as well as companies and the quality of their credit. It doesn’t matter if it’s comparing corporate bonds with government bonds or creating an optimal portfolio mix investors should seek diversification instead of simply seeking the returns.

FAQS

Q. What is asset mix or portfolio mix?

A. Asset mix, also known as portfolio mix, is the term used to describe how the investments are split between different categories of assets such as bonds, stocks and cash as well as other alternatives. It is a crucial strategy to manage risk and yield in a portfolio of investments.

Q. Difference between bonds issued by the government and corporate bonds

| Aspect | Government Bonds | Corporate Bonds |

| Issuer | Indian Government | Indian Private Corporations |

| Risk | The lowest within the debt securities market | Different levels, based on the creditworthiness of the business. |

| Returns | Relatively, it’s lower | Potentially higher to offset the risk |

| Liquidity | Highly liquid | It varies based on the specific bond and the company. |

| Taxation | Tax benefits are available for specific bonds like tax-free and SGBs | Interest is tax deductible |

Q. Corporate bonds vs. government bonds ; which one is superior?

A. The majority of people consider government bonds to be safer because they are backed by the government, providing security but lower yields. Corporate bonds are, however generally have higher yields, but carry more risk because they are dependent on the issuing company’s financial condition. The decision between these two is dependent on the risk-taking capacity of the investor and investment objectives.

Disclaimer Note: Investments in debt securities, municipal debt securities/securitised debt instruments can be a risk, which include delay or the inability to pay. Check all offer documents thoroughly.