how to apply credit card with Credilio

Have you ever found yourself in a situation where you needed a little extra financial wiggle room, or maybe you’ve been eyeing the perks that come with owning a credit card? Well, you’re in luck! Applying for a credit card doesn’t have to be a perplexing puzzle, and with Credilio, it’s easier than ever. Whether you’re looking to rack up rewards points, build your credit history, or simply enjoy the convenience of cashless transactions, we’ve got you covered.

In this blog, we’ll walk you through the steps to apply for a credit card with Credilio, and before you know it, you’ll be unlocking a world of financial opportunities. So grab a cup of coffee, and let’s dive into the world of credit cards together! how to apply credit card with Credilio

Benefits of Applying for a Credit Card with Credilo

Applying for a credit card can sometimes feel like navigating through a maze. Fortunately, with Credilo, the process isn’t just straightforward—it comes packed with a host of benefits that make it a smart choice for anyone looking to improve their financial flexibility. From the ease of their online application process to competitive interest rates and a stunning rewards program, Credilo sets you up for financial success from the get-go.

Convenient Online Application Process

The beauty of Credilo’s application process lies in its simplicity and convenience. Gone are the days of endless paperwork and waiting in long queues at the bank. Credilo offers an online application portal that is user-friendly and accessible 24/7, meaning you can apply whenever it fits into your schedule. Just a few clicks from the comfort of your home, and you’re well on your way to owning a credit card. The platform is designed to guide you through every step, ensuring that you understand each part of the process. What’s more, you can check the status of your application in real time, keeping you informed at every stage.

Competitive Interest Rates and Rewards Program

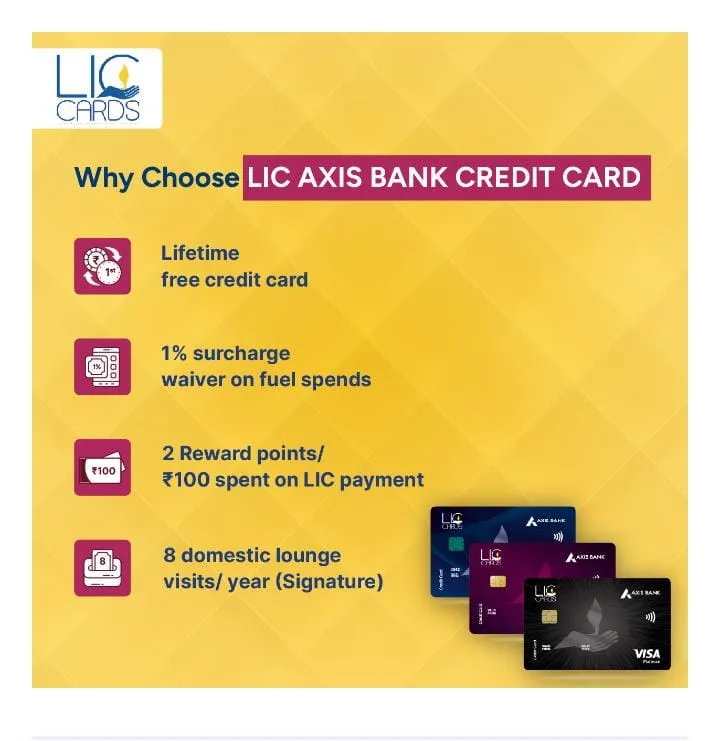

Another perk of opting for a credit card through Credilo is their competitive interest rates. They understand the importance of providing their customers with rates that are feasible and aligned with market standards. This ensures that you are not overburdened with high-interest rates, making your borrowing experience more manageable and affordable.

In addition to favorable interest rates, Credilo also boasts an impressive rewards program. Whether you love travel, dining out, or shopping, there’s something for everyone. Each purchase earns you points that can be redeemed for various benefits, such as flight tickets, hotel stays, gift vouchers, and much more. It’s a great way to make your spending work for you and enjoy a range of lifestyle benefits simply by using your credit card.

Eligibility Criteria for Credilo Credit Card Application

Before diving headfirst into the application process, it’s vital to understand the eligibility criteria set by Credilo. These requirements are designed to ensure that applicants are in a sound financial position to manage a credit card responsibly. By familiarizing yourself with these criteria, you can better prepare yourself for a successful application.

Age and Residency Requirements

To apply for a credit card with Credilo, you must meet certain age and residency requirements. Applicants need to be at least 18 years old, which is the legal age for entering into contracts in most jurisdictions. This ensures that you are capable of understanding and agreeing to the terms and conditions of the credit card agreement.

Moreover, you should be a legal resident or a citizen of the country in which Credilo operates. This requirement is crucial as it assures Credilo that you fall under the legal and regulatory framework they are accustomed to dealing with. Proof of residency or citizenship may be requested during the application process, so it’s wise to have these documents ready.

Minimum Income Criteria

Income stability is key when applying for a credit card, which is why Credilo has set a minimum income criterion for applicants. This criterion varies depending on the specific credit card product and the applicant’s location but serves as an assurance to Credilo that you have the financial means to make regular payments. Being transparent about your income and ensuring it meets or exceeds the minimum requirement will significantly increase your chances of approval.

Credit Score Considerations

Lastly, your credit score plays a pivotal role in the application process. Credilo, like most credit card issuers, will conduct a credit check to evaluate your creditworthiness. A good to excellent credit score indicates to Credilo that you have a history of managing your financial obligations well and are likely to do the same with your new credit card.

However, if your credit score is not up to the mark, don’t lose hope. Some Credilo credit card products are tailored for individuals looking to build or rebuild their credit. In such cases, factors other than credit score, such as income stability and the absence of recent bankruptcies, may be given more weight.

In summary, applying for a credit card with Credilo offers numerous benefits that extend beyond the convenience of digital application processes to encompass competitive rates and a robust rewards program. By understanding and meeting the eligibility criteria, including age, residency, income, and credit score requirements, you position yourself for success in your credit card application. This, combined with the advantages that Credilo credit cards offer, can significantly enhance your financial flexibility and personal or household budget management. Remember, responsible credit card use is key to maintaining a healthy financial lifestyle.

How to Apply for a Credit Card with Credilo

Applying for a credit card with Credilo is a straightforward process designed to be user-friendly and efficient. Whether you’re a first-timer or looking to add another card to your wallet, follow these simple steps to apply for your new credit card.

Step 1: Visit Credilo’s Official Website

The first step in your journey to getting a credit card with Credilo is to visit their official website. You can do this from any device with internet access – a computer, tablet, or smartphone. Once you’re there, look for the section labeled “Credit Cards” or a similar phrase, which should be easy to spot on the homepage or through the site’s menu options.

Step 2: Create an Account or Log In

If this is your first time applying for a card with Credilo, you’ll need to create an account. Click on the “Sign Up” or “Create Account” button and follow the prompts to provide your basic information. If you’re already a member or have previously applied for a product through Credilo, simply log in with your existing credentials. This step is crucial, as it ensures your application and any future dealings are securely linked to you.

Step 3: Fill Out the Application Form

After logging in or creating an account, you’ll be directed to the credit card application form. Here, you’ll need to provide detailed information, including your full name, address, date of birth, employment details, and annual income. It’s important to be as accurate as possible to avoid any delays in processing your application. You’ll also select the specific credit card you’re applying for, so make sure you’ve researched your options beforehand.

Step 4: Submit Required Documents

To proceed with your application, Credilo will require certain documents to verify the information you’ve provided. This typically includes identification such as a driver’s license or passport, proof of income like recent payslips or a tax return, and possibly a utility bill or bank statement to confirm your address. The website will guide you on how to upload these documents directly or, if necessary, provide an address to mail them.

Step 5: Review and Submit Application

Before hitting the submit button, take a moment to review your application thoroughly. Check all the details for accuracy and completeness. Missing or incorrect information can delay processing or result in a declined application. After reviewing, click on “Submit” to send your application to Credilo for processing. You will typically receive an email confirmation, and Credilo will reach out with next steps or a decision on your application within their stated timeframe.

Tips for a Successful Credit Card Application with Credilo

Ensuring your application is as strong as possible increases your chances of approval. Here are a few tips to help make your credit card application with Credilo successful.

Review Your Credit Report Before Applying

Before you apply, it’s wise to review your credit report. This allows you to correct any errors that might negatively impact your application. It also gives you a clear picture of your credit health, helping you understand what credit products you may be eligible for. Credilo may consider your credit score when reviewing your application, so it’s good to know where you stand.

Ensure Your Income Details are Accurate

Your income is a critical factor in determining your eligibility for a credit card. Make sure the income details you provide on your application are accurate and up-to-date. Underreporting your income could limit your credit options, while overreporting could lead to complications or rejection. Be prepared to provide recent payslips or other proof of income as requested to support your application.

Provide Complete and Correct Information

One of the most common reasons for delays or rejections in credit card applications is incomplete or incorrect information. Take your time filling out the application to ensure every piece of information you provide is correct and complete. Double-check your personal details, address, employment information, and any other required fields. This reduces the need for follow-up and can speed up the approval process.

By following these steps and tips, you’ll be well on your way to successfully applying for a credit card with Credilo. Remember, patience is key – it may take some time to process your application and receive your new credit card, but the financial freedom and opportunities it unlocks can be well worth the wait.

Common Mistakes to Avoid When Applying for a Credit Card with Credilo

Applying for a credit card through Credilo can be an exciting step towards financial flexibility and opportunities. Like with any financial step, it comes with responsibilities and necessitates attentiveness. A slight oversight could mean the difference between approval and rejection, not to mention the long-term impacts on your credit health. Let’s dive into some common pitfalls to avoid to ensure a smooth credit card application process with Credilo.

Providing False Information

One of the cardinal mistakes when applying for a credit card, especially through platforms like Credilo, is providing incorrect or false information. It might be tempting to tweak your income details or hide your true financial situation to improve your chances of approval, but remember, honesty is crucial. Credit card issuers have their means of verifying the information you provide, and discrepancies can lead to immediate rejection.

Beyond just the immediate rejection, being dishonest on your application can flag you as a high-risk applicant to other lenders. It’s a small world in the credit universe, and you don’t want to start off on the wrong foot. Provide accurate data concerning your income, employment status, and existing debts. If your financial situation isn’t perfect, it’s better to be truthful. There are credit card options for various financial scenarios, and Credilo can help match you with the right fit.

Ignoring the Fine Print

Admit it – we’ve all been guilty of skimming through terms and conditions at some point, ticking boxes without fully grasitating the agreements we enter into. However, when it comes to applying for a credit card via Credilo or any other platform, not paying attention to the fine print can lead to unpleasant surprises in the future.

Interest rates, annual fees, late payment penalties, and reward point expiration policies are just the tip of the iceberg. Each credit card comes with its terms, and overlooking these details can result in costs that outweigh the benefits of the card. For example, a card may offer enticing rewards, but if it comes with a high annual fee or steep penalties for late payments, it might not be the best choice for your financial habits.

Taking the time to understand the terms and conditions not only helps you choose a card that aligns with your spending habits and financial goals but also educates you on your rights and obligations as a cardholder. It might feel like homework, but consider it a valuable investment in your financial health. Plus, it can save you from a lot of headaches down the line!

In closing, applying for a credit card with Credilo is a step towards unlocking a world of financial opportunities, but it’s imperative to approach it with diligence and honesty. Avoid these common pitfalls by providing accurate information and paying close attention to the fine print. By doing so, you’ll increase your chances of approval and ensure that your credit card works for you, not against you. Remember, the right credit card can be a powerful financial tool, but it’s the wise use and understanding of it that truly unlocks its potential. Happy card hunting!

Conclusion

After walking through the steps to apply for a credit card with Credilio, it’s clear that the process is straightforward and designed with the user in mind. Credilio simplifies the journey to obtaining a credit card, making it accessible and less intimidating, especially for first-timers. Remember, the key to a successful application lies in accurately completing the forms, choosing the right credit card for your financial goals, and maintaining a good credit history.

Applying for a credit card is a significant step towards financial flexibility and opportunities. With Credilio, this step is made easier. Don’t forget to:

– Gather all the necessary documents before you start.

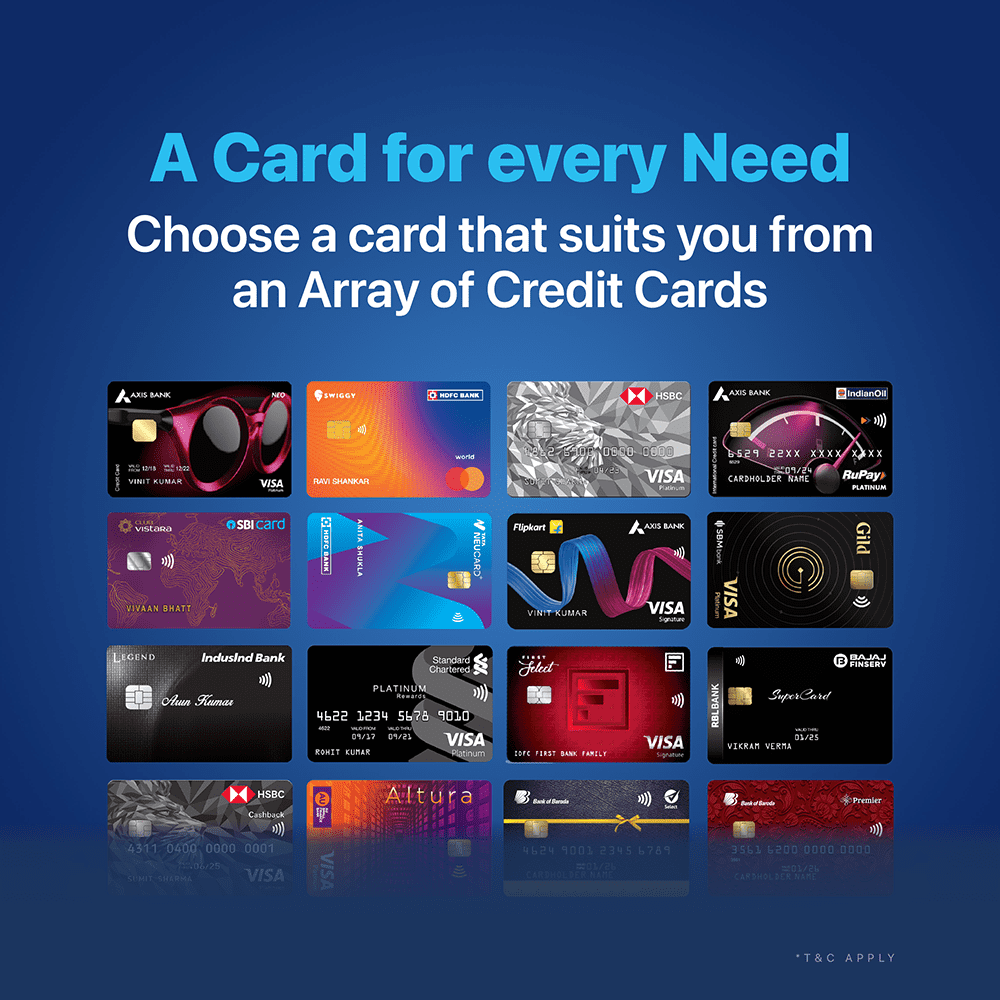

– Review all the credit card options available to you.

– Double-check your application for errors.

By following these simple tips, you’re well on your way to unlocking a world of financial opportunities. Whether you’re looking to earn rewards, build credit, or need a little extra for those unexpected expenses, Credilio is here to help make your financial goals a reality.