Among all user segments, HDFC Credit Cards are the most widely used cards. With these cards, you can improve your lifestyle, treat yourself to a lavish pleasure, make meaningful purchases, receive fuel perks, and take flights to far-off places.So, Lets fund out in below list about India best HDFC bank credit card in 2024

India best HDFC bank credit card list

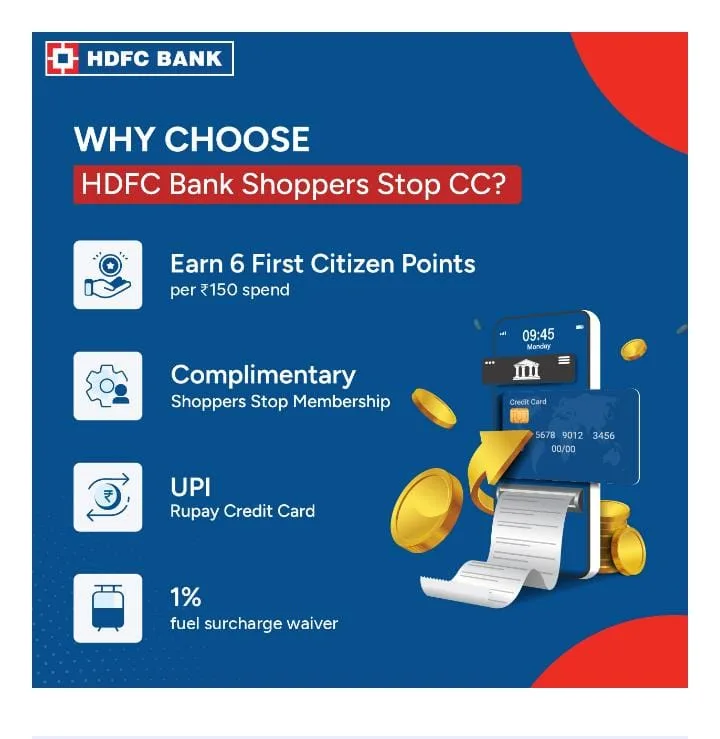

India top 10 HDFC bank credit card list| Name of the Card | Annual Fee | Type of Card | |

|---|---|---|---|

| HDFC Freedom Credit Card | Rs.500+GST | Shopping and Rewards | |

| HDFC Indian Oil Credit Card | Rs 500+GST | Fuel Credit Card | |

| HDFC Infinia Credit Card | Rs 12,500+GST | Infinia Metal Edition Credit Card | |

| HDFC MoneyBack Credit Card | Rs.500+GST | Shopping and Cashback | |

| HDFC Millenia Credit Card | Rs.1000+GST | Shopping and Cashback | |

| HDFC Diners Club Black Credit Card | Rs.5000+GST | Lifestyle and travel | |

| HDFC Regalia Credit Card | Rs.2500+GST | Luxury Travel Card | |

| HDFC Platinum Plus Card | Rs.399+GST | Shopping and Rewards | |

| HDFC Business Platinum Credit Card | Rs.299 +GST | Corporate | |

| HDFC Business Moneyback Credit Card | Rs.500+GST | Reward Point and CashBack |

Features & Benefits of India best HDFC bank credit card

Features

- Some common features you can enjoy after applying for HDFC Bank Credit Card online.

- Annual fees and renewal fees will vary for each cardholder depending on the card held and will be informed at the time of applying for the card.

- Credit-free period up to 50 days is available. If the cardholder opts for revolving payment, then an interest as low as 1.9% p.m. will be applied on the balance carried forward.

- Cash withdrawal charges at 2.5% of the amount withdrawn with a minimum of Rs. 500 will be collected.

- Limit on the Credit Card will be fixed by HDFC bank based on several criteria and the limit has to be shared among the Add On members as

well. The same will be informed to the cardholder at the time of delivering the card.

If the card is used beyond the limit, 2.5% of the over limit will be charged for all cards except Infinia.

A late fee ranging from Rs. 100 to Rs. 750 is applied per statement cycle for the card dues not paid in accordance to the due date.

Benefits

The Benefit of HDFC Credit Cards are a lot, however, the most popular cards among each segment of users because of the following reasons:

- Instant approval on applying for HDFC credit card online.

- It can be automatically set to pay recurring bills like phone, electricity, and water bills.

- It has the best ‘buy now and pay later’ option. You also get a grace period up to 50 days from the date of purchase. During the grace period, interest will not be charged on the outstanding amount.

- You will earn reward points for every purchase with the card which can be redeemed for exciting gifts and vouchers.

- The Applicant can easily apply for HDFC Jumbo Instant Loan.

- With selected offline and online merchants, HDFC offers a host of cash back and discounts.

- The Credit Card statement gives an item wise list of expenditures made on the Credit Card, which helps you keep track of your expenses.

How to Apply for an HDFC Credit Card Online?

- Click on the ‘Apply Now’

- Compare various HDFC Credit Card offers to find the best one for you.

- Submit an online application form for the card that you have chosen along with some personal details and HDFC Credit Card Document.

- If you fulfill the HDFC Credit Card Eligibility, the card will be issued to you after it is approved.

Fee & Charges of HDFC Credit Card

Here is a list of service charges associated with your HDFC Credit Card. However, the fees and charges may vary because of different HDFC Credit Card types. You can call HDFC Credit Card Customer Care for complete details.| Interest Free Period | Up to 50 days | |

|---|---|---|

| Interest Rate | 3.49% per month | |

| Additional Card Fee | Free | |

| Cash advance fees | 2.5% of the amount | |

| Cash processing fee | Rs. 100 | |

| Reward redemption fee | Rs. 99 per request | |

| Foreign currency transactions Charges | 3.50% | |

| Balance transfer charges | 1% of the amount or minimum Rs. 250 | |

| Reissuance fee | Rs. 100 | |

| Payment return Fee | 2% | |

| Cash advance limit | 40% of the credit limit | |

| Overlimit Charges | 2.50% of the overlimit amount | |

| Card Replacement Charge | Rs. 100 |

Eligibility to Apply for an HDFC Credit Card?

The HDFC Bank has set the following eligibility criteria for availing its Credit Card facility:

- The applicant can either be salaried or self-employed.

- Applicant should be in the age group between 21 years to 60 years if salaried or between 21 years to 65 years if self-employed.

- Should have a stable income.

- Applicant should submit income proof, address proof, business proof, and Photo ID.

- Credit score should be above 750.

Documents Required for HDFC Credit Card

For Salaried employees

- 2 photographs of the applicant in passport size.

- ITR records from the last two years.

- Proof of identity such as the applicant’s Passport/ PAN Card/ Voter ID/ Driving License

- Proof of Residential Address such as Registered Rent Agreement/ Leave and License/ Utility Bill of at least three months/ Passport.

- Proof of Income such as last six months’ salary slip, Form 16 of two years, Bank statement of previous six months (that reflects salary is credited or EMI is debited).

For Self-Employed

- 2 photographs of the applicant in passport size.

- Proof of identity such as the applicant’s Passport/ PAN Card/ Voter ID/ Driving License.

- Proof of Residential Address such as Registered Rent Agreement/ Leave and License/ Utility Bill of at least three months/ Passport.

- Proof of Business like GST/ Service Tax Registration/ company’s incorporation details/ Address proof of the business/ accounts and balance sheets showing profit and loss statements which have been certified by a CA/ the proof of the business’ existence/ a copy of the partnership deed and business profile.

How to Pay HDFC Credit Card Bill Online

You can make HDFC Credit Card payments using different options:

- Netbanking: Use HDFC Net Banking service for your credit card number as the beneficiary account number to transfer funds.

- Mobile Banking: Download the HDFC mobile banking app and make payments from your smartphone.

- Cheque: Drop a cheque at any HDFC collection centre at least 10 days before the due date.

- Cash: Make a cash payment towards the loan at your nearest HDFC branch.

How to use HDFC Credit Card (Tips & Advice)

To make the best HDFC Credit card use, here are some simple tips:

- Pay the full outstanding amount on or before your due date.

- Avoid using your HDFC Card to make cash withdrawals unless it is an emergency.

- Do not use the full available credit each month as it reflects poorly on your CIBIL report.

- Do not make minimum payments as it is the easiest way to get entangled in credit card debts.

- Use your credit card only when required. Or make sure you keep track of the payments made using your card.

- Never disclose your credit card details to anyone over email, SMS, or phone calls.

Balance Transfer: How to use the BT feature and what are the Benefits?

With HDFC Balance Transfer on EMI facility provided by HDFC Bank, you can easily transfer your other bank’s credit card balance to HDFC at attractive rate of interest. You can opt for low EMIs without any hassle of documentation. It is a quick and easy method to clear your outstanding card amount, through a BT to your Credit Card. Pay EMIs as low as Rs. 27 per Rs. 10,000 and repay in easy instalments of 9 to 48 months.

You can check your eligibility for this facility by logging into HDFC Net Banking & Click Cards → Credit Cards → Transact → Balance Transfer On EMI. You can also call HDFC’s PhoneBanking round the clock.

HDFC Bank Credit Cards FAQs

✅ How do I check the status of my Credit Card application?

It is completely hassle-free to check the status of your Credit Card application. If you are an existing HDFC customer, log on to the bank’s website. Enter the 16-digit application reference number and verify the inputs with your date of birth or mobile number. You will instantly be updated about the status of the application.

✅ How do I change the address for my HDFC Credit Card?

You can change the address by sending an e-mail to the bank. Alternatively, you can process the request on the portal.

✅ Can I stop card statements from coming to my postal address?

For a change in address of correspondence, download the physical statement suppression MID form from the official HDFC website. You are required to duly fill it, sign it, and send it to the following address:

HDFC Bank Cards Division,

O. Box No. 8654,

Thiruvanmiyur, Chennai- 600 041

✅ What should I do when my card is lost or stolen?

Follow these steps in case of loss or theft of card:

Call customer care service at 1800 266 433 and report the loss of card. It is a 24X7 facility.

Log on to net banking account and report the missing card and hotlist your card.

✅ What to do when an unauthorised transaction is made on my lost card?

If a credit card transaction appears to have been “not done by you,” you can report it by contacting 18002586161.

Additionally, before reporting unauthorised transactions, have the following information on hand:

- Credit card number with sixteen digits

- Type/ kind of transaction

- Date of the exchange

- Transaction amount

✅ How can I contact HDFC Credit Card customer care?

You can contact HDFC Credit Card Customer Care for your queries and complaints using the following methods:

- Send an email

- Call

- Visiting the branch

- Post

- Typically, the response to a query takes a maximum of 10 working days. You can raise the question after this time frame.

✅ Can I use my HDFC credit card to apply for a loan?

You can easily raise a fast loan against your credit card limit with your HDFC Credit Card. Thus your card makes you credit-ready in case of financial emergency or cash lapse scenarios. You can use any of the following loan facilities:

- HDFC Insta Loan: In a matter of seconds, your HDFC Bank account will be credited with an instant loan.

- With the HDFC Bank Instant Jumbo Loan, you can apply for a loan without having to fill out any paperwork. The same can be requested online.

- HDFC Balance Transfer on EMI: Your card permits to transfer your card balance at attractive rate of interest. You can opt for low EMIs without any hassle of documentation.

Using a BT to your credit card is a quick and simple way to pay off the balance on your card.

HDFC Smart EMI: You may easily convert your card purchases into manageable installment payments with Smart EMI.

✅ Can reward points on my HDFC Credit Card expire?

Yes. Reward points on your card expire. The points are valid for 2 years only. Premium HDFC Credit Cards such as HDFC Diners Club Black Credit Card offer an extended validity of 3 years.

✅ How to Activate HDFC Credit Cards Online?

- Log on to the HDFC Bank Net Banking website.

- Enter your PIN and customer ID

- Select “Credit Card ATM PIN” from the Requests menu in the HDFC Credit Cards section.

- Select the card that you wish to set the PIN for Once you set the PIN, your card is enabled.