ntroduction

Hey there, savvy savers! Are you tired of the interest rates on your savings account barely keeping up with inflation? Well, it’s time to level up your investment game with a super-charged savings strategy: Fixed Deposits (FDs) with Fincare Small Finance Bank, in collaboration with Bajaj Finance. Maximizing Returns with Fixed Deposits have long been a go-to for those looking to grow their savings safely and steadily. With interest rates reaching up to 9.20%*, it’s no wonder FDs are grabbing headlines and turning heads.

This partnership between Fincare SFB and Bajaj Finance, and the introduction of the Stable Money App, has made accessing such lucrative rates easier and more convenient than ever before. Whether you’re a conservative investor who cherishes capital security or someone looking to supplement their income with regular interest payouts, this guide will walk you through how to maximize returns and achieve your financial goals. Buckle up, because your journey towards more stable and impressive money growth starts now!

Understanding Fixed Deposits

Definition and Benefits

Fixed Deposits (FDs) are a popular form of investment that involve locking away a sum of money with a financial institution for a specific period of time. This type of investment is known for yielding guaranteed returns at a predetermined interest rate, making it an incredibly reliable way to save money.

The benefits of Fixed Deposits are manifold. Firstly, they offer a higher interest rate compared to regular savings accounts, ensuring that your money grows at a more substantial pace. Secondly, FDs provide safety and stability since they are unaffected by market fluctuations, offering a risk-free way to secure your funds. This makes FDs an ideal choice for those looking to save money with minimal risk involved. Moreover, the flexibility in terms of choosing the deposit term – from a few months to several years – caters to various financial goals, whether short-term or long-term. Lastly, the interest earned on FDs can be a source of regular income, especially beneficial for retirees or those looking for a steady income stream.

Importance of Maximizing Returns with Fixed Deposits for Savings

In the realm of saving, fixed deposits hold paramount importance. They serve as a cornerstone for building a healthy financial portfolio, especially for individuals aiming for a blend of growth and security in their savings. FDs encourage the habit of saving by locking away a portion of your income, thereby preventing impulsive spending.

The predictable returns on FDs make them an excellent tool for financial planning. Whether it’s saving for a major purchase, creating an emergency fund, or planning for retirement, fixed deposits can help achieve these goals with certainty. The cumulative interest feature available in fixed deposits compounds over time, exponentially increasing your savings without any extra effort. Given their secure and low-risk nature, FDs are particularly beneficial for conservative investors or those nearing retirement who cannot afford to gamble with their hard-earned money. In essence, fixed deposits act as the backbone of a robust saving plan, ensuring peace of mind and financial security.

Fincare Small Finance Bank (SFB)

Overview of Fincare SFB

Fincare Small Finance Bank (SFB) has emerged as a beacon of strength and reliability in the banking sector, especially known for its customer-centric approach and innovative financial solutions. Established with the objective of providing banking services to the unbanked and underbanked segments of the society, Fincare SFB has rapidly expanded its footprint across India, offering a wide array of banking products and services that cater to the needs of various customer segments.

Fincare SFB stands out for its commitment to leveraging technology to enhance customer experience. The bank offers digital-friendly services, enabling customers to transact and manage their accounts conveniently from anywhere. This focus on digital innovation aligns with the growing demand for online banking facilities, allowing Fincare SFB to cater to the tech-savvy generation while also simplifying banking for all demographics. The bank’s community-oriented approach, competitive interest rates, and emphasis on transparency and ethics have earned it a trusted place among customers seeking a dependable banking partner.

Fixed Deposit Schemes Offered by Fincare SFB

Fincare Small Finance Bank offers a variety of fixed deposit schemes tailored to meet diverse financial goals and requirements. These FD schemes are designed to maximize returns for investors, making Fincare SFB a compelling choice for anyone looking to invest in fixed deposits.

One of the hallmarks of Fincare SFB’s FD offerings is the attractive interest rates that it provides. With interest rates going up to 9.20%* for specific tenures, the bank stands out as one of the highest interest-paying banks in the fixed deposit segment. This high interest rate is especially beneficial in a low interest rate environment, offering investors the opportunity to earn significant returns on their deposits.

The bank provides flexible tenure options ranging from 7 days to 10 years, catering to both short-term and long-term investment needs. This flexibility allows depositors to plan their investments according to their financial goals and liquidity needs. Additionally, Fincare SFB offers various payout options, including monthly, quarterly, and at maturity, providing depositors the choice to manage the cash flow as per their requirements.

Notably, Fincare SFB also offers a special scheme for senior citizens, providing them an additional interest rate boost, reflecting the bank’s consideration for the elderly population’s financial well-being. Moreover, the bank has made the process of opening an FD account simple and hassle-free, with an option for online account creation, making it accessible for everyone to start their investing journey.

In essence, the fixed deposit schemes by Fincare SFB are designed to cater to the needs of a wide spectrum of investors, providing them a safe and profitable avenue to grow their savings. Whether you are a young professional starting your financial journey, a middle-aged individual saving for a big life event, or a retiree looking for regular income, Fincare SFB’s FD schemes offer the stability and growth potential to meet your savings objectives.

Bajaj Finance

Introduction to Bajaj Finance

When conversation veers towards reliable and rewarding investment vehicles, Fixed Deposits (FDs) with Bajaj Finance invariably get a special mention. Bajaj Finance Limited, a part of the prestigious Bajaj Finserv, stands as a beacon of financial stability and integrity in India’s crowded landscape of finance companies. With a focus on customer satisfaction and transparency, Bajaj Finance offers a multitude of financial products, but its Fixed Deposit schemes are particularly noteworthy for those seeking steady growth in their savings without the volatility of equity markets.

Benefits of Fixed Deposits with Bajaj Finance

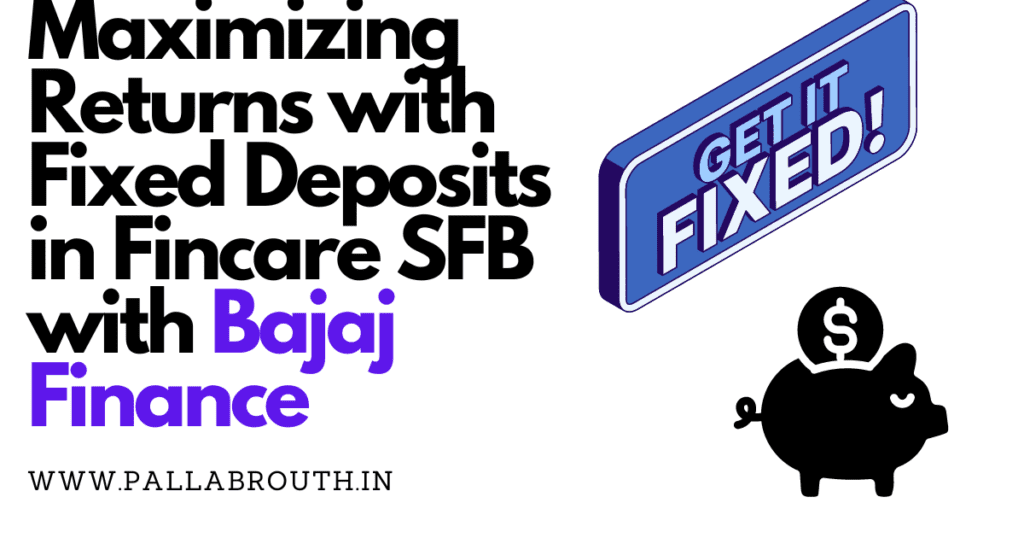

Fixed Deposits with Bajaj Finance are not just about parking your money and watching it grow; they’re about making a smart choice towards securing your financial future. Here are some compelling benefits:

– Unmatched Security: With high safety ratings of FAAA by CRISIL and MAAA by ICRA, your investments are as secure as they can get.

– Attractive Interest Rates: Offering one of the highest interest rates in the market, Bajaj Finance ensures your savings grow at an optimal pace.

– Flexible Tenures: Choose from a wide range of tenure options to match your financial goals, making it easier to plan for both short-term and long-term objectives.

– Loan against FD: In need of emergency funds? Get a loan against your FD up to 75% of its value, without breaking it.

– Online Process: With a simple and user-friendly online process, starting your FD is just a few clicks away.

Interest Rates Comparison with Other Institutions

In the quest for the best fixed deposit rates, a comparative analysis reveals that Bajaj Finance often tops the chart. While most banks and financial institutions offer interest rates ranging between 5% to 7% on fixed deposits, Bajaj Finance steps up the game by offering rates that can go up to 9.20%* for certain investor categories, such as senior citizens. This stark difference not only highlights Bajaj Finance’s commitment to providing value to its customers but also positions it as a frontrunner in the competitive space of fixed deposits.

Maximizing Returns with Fincare SFB & Bajaj Finance

Detailed Analysis of Fixed Deposit Options

When it comes to choosing the right Fixed Deposit, the landscape can seem quite vast. However, focusing on Bajaj Finance and Fincare Small Finance Bank (SFB), let’s delve into what makes their FD options stand out. Both institutions offer a range of tenures from 12 months to 60 months, with interest rates tailored to reward long-term investors.

The interest payout options vary, offering flexibility to investors according to their cash flow needs: cumulatively, where the interest is paid at maturity, or non-cumulatively, where the interest is paid at regular intervals. For those aiming to maximize returns, opting for a cumulative FD with a longer tenure at Bajaj Finance or Fincare SFB could see your initial investment grow substantially, thanks to the magic of compounding interest.

Strategies for Optimal Returns

To truly maximize your returns with Fixed Deposits in Bajaj Finance and Fincare SFB, consider the following strategies:

– Stagger Your Investments: Instead of investing a lump sum in a single FD, stagger your investments across multiple FDs with varying tenures. This strategy, known as laddering, not only provides liquidity but also helps in managing interest rate risk.

– Reinvest Your Interest: Opting to reinvest your interest payouts rather than withdrawing them can significantly impact the growth of your investment due to compounding.

– Monitor the Interest Rate Environment: Stay informed about the interest rate trends. Should the rates increase significantly, consider breaking your current FD (mindful of any penalty) and reinvesting at a higher rate.

Best Practices for Managing Fixed Deposits

Managing your Fixed Deposits effectively is crucial to ensuring that your investment journey is smooth and rewarding. Here are some best practices:

– Keep an Eye on Renewal Dates: Automate reminders for your FD’s maturity date so you can make timely decisions about renewal or reinvestment.

– Review Your Investment Portfolio Regularly: Your financial goals and needs can change, so it’s important to periodically review your FD investments to ensure they still align with your objectives.

– Make the Most of the Online Tools: Utilize online calculators and the Stable Money App to track your investments, forecast your returns, and manage your FDs efficiently.

– Stay Updated on Taxation Rules: Understand the tax implications of your FD investments. Interest income from FDs is taxable, so plan your taxes accordingly, possibly exploring options like Tax Saver FDs.

By integrating these insights and strategies into your financial planning, investing in Fixed Deposits with Bajaj Finance and Fincare SFB can be a powerful way to achieve steady and predictable growth in your savings. With the right approach, you can ensure that your money not only remains safe but also works hard for you, setting a strong foundation for your financial future.

Conclusion

In today’s financial landscape, where the uncertainty of market-based investments can give even the most astute investor pause, fixed deposits stand out as a beacon of stability. Opting for fixed deposits with Fincare Small Finance Bank and Bajaj Finance not only furnishes you with an opportunity to earn up to 9.20%* interest but also provides a layer of safety for your hard-earned money. The partnership between these two financial powerhouses means you’re placing your investments in the hands of industry leaders, ensuring that your financial growth is both steady and reliable.

By choosing to invest through the Stable Money App, you’re adding an extra layer of convenience and accessibility to your financial planning. This app simplifies the process of initiating and managing your fixed deposits, making it easier than ever to watch your savings grow from the comfort of your home or while on the move.

– *Earning high interest: With rates up to 9.20%, your money grows faster than in a traditional savings account.

– *Safety and stability: Backed by two reputable institutions, your investment is secure.

– *Ease of use: The Stable Money App brings the whole process to your fingertips, making investment management a breeze.

In the end, maximizing your returns with fixed deposits through Fincare SFB and Bajaj Finance is a smart move for those seeking a blend of high interest, security, and convenience. It’s a financial decision that supports your goals today, while paving the way for a more prosperous tomorrow