Have you ever been tempted by the promise of lifetime free credit cards, offering a world of benefits without the hassle of annual fees? It sounds like a dream come true for many of us trying to navigate the complex world of credit. These cards seem to offer instant approval, fantastic rewards, and, importantly, no yearly charges. But, as with anything that sounds too good to be true, there are pros and cons to consider. Let’s dive in and explore what lifetime free credit cards are all about, so you can make an informed decision on whether they’re right for you.

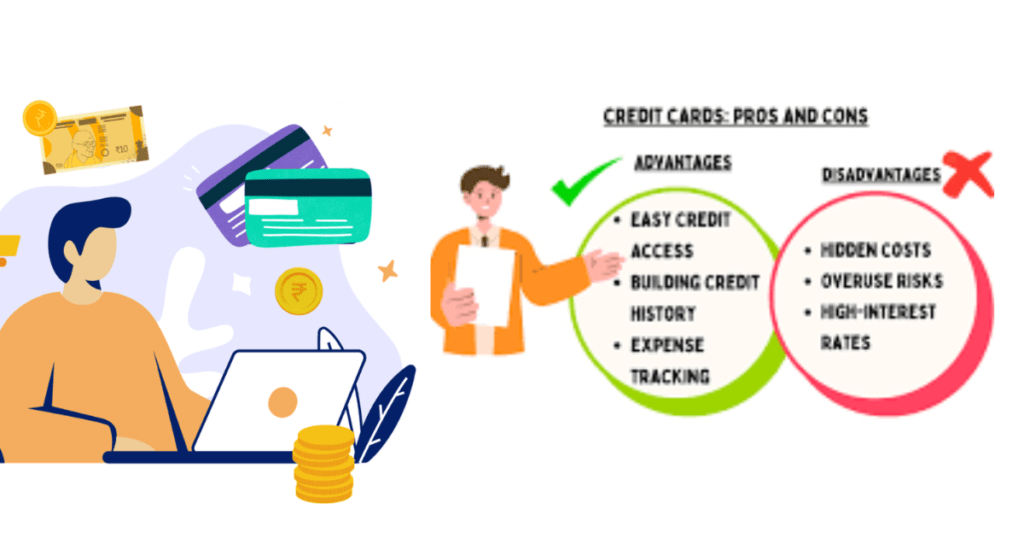

Pros and Cons of Lifetime Free Credit Cards Explained

Introduction

Lifetime free credit cards may seem enticing with their promise of no annual fees and attractive rewards. However, it is important to carefully weigh the advantages and disadvantages before making a decision. Understanding what these cards offer and the potential drawbacks will help you make an informed choice about whether they are suitable for your financial needs.

Absolutely, let’s dive right into the world of lifetime free credit cards and see what they have to offer, and maybe some of the finer print that’s not always upfront and center.

Pros of Lifetime Free Credit Cards

When you hear about lifetime free credit cards, it’s like hearing a song that you can’t help but dance to. The idea of not having to pay to use a credit card can be very appealing. Here, we’ll explore some of the sunny sides of having a lifetime free credit card.

Instant Approval

One of the sweetest parts of signing up for a lifetime free credit card is often the instant approval feature. Financial institutions keen on attracting more customers with these cards have streamlined the process, making it as quick as a flash. This means you can apply today and, in some cases, start using your credit line almost immediately. It’s especially handy for those moments when you need to make a swift move, like snagging an early bird discount on tickets or making an emergency purchase.

No Annual Fees

The highlight of lifetime free credit cards, and rightfully so, is the absence of annual fees. Imagine a world where you don’t have to pay a fee each year just for the privilege of using a credit card. It’s quite the saving on its own, considering that annual fees on some credit cards can dig a hole in your wallet over time. This makes lifetime free credit cards particularly attractive for users who prefer to keep their spending lean and efficient without the worry of an annual fee sneaking up on them.

Credit Card Benefits and Perks

Now, don’t think that just because it’s a lifetime free credit card, it’s a no-frills deal. Many of these cards come loaded with benefits and perks that can make your spending more enjoyable and, sometimes, more rewarding. From cash back on purchases, discounts at partner stores, to even travel insurance and lounge access for some, the benefits can add up quickly. It’s like finding a hidden trove of treasures in your wallet that rewards you for your regular spending.

Cons of Lifetime Free Credit Cards

Now, let’s dim the lights and talk about the other side of the story. While lifetime free credit cards come with appealing features, they also have their downsides. It’s essential to weigh these cons carefully against the pros before making your move.

Higher Interest Rates

Here’s the kicker: while you might save on annual fees, these cards often come with higher interest rates. It’s a bit like a seesaw; you go down on annual fees, but up go your interest rates. If you’re someone who carries a balance on your credit card from month to month, this can mean higher costs over time. It’s crucial to consider how you plan to use your card and if the benefits truly outshine potentially higher interest charges.

Hidden Fees and Charges

Much like hidden traps in a treasure hunt, lifetime free credit cards can come with their array of hidden fees and charges. It could be anything from higher foreign transaction fees, cash advance fees, or even fees for specific types of transactions. The best defense against these hidden charges is a good offense – make sure to read the fine print and understand exactly what you’re signing up for. Knowledge is power, especially when it comes to managing your finances smartly.

Limited Credit Card Rewards

Lastly, while some lifetime free credit cards offer enticing rewards and benefits, others might come with a more limited selection. It’s like going to a buffet and finding out there are only a few dishes you like. If earning rewards or points is a significant factor for you, this limitation can be a bit of a letdown. Be sure to compare the rewards structure of different cards and see how they match up with your spending habits and preferences. Sometimes, paying a reasonable annual fee for a card offering richer rewards could be a more value-packed option in the long run.

Choosing a lifetime free credit card can indeed be a smart financial move, but it’s essential to weigh both sides of the coin carefully. Consider how you plan to use the card, your financial habits, and what you value most in a credit card offering. Whether the instant approval, absence of annual fees, and the benefits outweigh the potential higher interest rates, hidden fees, and reward limitations is a personal decision. Armed with the right information, you can choose a card that aligns best with your financial goals and lifestyle. After all, the goal is to have your credit card work for you, not the other way around. Cheers to making informed financial choices!

Factors to Consider when Choosing a Lifetime Free Credit Card

Choosing the right lifetime free credit card is crucial to ensure it fits your financial habits and goals. Here are some key factors to consider before making your choice.

Credit Score Requirements

Your credit score plays a pivotal role in determining whether you’ll be approved for a lifetime free credit card. These cards often require a good to excellent credit score as they offer the perk of no annual fees. To avoid disappointment, it’s wise to check the credit score requirement before applying. If your score is below the requirement, it might be a good idea to work on improving it first.

Credit Limit

The credit limit is another important factor to consider. It’s essentially the maximum amount you can borrow at any given time. Credit limits on lifetime free credit cards can vary significantly depending on the issuer and your financial profile. Think about your spending habits and whether the offered credit limit meets your needs. Remember, a higher credit limit not only allows for more spending flexibility but can also positively impact your credit score by lowering your credit utilization ratio, provided you don’t max out the card.

Additional Features and Services

Some credit cards come with additional perks that can be incredibly valuable. These might include cash back on purchases, airline miles, or access to exclusive discounts and offers. However, it’s essential to consider whether these features align with your lifestyle. For instance, if you’re not a frequent traveler, a card that offers airline miles might not be the best fit for you. Compare the benefits of different cards to find one that offers rewards you’ll actually use.

Customer Support

Excellent customer support is something many people might overlook when choosing a credit card. Yet, it becomes crucial when you face issues like fraudulent transactions or need clarification on charges. Lifetime free credit cards from issuers known for their robust customer service can offer peace of mind. Before applying, read reviews or ask for recommendations to gauge the quality of the issuer’s customer support.

How to Apply for a Lifetime Free Credit Card

Now that you know what to look for in a lifetime free credit card, the next step is the application process. Here’s how to go about it.

Research and Compare Different Credit Card Options

Start by doing thorough research. Make a list of lifetime free credit cards and compare them based on the factors mentioned earlier: credit score requirements, credit limit, additional features, and quality of customer support. Use online comparison tools or financial websites to aid your research. This step is crucial to narrow down the options to those that best fit your financial situation and lifestyle.

Check Eligibility Criteria

Once you’ve shortlisted a few credit cards, the next step is to check Your eligibility criteria. Apart from the credit score, look into other requirements such as annual income, age, and residency. Understanding these criteria will help you gauge your chances of approval and ensure you’re applying for cards that match your profile.

Gather Required Documents

Before submitting your application, ensure you have all the necessary documents at hand. Typically, you’ll need proof of identity (like a passport or driver’s license), proof of income (such as pay stubs or tax returns), and in some cases, proof of address. Having these documents ready can streamline the application process and speed up approval times.

Submit Application Online

Finally, it’s time to apply. Many credit card issuers allow you to submit your application online —a convenient and fast way to apply. The online application process usually involves filling out a form with your personal and financial information and uploading the required documents. Alternatively, if you prefer a more traditional approach or require assistance, you can apply in person at a bank branch. Some issuers might also offer the option to apply over the phone.

Regardless of the method you choose, carefully review all information before submitting your application to avoid any delays due to errors. Once submitted, you’ll typically receive an instant decision or notification of when to expect a decision on your application.

obtaining a lifetime free credit card can be a smart financial move, offering the convenience of a credit card without the burden of annual fees. By carefully considering factors like credit score requirements, credit limit, and additional perks, and following the right steps in the application process, you can find a card that not only meets your financial needs but also enhances your spending power and rewards you in ways that matter most to you. Remember to use your credit card wisely to maintain a healthy credit score and enjoy the maximum benefits your card has to offer.

In conclusion

Tips for Using a Lifetime Free Credit Card Wisely

Embarking on the adventure of managing a lifetime free credit card can be liberating yet daunting. Like any financial tool, the benefits are maximized when used with knowledge and caution. To ensure you glide smoothly on this journey, here are a few proven tips that could safeguard your financial health and enhance the value of your credit card.

Pay Your Bills on Time

Punctuality in bill payments is not just about avoiding late fees – it’s a cornerstone of credit wisdom. Paying your credit card bill on time each month is a straightforward yet powerful strategy. It demonstrates to lenders that you’re a responsible borrower, which can be beneficial for your credit score. Here’s the kicker: consistent on-time payments can open doors to lower interest rates on loans and other credit cards, not to mention keeping pesky late fees at bay.

Set reminders on your phone or enroll in automatic payments if remembering due dates isn’t your forte. This simple habit can save you from unnecessary charges and keep your credit score on an upward trajectory.

Keep Utilization Ratio Low

Your credit utilization ratio might sound like financial jargon, but it’s actually a simple concept with significant impact. It refers to how much of your available credit you’re using at any given time, and it’s a major ingredient in the recipe for your credit score. The golden rule? Keep your utilization below 30%. This tells potential lenders that you’re not overly dependent on credit, painting you in a more financially stable and trustworthy light.

Here’s how you can keep this ratio in check: try to pay off a chunk, if not all, of your balance before the billing cycle ends, and avoid maxing out your card. Not only does this strategy help your credit score, but it also ensures you’re not accumulating interest on large balances.

Monitor Your Credit Score Regularly

Staying informed about your credit score might seem like homework, but in the world of credit cards, knowledge is indeed power. Regular checks allow you to understand the effect of your financial actions on your credit health. Notice a dip after missing a payment or reaching your credit limit? You’ll know what habits to improve. Monitoring your score frequently also helps in spotting errors or fraudulent activity early, enabling swift action to safeguard your credit.

Many websites like Credilio and credit card issuers offer free credit score monitoring, making this practice easier than ever. Engaging with your credit score regularly demystifies credit and turns it into a tool for achieving financial stability.

In conclusion, lifetime free credit cards, like any form of credit, come with great opportunities if used wisely. By ensuring you pay your bills on time, keeping your credit utilization low, and monitoring your credit score regularly, you can navigate the world of credit with confidence. These practices not only help in maximizing the benefits of your credit card but also in maintaining a healthy financial profile, proving that disciplined credit usage is indeed rewarding.

In conclusion

Conclusion

Deciding on whether a lifetime free credit card is suitable for you ultimately depends on your personal financial habits and goals. With their mix of instant approval, enticing rewards, and absence of annual fees, these cards offer appealing benefits for many. However, it’s crucial to stay mindful of potential hidden charges and evaluate how the rewards align with your spending. By carefully considering both the pros and cons, you can make an informed decision that supports your financial wellbeing.