Introduction

Brief overview of short-term investments and the importance of maximizing returns

Strategies to Maximize Returns with Short-term investments, often held for less than a year, are a smart way to grow your wealth without locking funds away for long periods. Whether you’re saving for a near-future goal or building an emergency fund, maximizing returns on these investments can significantly impact your financial health. By choosing strategies wisely, you can enjoy higher gains while managing risks, ensuring your money works as hard as you do.

Understanding Strategies to Maximize Returns

Definition of short-term investments

Short-term investments are like the sprinters of the financial world: quick, efficient, and aiming for fast results. Unlike their long-distance relatives that you hold onto for years (or even decades), short-term investments are all about making your money work for you over a period that typically ranges from a few months up to five years. The goal? To earn returns more swiftly than waiting around for long-term investments to mature. They’re the perfect choice for folks looking to meet nearer financial goals, like saving up for a vacation, an emergency fund, or even just to keep your cash growing while deciding on longer-term financial strategies.

Types of short-term investment options available

Luckily, the world of short-term investments isn’t a one-size-fits-all deal. There’s a variety of options to choose from, each with its own perks and quirks:

– Savings accounts: The tried and true option, perfect for those who want zero risk. Just stash your cash and watch it grow at a (usually modest) interest rate.

– Certificates of Deposit (CDs): Slightly more commitment required here, as your money gets locked in for a predefined period. But, as a trade-off, you often get better interest rates than savings accounts.

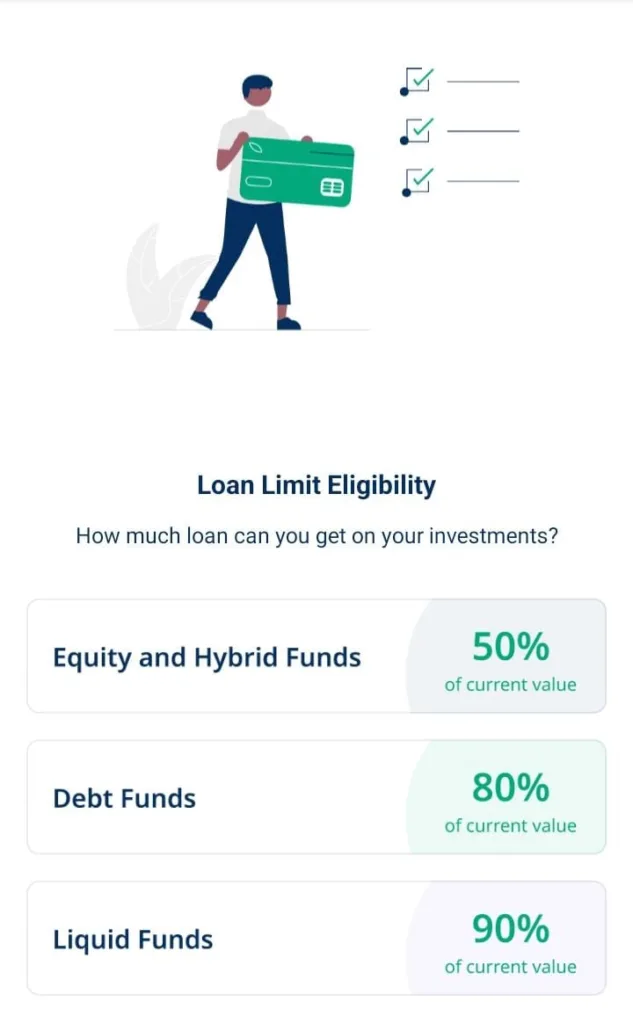

– Money market accounts: A bit like savings accounts with a twist, offering higher interest rates in exchange for higher balance requirements.

– Short-term bond funds: These involve investing in bonds that are set to mature soon. A bit riskier, but with potential for better returns.

– Treasury securities: Super safe, government-backed options. You won’t get rich quick, but you won’t lose your shirt either.

– Peer-to-peer lending: For the more adventurous, this involves lending your money directly to individuals or businesses, potentially earning higher returns in the process.

Factors to consider when choosing short-term investments

Choosing the right short-term investment boils down to a balancing act between three key factors:

– Risk tolerance: How much uncertainty are you willing to stomach? Higher potential returns often come with higher risks.

– Liquidity needs: How soon might you need access to your cash? Some options are more flexible than others when it comes to withdrawing your investment.

– Investment goals: What are you aiming to achieve with this investment? Your goals will guide whether you prioritize safety, returns, or a mix of both.

Importance of Maximizing Returns on Short-Term Investments

Significance of higher returns in financial planning

In the grand scheme of financial planning, nabbing higher returns on short-term investments is akin to finding bonus coins behind the couch cushions; it’s unexpected extra cash that can significantly boost your financial well-being. Whether you’re saving up for a down payment, preparing for unforeseen expenses, or just padding your emergency fund, squeezing out those extra percentages in returns can make a big difference. It’s not just about growing your money, but doing so in a smart way that aligns with your immediate financial needs and long-term dreams.

Impact of maximizing returns on overall financial growth

Maximizing returns on short-term investments acts as a catalyst for your overall financial growth. Think of it as putting your money on a fast-track program: the better the returns, the quicker your money grows, accelerating your journey towards financial milestones. This doesn’t just mean reaching your goals sooner; it also opens up opportunities to invest more in other areas, diversify your portfolio, and even take calculated risks with long-term investments, knowing you’ve got a solid, fast-growing foundation to back you up.

By prioritizing higher returns on short-term investments, you’re not only securing a safer, more prosperous present but also laying down the stepping stones for future financial freedom and stability.

Strategies to Maximize Returns on Short-Term Investments

The journey toward maximizing returns on short-term investments starts with strategic moves and smart decisions. Whether you’re saving for a dream vacation, planning a big purchase within a year, or just looking to grow your savings more efficiently, adopting a strategic approach to your investment can make a significant difference. Here are some strategies that can help you optimize your returns without locking away your funds for extended periods.

Diversification of short-term investment portfolio

Putting all your eggs in one basket is rarely a good idea, especially when it comes to investing. Diversifying your short-term investment portfolio means spreading your investments across various assets. This strategy reduces risk by ensuring that a poor performance in one investment doesn’t dramatically impact your overall return. Consider a mix of high-yield savings accounts, certificates of deposit (CDs), money market funds, and short-term bonds to diversify effectively.

Importance of research and analysis before investing

Before jumping into any investment, taking the time to research and analyze potential options is crucial. Understand the market trends, the factors influencing returns, and any associated costs or fees. Additionally, evaluate how each investment aligns with your financial goals and risk tolerance. This foundational work will not only prepare you for making more informed decisions but can significantly impact the success of your short-term investment strategy.

Utilizing high-yield savings accounts or certificates of deposit

High-yield savings accounts and certificates of deposit (CDs) are among the simplest options for short-term investors looking for safer places to park their money. High-yield savings accounts offer flexibility and easy access to your funds, with slightly better returns than traditional savings accounts. On the other hand, CDs typically offer a fixed interest rate for a set period and can provide higher returns if you’re willing to lock in your investment for a few months to a year.

Exploring short-term bond investments for better returns

For investors willing to take on a bit more risk for the chance of higher returns, short-term bond investments can be an attractive option. These bonds, including government, municipal, and corporate bonds, typically mature in one to five years and can offer better yields compared to savings accounts or CDs. However, it’s essential to understand the risks involved, as bond prices can fluctuate with changes in interest rates.

Implementing a disciplined investment approach

Consistency is key when it comes to maximizing returns on short-term investments. Set clear investment goals, establish a regular investment schedule, and stick to it. Avoid the temptation to react impulsively to short-term market fluctuations. Instead, stay focused on your investment strategy, regularly review your portfolio, and make adjustments as necessary to stay on track towards reaching your financial goals.

Risks Associated with Short-Term Investments

While short-term investments can be a great way to grow your savings without committing to long-term holdings, they do come with their own set of risks. Understanding these risks and knowing how to navigate them can help you protect your investments and maximize returns.

Understanding risks involved in short-term investments

Short-term investments are not immune to risks, including market volatility, interest rate fluctuations, and inflation. Market volatility can lead to sudden changes in investment value, while interest rate changes can affect the profitability of bonds and savings accounts. Inflation can also eat away at the real value of your returns, making it crucial to choose investments with rates that outpace inflation.

Strategies to mitigate risks while maximizing returns

Mitigating the risks of short-term investments requires a balanced approach and strategic planning. Here are some strategies to consider:

– Stay Informed: Keep abreast of economic indicators and market trends that could affect your investments. This knowledge can help you make timely adjustments to your strategy.

– Quality over Quantity: When investing in bonds, prioritize those with higher credit ratings. They tend to carry a lower risk of default.

– Diversify: As mentioned earlier, diversification can spread risk. Consider a mix of investment types to buffer against market fluctuations.

– Consider Laddering CDs: Instead of investing a lump sum in a single CD, divide it into several CDs with staggered maturity dates. This strategy can provide regular, accessible returns and reduce risks related to interest rate changes.

– Set Aside an Emergency Fund: Keeping a portion of your savings in a highly liquid form, like a high-yield savings account, ensures you’re not forced to withdraw from your investments prematurely at a loss.

By adopting these strategies, you can navigate the complexities of short-term investments more safely and effectively. Remember, every investment carries some level of risk, but with careful planning, research, and a disciplined approach, you can maximize your returns while keeping those risks in check. Whether you’re new to investing or looking to refine your strategy, taking these steps can lead you to more fruitful short-term investment outcomes and contribute positively to your overall financial health.

Monitoring and Adjusting Short-Term Investment Strategies

Investing, especially on a short-term basis, isn’t a set-it-and-forget-it kind of deal. It’s more like steering a boat in a dynamic river – you need to be aware and adjust as you go. Whether you’re a novice dipping your toes in the investment waters or a seasoned investor, understanding the importance of monitoring and making timely adjustments to your investment strategies can significantly impact your ability to maximize returns.

Importance of regularly monitoring short-term investments

Regularly keeping an eye on your investments allows you to catch the pulse of the market and your specific investments’ performance. It’s like checking the weather before you head out; it prepares you for what’s to come. By monitoring your investments, you can quickly identify when a particular asset is underperforming and assess whether it’s a temporary dip or a long-term trend. This proactive approach helps prevent potential losses and capitalize on emerging opportunities. Remember, in the world of short-term investing, information and speed are your best allies.

Strategies for adjusting investment plans based on market conditions

When the market shifts, which it inevitably will, having a strategy to adjust your investment plan is key. Here are a few strategies you might find useful:

– Stay Informed: Keep up with financial news, market trends, and economic indicators. Knowledge is power, and being informed helps you make more educated decisions.

– Diversification: Don’t put all your eggs in one basket. Spread your investments across different assets to minimize risk. If one investment is faltering, another might be flourishing.

– Set Stop Loss Orders: These are designed to limit an investor’s loss on a security position. If an investment starts to plummet, a stop-loss order can prevent major financial damage.

– Be Ready to Pivot: Flexibility is crucial. Be prepared to shift your focus to more promising opportunities as they arise.

– Seek Professional Advice: Sometimes, it’s best to consult with a financial advisor. They can offer personalized advice tailored to your financial situation and goals.

Case Studies: Successful Examples of Maximizing Returns on Short-Term Investments

Looking at real-life examples can be incredibly insightful and inspiring. Understanding how individuals or companies have navigated the complexities of short-term investments to achieve success can offer valuable lessons and perhaps, a blueprint to tweak and apply in your own investing journey.

Real-life examples of individuals or companies who effectively optimized returns on short-term investments

Example 1: Tech Stock Windfall

A savvy investor recognized early signs of a technology company about to launch a groundbreaking product. By investing heavily just before the product launch and selling shares at the peak of market excitement, the investor made significant gains in a matter of months.

Example 2: Real Estate Flipping

A real estate enthusiast with an eye for potential acquired a distressed property in a recovering neighborhood. After minimal renovations, the property was sold at a premium, all within a year, showcasing how understanding market dynamics can lead to lucrative deals.

Example 3: Currency Trading

An individual with a keen understanding of currency markets capitalized on fluctuating exchange rates. By closely monitoring economic indicators and geopolitical events, they were able to buy low and sell high, securing profitable returns in a short period.

Lessons learned from successful investment strategies

What can we take away from these examples? Here are a few key lessons:

– Research is Key: In-depth knowledge of the market and specific investment opportunities can significantly increase your chances of success.

– Timing Matters: Especially in short-term investments, buying and selling at the right time can make all the difference.

– Risk Management: Wise investors always have strategies in place to manage risks. They know when to cut losses and when to let profits run.

– Adaptability: Successful investors are always ready to adapt their strategies based on new information and changing market conditions.

– Patience is a Virtue: Even in short-term investing, sometimes you need to wait for the right moment to make your move.

By integrating these insights and lessons into your own investment strategy, you can be better prepared to navigate the complexities of short-term investing. Remember, knowledge, diligence, and adaptability are your most valuable assets in the quest to maximize returns on short-term investments. Start small, stay informed, and don’t be afraid to adjust your course as you learn and grow in your investment journey.

Conclusion

Recap of key strategies to maximize returns on short-term investments

To boost your short-term investment gains, remember to diversify your portfolio, keep an eye on interest rates, consider using online savings accounts and short-term bonds, and reassess your investments regularly for better alignment with your financial goals. These strategies can significantly impact your returns without locking you into long-term commitments.

Encouragement for readers to apply these strategies for better financial growth.

Now that you’re equipped with these practical strategies, it’s time to put them into action. Remember, every step you take towards optimizing your short-term investments moves you closer to your financial goals. Go ahead, apply these tips, and watch your financial health grow. Your journey towards better financial growth starts with a single step. Embrace these strategies, and let’s make your money work harder for you!