Introduction to Top Five Defence Stocks

The stocks of defense have received a lot of attention in recent times. With tensions on the rise and nations increasing their defense budgets investing in this field is becoming increasingly appealing. This guide will show you how you can invest in Top Five Defence Stocks, even if you have little money.

Why Invest in Defence Stocks?

The defence industry offers unique investment opportunities. The governments of the world allot large budgets to defense, providing a consistent income stream for businesses that operate in this area. Furthermore, technological advancements and geopolitical issues make defense stocks a reliable investment.

Top Defence Stocks to Consider in 2024

Making sure you invest in the right stocks is essential to maximize return. Here are a few of the best defensive stocks to take into consideration:

- Hindustan Aeronautics Limited (HAL)

- Bharat Electronics Limited (BEL)

- Bharat Dynamics Limited (BDL)

- Mazagon Dock Shipbuilders Limited (MDL)

- Paras Defence

Hindustan Aeronautics Limited (HAL)

HAL is one of the major players in the Indian defense sector. It is a leader in the development, design and production of helicopters, aircrafts and other related systems.

- Established in 1940

- Headquartered in Bangalore

- Book for Strong Order

- Government support

Bharat Electronics Limited (BEL)

BEL is a key participant in the Indian defense sector. The company is focused on the production of electronic devices that are advanced to support the military.

- Established in 1954

- Headquartered in Bangalore

- Variety of product lines

- Solid R&D capabilities in R&D

Bharat Dynamics Limited (BDL)

BDL is a top manufacturer of missiles and ammunition systems. BDL plays an important part in the defense capabilities of India.

- Established in 1970

- Headquartered in Hyderabad

- The company specializes in missile systems.

- Potential for exports that are strong

Mazagon Dock Shipbuilders Limited (MDL)

MDL is a renowned shipbuilding yard located in India. The company designs and builds submarines and warships to the Indian Navy.

- Established in 1934

- Headquartered in Mumbai

- Book of Strong Order

- Government assistance

Paras Defence

Paras Defence and Space Technologies (PDST) is a private sector company that is principally involved in the development, design manufacturing, testing and manufacturing of a wide range of defense and space engineering solutions and products. The company is a part of four key segments: Defence & Space Optics, Defence Electronics, Heavy Engineering and Electromagnetic Pulse Protection Solutions.

- The company specializes in high-tech space and defence products

- The company was established in 1979 and has its headquarters in Navi Mumbai

- It focuses on optics, electronics and defence systems.

- Strong R&D capabilities, diversified product portfolio

How to Begin by Investing in the Rs25?

- One of the most attractive advantages of investing in defence stocks is the fact that you can begin with a tiny amount. Here’s how to begin:

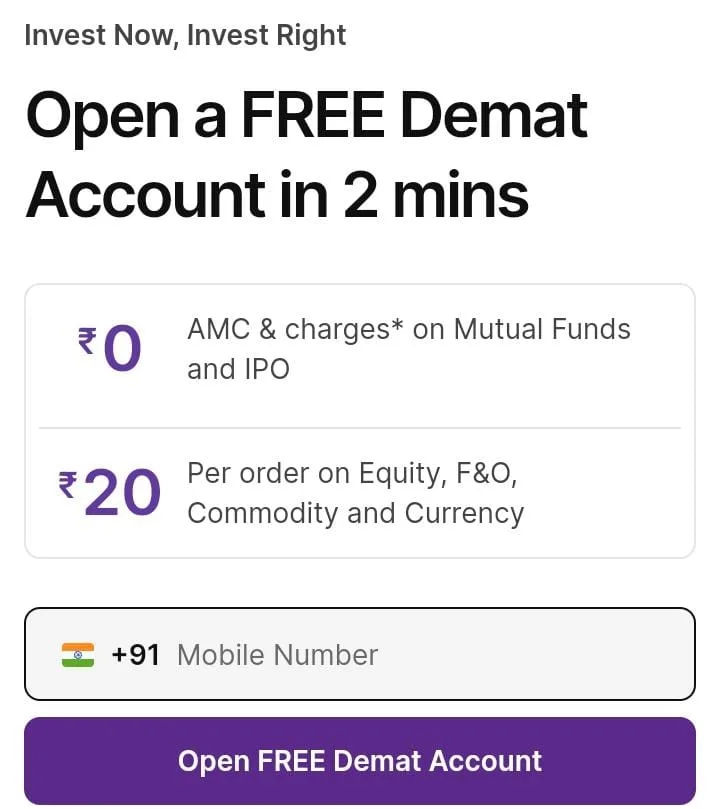

- Create an account with a brokerage

- Find a reliable broker

- Choose one of the mutual funds Which you want to invest in

- Start small with a few drops

Here are Some Defence Sector Mutual Funds

If you’re looking for a diverse method, think about the possibility of investing in mutual funds that concentrate on the defence industry. They pool funds from several investors to create an array of defense stocks.

Top Mutual Funds to Consider

Here are a few mutual funds that are focused on the defense industry:

- SBI Defence Fund

- ICICI Prudential Defence Fund

- HDFC Defence Fund

Benefits of Investing in Mutual Funds

Mutual funds are a great investment option that offers many benefits:

- Diversification

- Professional management

- Lower risk

- Liquidity

Risks associated to Defence Stocks

While investing in stocks for defence could be profitable but it’s important to know the potential risks:

- Geopolitical risk

- Regulation changes

- The dependence on contracts from the government

- Technological disruptions

Strategies for minimizing risks by using Defence Stocks

To reduce risks, think about these strategies:

- Diversify your portfolio

- Stay informed about geopolitical developments

- Make investments in companies that have strong fundamentals

- Speak with a financial advisor

Long-Term Growth Prospects

The defense sector is set for growth over the long term. Budgets for defence technology advancements and geopolitical tensions are all contributing to the sector’s resilience as well as its potential for high returns.

Technological Advancements

Technological advances play an important role in the defense industry. Businesses who are investing in R&D and innovation are most likely to experience an increase in their revenues.

- Machine learning and AI

- Cybersecurity

- Modern weaponry

- Systems that are not manned

Government Policies and Support

Support from the government is essential to the development of the defense sector. Subsidies, policies that are favorable and contracts can greatly enhance the performance of defence businesses.

Conclusion

A portfolio of stocks in the defence sector provides a unique opportunity to profit from a sector that has strong growth potential. By choosing the best mutual funds and stocks using risk-reduction strategies, you will be able to make the most out of your investment.

Disclaimer We do not advise any kind of buying or selling on this blog. Always consult your Financial advisor before investing.

Discover the universe of Stock Market by Opening a Demat Account with your preferred broker and get an investment strategy worth Rs.15,000!

To start investing into Mutual Funds Click Here to create a Demat Account for Free Today!

Frequently Asked Questions

+ Is the defence sector a good one that you can invest your money in?

Yes investing in the defence sector is a wise decision due to the steady expenditure by the government, technological advances as well as geopolitical stability providing long-term stability and growth.

+Why should I invest in stocks of defence?

The investment in stocks of the defence sector provides stability because of the consistent government spending, the potential for long-term growth and also resilience against economic recessions.

+Is it possible to invest in stocks of defence on a budget?

Yes, you can begin investing in stocks of defence with only a modest budget by establishing an account with a brokerage, selecting a reputable broker, and looking into mutual funds that are focused specifically on the defence industry.

+What are the risk factors with investing in stocks of defence?

There are risks associated with geopolitical instability, regulations, reliance on government contracts, as well as the possibility of technological disruptions.