1. What are the methods of investing in mutual funds?

There are many methods of investing into Mutual Funds:

* Single Investment (Lump Sum Investment)

* Systematic Investment Plan (SIP),

* Systematic Transfer Plan (STP),

* Dividend Transfer Plan (DTP),

* Systematic Withdrawal Plan or SWP

These plans are designed to help you select the investment strategy best suited to your income and investment goals. Let’s look at each.

1.1 Single Investment (Lump Sum Investment)

Let’s say that you’ve managed to create a savings account and you are looking for ways to invest and earn money. On the other hand, you’re an employee and you’ve been awarded an adequate award this year. If you need to put it into a fund instead of to spending it on extravagant trips or a expensive gadget. You begin to take look at the various options and come to the conclusion that shared assets can provide an array of options to explore.

You will determine the level you prefer of risk, set your investment goal and start evaluating the various schemes. Once you’ve decided on which schemes you wish to invest in and you have to choose whether you want to put the entire fund into.

There are pros and cons when buying the form of a lump amount. If you purchase the right amount at the right time you can make an enormous amount of money however if you buy in the wrong moment it could put your money in danger. It is crucial that lump sum investors keep a long-term investment plan in place and invest in schemes that have stable record to hedge against this.

1.2 Systematic Investment Plan (SIP)

This is a great option and is a great option for our nation’s people who are working and earning an income that is consistent monthly. A SIP strategy is beneficial to you if you don’t have savings but would like to begin building money to pay for future expenditures. If you decide the mutual fund option using the SIP approach, you could begin saving as low as 500 dollars per month.

Like a recurring deposit that requires you to deposit an amount that is predetermined each month, it adds to your capital total and also earns compound interest. With the SIP investment model units are purchased according to the NAV of the scheme on day when the installment is paid. Since your money is placed in the same scheme in different levels of market which means you’re able to benefit of the rupee cost averaging. In the end, less units are bought during the high market than in the low-market conditions.

1.3 Systematic Transfer Plan (STP)

An STP is specifically designed for people who have funds but don’t wish to invest them in an SIP or lump sum. In the beginning, you can invest your money in a more secure alternative and then gradually transferring them into a higher yield strategy (such like equity) from the same fund house an STP will assist you in regularly placing your money into stocks.

They make use of the benefits that come with SIP through the transfer of a smaller amount to high-return schemes. They also have benefit from lump sum investment without the extra risks. This is the combination of the two and, if utilized properly it can help you achieve reaching your financial objectives. Make plans to transfer dividends

Most the investors know about an Dividend Reinvestment Plan (DRIP) in which the dividend is returned to the scheme which generated it. Dividend transfer plans are like one DRIP in that it functions however, its structure is a bit different.

1.4 Systematic Withdrawal Plan or SWP

While this could be more a withdrawal method as opposed to an investment one like the name implies we thought it was necessary to include as managing one’s requirements in terms of expenses and needs is the main purpose of investing.

Imagine that you work hard to save money and then invest in it over the course of your life to create a strong nest eggs. You’ll receive your pension you plan to receive at retirement and will have a solid amount in your savings account. But, you’re not great in budgeting and end with spending money on things which aren’t essential. This means you risk running out of money and then running out of funds to invest in or save. It’s not the most good idea.

2. How can I withdraw funds in mutual funds?

If you made your investment through a distributor or broker You can take funds from mutual scheme funds. You can request withdrawal by contact your broker.

The withdrawal procedure is simple. There are a variety of methods to exchange your money.

2.1 With the Assistance of a Distributor or Broker

If you have invested through a distributor or broker You can take funds from mutual scheme funds. You can request withdrawal by contact your broker. If you wish to withdraw your money in person then you need to fill out and fill out a withdrawal request form. The form is delivered directly to Asset Management Company by the broker.

However you are able to redeem your funds online when the broker offers an online service via an online website or an mobile app.You have the ability to access to your account with a mutual fund, choose the option to withdraw and then enter the amount of units you wish to withdraw, and then your request will be processed within a few hours.

2.2 Through the Company for Asset Management

With AMC You can also redeem the mutual funds plan in a single transaction. You can make a request for withdrawal in person at the AMC branch or make it on the internet. To get justice, all you have to do is go to AMC’s official website, or download their mobile app.

2.3 With the Assistance of Transfer Agents and the Registrar

With the help of R & T Agent, they can assist you in investing with mutual funds, and also withdraw from the funds. You can take your money from R&T Agents by making a withdrawal request in person, or on the internet.

2.4 Through Your Trading and Demat Account

You may also take money through mutual fund funds you invested in using an Demat or trading account. Log into your account, choose the amount you wish to withdraw and make a request to verify the investment in your mutual fund. Once your request has been verified, the redemption is processed and funds will be transferred to the account associated with it.

3. The difference in SIP in comparison to Lumpsum Investment:

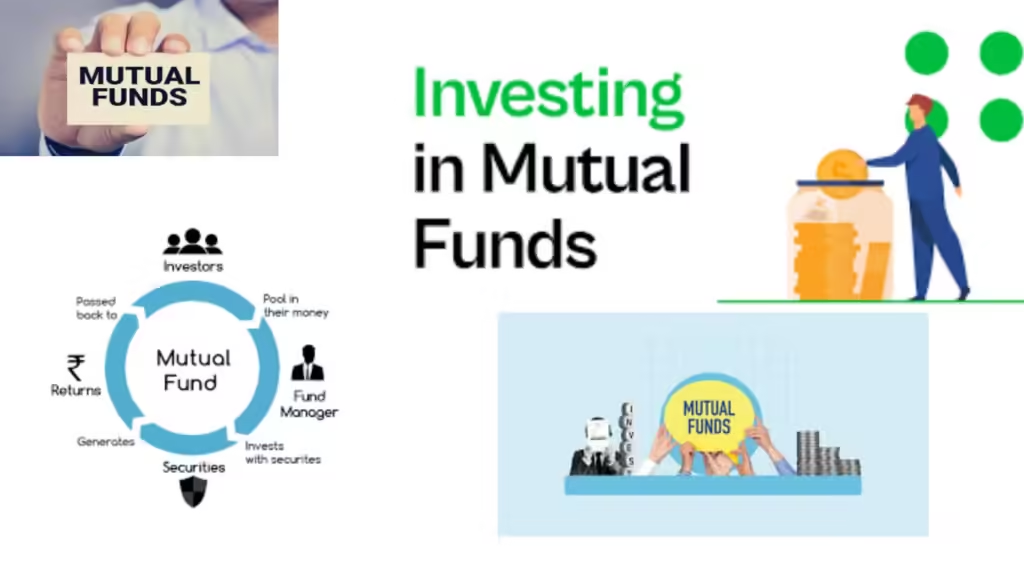

Mutual funds are described as a fund that is sourced from a variety of investors. The fund is then invested in stocks, bonds as well as other asset classes in the form of securities. The lump-sum and SIP investment are two more methods of investing into mutual funds. Based on a variety of aspects, investors can decide to invest in an investment plan that is systematic (SIP) or pay an one-time payment.

Find out the difference between these two ways in investing.SIP and lump sums will also be discussed in this article.

3.1 How Does a SIP Investment Work?

Before we discuss the distinctions of SIP as well as lump sum mutual funds it is important to know what an SIP is. The systematic plan for investment, referred to as an SIP is a way for investors to frequently allocate a tiny amount in money towards their chosen mutual funds. This is a methodical way to systematically allocating certain amounts of money in accordance with the title. It could occur every half-year, each quarter, each month, etc.

A set amount per month is taken from an individual’s account at the time an investment plan that is systematic is in place. Thus, investing regularly in this way can help in achieving the financial goals of one’s choice.

A well-planned investment strategy permits investors to spread their investments over time, as opposed to a single lump amount. SIPs enable you to begin investing in MFs with no huge amount of cash. This helps in establishing a sense of financial responsibility as time passes.

3.2 What’s an investment made from Lumpsum?

When investing in a lump sum that investors make all their funds in one go to obtain the amount that they wish to purchase. If a fund’s net asset value, or NAV is lower, this type of investing can be more profitable. A lower NAV allows investors to purchase greater units in this case. A higher NAV however, on the other on the other hand, requires investors to purchase less units.

Let’s look at the difference in between SIP and lump sums now we’ve established the basic idea of investment methods.

4. A comparison between lump sums and SIP is presented in the following:

| The Basis for Comparing | SIP | Lumpsum |

| Need to Keep an Eye on the Market | Because they are able to enter different market cycles throughout their SIP time, investors should be aware of the market’s performance regularly | Since the lump sum investment is usually designed for a long-term investment investors don’t need to monitor the market. |

| Flexibility | In comparison to lump sum options, SIPs offer more flexibility in terms of investing. | Investments in Lumpsum are not flexible. |

| Response to Volatility in the Market | SIPs aren’t able to handle market volatility. | Investments in Lumpsum are quick to respond. |

| Financial discipline training | When investors begin to develop the habit to invest in a structured method, this investment strategy can help to bring financial discipline to their lives. | Because the investment is made in one session It does not foster the discipline required for this. |

4.1 Which is Superior?

There are numerous advantages to lump sum and SIP investments. Making a decision between them can be a challenge for investors. However knowing the differences between these two will help you make an informed decision.

The main difference between a lumpsum venture as well as a taste is in the earnings. When investing for a single time individuals only allocate funds one time. But, they frequently put money into an SIP.

An SIP is a preferred choice for many individuals because of its emphasis upon financial discipline. An investment in lump-sum in contrast is one that requires the allocation of funds all at once therefore this is not the situation.

In addition, people should consider some important aspects in deciding on the best investment strategy. The kind of fund is the most important factor, as well as the amount that can be invested, the investment objectives for investors and investment objectives are a few instances of these aspects.

A comparison of SIP and lump sums is now completed. In deciding on any of the investment options prospective investors need to consider the previous factors.

5. Mutual Fund Investment Platform:

Funds that are sold directly to customers by AMC are referred to by the name direct mutual funds.AMC doesn’t provide the broker that distributes the direct mutual fund commissions or incentives. The savings for customers are because of this. In comparison to conventional mutual funds, it result in greater returns.

5.1 Broker who offers mutual funds direct

Direct mutual funds may be provided by several stock brokers online in India which include Zerodha, 5paisa, Groww along with Paytm Money. They offer the mobile app and a web site for their own direct mutual funds platform called Zerodha Coin. Zerodha is one of the brokers that offers a an investment in mutual funds that is free. A flat rate per deal is due by the other brokers, including 5paisa.

If you live in India, Zerodha Coin is the best application for investing directly into mutual funds. There aren’t any direct mutual funds provided by Upstox. Groww is among the biggest platforms for direct mutual fund investment.

5.2 The Best App for Direct Investment in Mutual Funds

Broker Fee for Demat Account Opening AMC Demat Account

Alice Blue Rs.0 Rs. 400

Tradeplus Rs.0 Rs. 0

Zerodha Rs.0 Rs. 300

Groww Rs.0 Rs. 0

5paisa Rs.0 Rs. 300

PayTM Rs.0 Rs. 0

6. Conclusion:

For investors mutual funds are considered to be among the top investments available. Investors can pick from a range of mutual funds, however prior to making a choice they should take into consideration their preferences and the risk they are willing to take.

A lump-sum investment or an all-in-one plan. SIP, also known as the systemic investment program, Plan for Symmetric Transfer or STP.DTP and the Dividend Transfer Plan,