Mutual Funds Explained in Simple Terms.

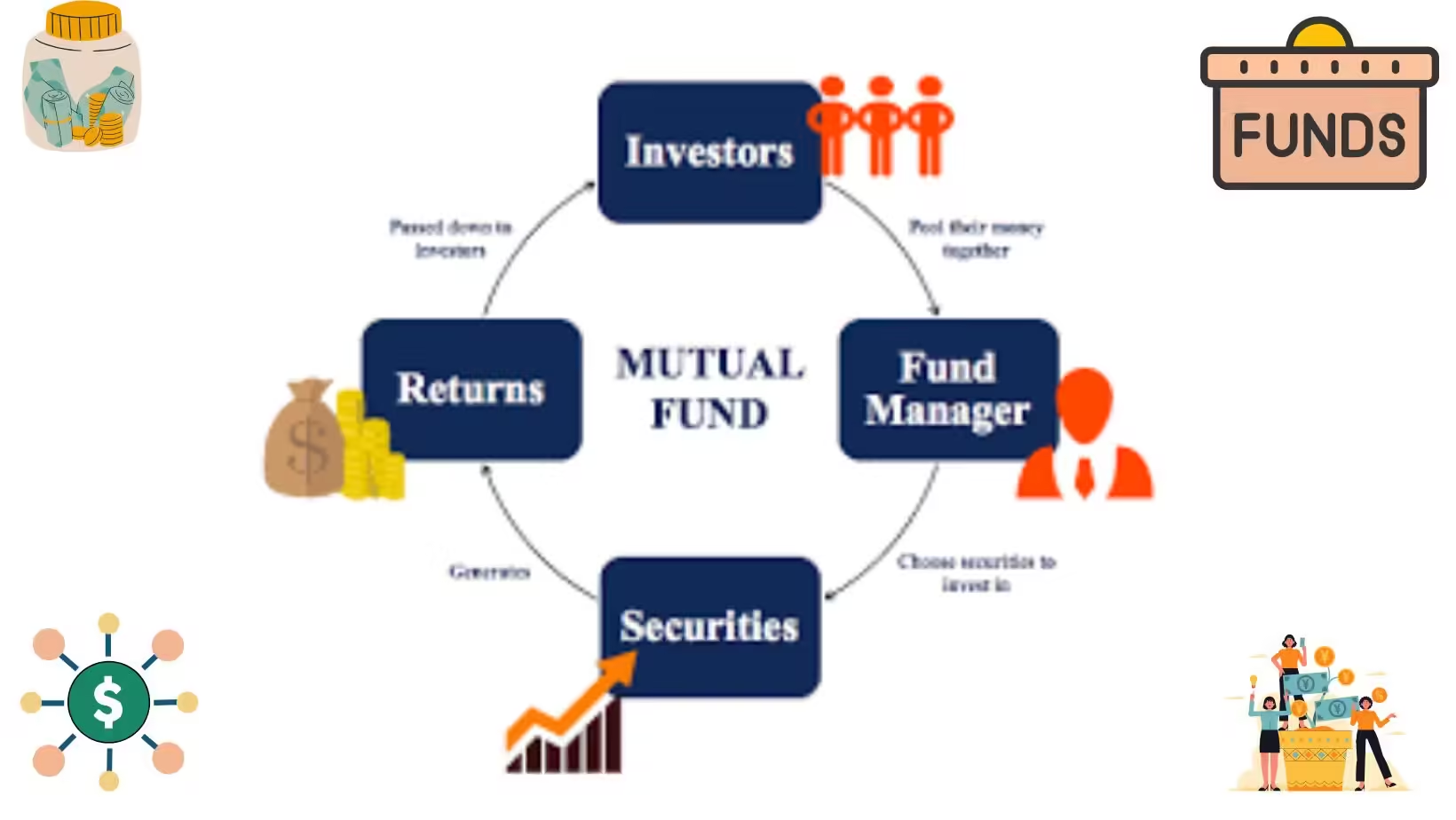

A fund of investments that pools the funds of multiple investors and utilizes it for the purchase of bonds, stocks or other kinds of security can be referred to as a mutual fund. The aim of the mutual fundis to offer investors the opportunity to invest in a wide range of investment options, which will assist in lowering risks and improve the chance of earning dividends.

There’s no doubt that you’ve heard about the slogan on TV as well as on the web about Mutual Funds being subject to market risk.

Does Mutual Fund safe? What are the risks associated in Mutual Funds?

Today, we’ll help you understand the many factors related to Mutual Funds in detail through our Best Mutual Fund Investment Guide on this page. It will inspire you to and confident in investing Mutual Fundsand understand the advantages that come with Mutual Funds investment and discover the reasons what the reason Indians continue to prefer Mutual Funds.

TIP: Are you worried about investing with Mutual Funds? You can look over our Mutual Funds Basics here.

Easy Link: https://sbimfinitiatedtrxn.page.link/fDt1BuXj1KnAamRs5

SBI InvestEasy App: https://2aia0.app.link/ICV8MjUyxLb

Sbi MF Plan: https://pallabrouth.in/sbi-mutual-funds/

MutualFund: https://pallabrouth.in/mutual-funds/

Nfo: https://pallabrouth.in/nfo/

Bonds: https://pallabrouth.in/bonds/

Types of Mutual Funds in India

To comprehend the various kinds of mutual funds that are available in India it is essential to understand passive as well as active mutual funds.

Active vs Passive Mutual Funds

| Parameter | Active Mutual Funds | Passive Mutual Funds (e.g. Index Funds) |

| Definition | Mutual funds that are run by a group of portfolio managers, who try to perform better than a benchmark index with stock selection and strategies for market timing. | They track the performance of benchmark index such as that of the S&P 500, by holding an array of securities closely matched to what is in the index. They are managed passively. |

| Objective of investment | To outperform a benchmark index. | To be able to compare the performance the benchmark index |

| Portfolio management approach | Actively controlled | Management through passive |

| Fees | The average is the higher | The majority of the time, they are lower |

| Possible returns | It could be greater or less than the benchmark index. | It is expected to be close to the return of the benchmark index. |

| The suitability of HTML0 for investors | It may be a good option to investors willing to pay more fees in exchange to increase the chances of beating the market. | It is a good option for those seeking a cost-effective method to diversify their portfolios and to match the performance of a specific market or segment of the market. |

- Equity Mutual FundsEquity mutual funds have an extensive portfolio of shares and are designed to give investors access to the stock market.

- Debt Mutual Funds:Debt mutual funds invest in a range of fixed-income bonds, including bond issues for corporations, government bond,and other money-market instruments.

- Balanced Mutual Funds If you are asking whether mutual funds are safe? It is a good choice for the person who is concerned.

The balance mutual fundinvest with a mixture of bonds and stocks. They can provide investors with growth and income. They are a good choice for those who are looking to get the best of both growth and security in their portfolio.

- money market mutual fundsMoney market mutual funds are invested in the short-term and highly liquid assets including the treasury bill and commercial papers. These funds are made to give investors an investment with low risk.

- Index mutual fundsIndex mutual funds are created to give investors identical returns as the index they are based on and typically have fewer fees as compared to actively managed mutual funds.

Index mutual funds can also be defined as investments which track the performance of specific market index, like for instance, the S&P 500 or the index of the NASDAQ composite.

Within the context of the Indian market, a few possible indices index funds could track are those of the S&P BSE Sensex and the NSE Nifty 50.

- Mutual funds in the sector:Sector mutual funds make investments in specific sectors or industry such as healthcare, technology or finance.

Investing in Mutual Funds- Features of Mutual Funds

This article will highlight the characteristics associated with Mutual Fundsthat will help you understand the reasons why individuals living in India might make investments in mutual funds which includes

- The convenience of investing with mutual fundsis usually more straightforward and efficient than buying individual securities. It is easy to purchase or sell mutual funds via the internet or by contacting an advisor in the financial sector.

- Tax advantages:Some types of mutual funds, like ELSS (Equity linked Savings Scheme) funds, provide tax advantages to those who invest in them. Investments in ELSS funds that exceed the limit of INR 1.5 lakhs per year qualify for tax-free deduction as per Article 80C in the Indian Income Tax Act.

- Income regular:Some fund types, including those with debt , are designed to offer investors an ongoing stream of income. This is especially appealing for investors or retirees who want steady income.

Are you aware?

Mutual Funds Investment involves multiple market players that enable the operations of Mutual Funds possible. In addition that we’ve AMCs and Custodians as well as Sponsors and Boards, Registrars and transfer agents with the same roles to perform.

There are many people who have one question on their mind- which mutual fund to put money into?

The solution is Index Funds

Index Funds- why they’re well-known.

- The cost of these companies is low due to their passive management.

- They provide diversification by offering an array of investments.

- They offer easy, stress-free investments.

Index Funds vs. Mutual Funds

Mutual funds and index funds are two types of investment vehicles which allow buyers to pool their funds together to create diversifying portfolios of securities. There are however some fundamental differences between these two:

- Strategy for investing: Index funds are controlled passively and are able to track the market’s index however mutual funds can be either actively or actively managed.

- Diversification The two types of mutual funds provide diversification. However, mutual funds can offer greater flexibility in the kind of securities they offer.

- Costs and fees: Index funds generally are less expensive in terms of costs for management and fees when compared with the actively-managed mutual funds.

- Efficiency in taxation:Index funds may be more tax efficient due to their lower turnover as well as the absence of frequent selling and buying of securities.

How to Invest in Mutual Funds

There are a variety of methods to make investments in mutual funds such as by opening an account with a brokeror in conjunction with an financial advisor. These are the steps for buying mutual funds

- Find out your investment objectives:Before you start investing in mutual funds, you need to know your financial objectives and your risk tolerance. This will help you understand an idea of what time to put your money into the mutual funds?

- Opening an account at a brokerage:If you don’t already have one, you’ll have to create a brokerage account (Shoonya the very first Zero-Commission Trading Platform in India gives you this) for the purpose of investing with mutual funds.

- Search for mutual funds:Once you have a brokerage account, it is possible to explore mutual funds that are in line with the goals of your investments. There are numerous resources to assist you in finding the most efficient mutual funds that are available online, such as financial advisers and research tools.

- Pick the mutual fund you want to invest in:After you’ve identified some mutual funds that meet your goals for investing It’s now time to select your funds. Take into consideration factors like the fund’s efficiency fee, risk, and fees amount.

- Put money into the mutual fundOnce you’ve selected the mutual fund you want to invest in and have decided to put them into the fund, you’re now ready to make an investment. This can be done on the internet through an account with your broker or with a financial adviser.

Are Mutual Fund safe? Does it have a regulation from SEBI?

Absolutely, Mutual Funds investment is secure because SEBI (Securities and Exchange Board India) is a key function in safeguarding the rights of investors in mutual funds in India.

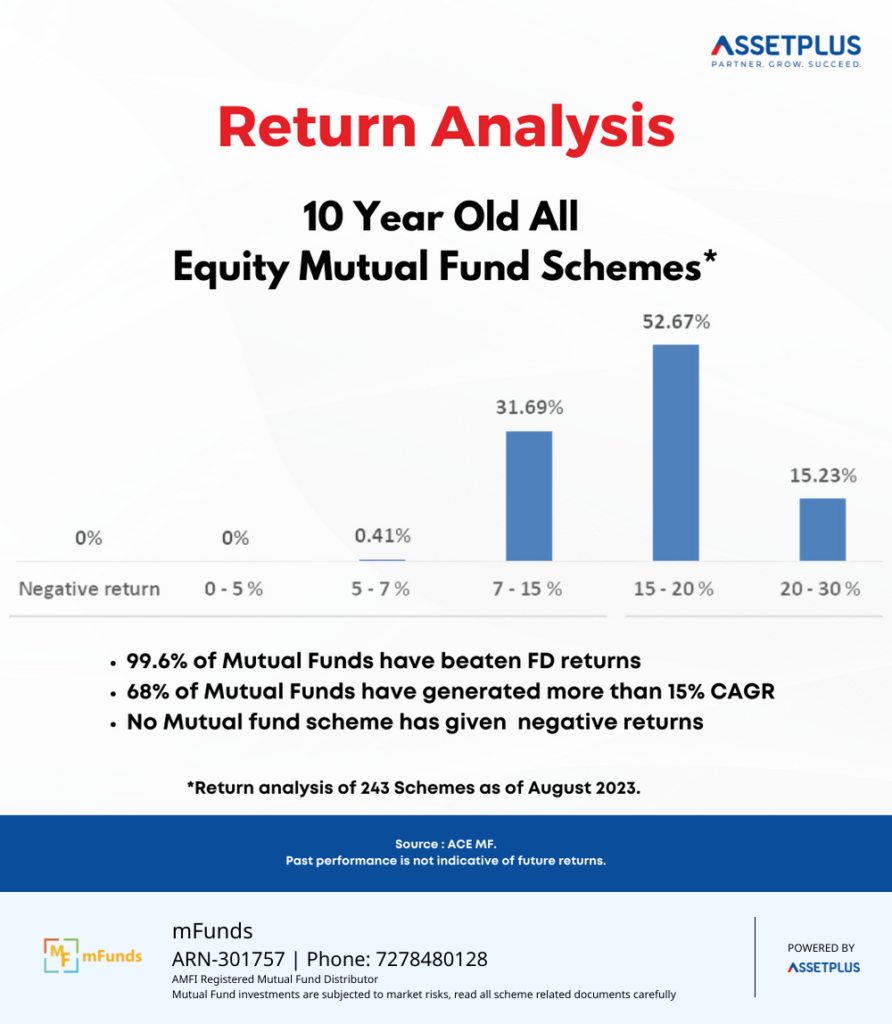

Do Mutual Funds Give Good Returns?

The return on mutual funds are subject to a wide range dependent on the fund as well as the current market environment. The general rule is that mutual funds can offer investors the benefit of a mixture of capital appreciation and income.

What is the Lock-in Period for Mutual Funds?

The lock-in time of mutual funds within India generally lasts for three years. The reason for the lock-in is to promote longer-term investments and deter traders who trade in the short term.

Pros and Cons of Mutual Fund Investment

We will now take a look an examination of the advantages and negatives of the investment with Mutual Funds:

Advantages of Mutual Funds

- DiversificationMutual funds give investors access to a broad range of securities that helps reduce risk as well as increase the possibility to earn profits.

- Professional managementMutual funds are run by experienced fund managerswho have the responsibility of selecting the investments in the fund’s portfolio.

- It is convenient to invest with mutual funds generally easier and less time-consuming than the purchase of individual securities. Investors can trade and buy mutual funds on the internet or by contacting an advisor in the financial sector.

Disadvantages of Mutual Funds

One of the downsides of mutual funds comprise

- Costs for Mutual fund charges tend to be on the high side. You should carefully think about the costs when choosing an investment fund. When deciding which one to choose it is recommended to look through the most effective Mutual Funds that you should consider investing in India.

- Risk:Like any investment, the risk of mutual funds is one aspect that can’t be overlooked. Your mutual fund investmentmay change over time and there is a chance that you lose money.

Tips-You ought to definitely check out this “best time to invest in a mutual fund,”

Most Popular Mutual Funds in India.

Mutual funds that are closed-ended or open-ended. funds:

- Mutual funds with open-ended terms:Open-ended mutual funds comprise funds that are always available to purchase or redeem. Investors are able to purchase and sell the shares of open-ended mutual funds at any point in time. In addition, the fund has to purchase shares back at the present Net Asset Value (NAV).

- closed-ended mutual fundsClosed-ended mutual funds can only be offered for sale during an offering time. When the period of offering has ended and the fund has been open to new investors, and the shares trade via an exchange. Mutual funds that are closed could trade at a higher or at a discount to their NAV on the basis of the demand and supply.

Ready to supercharge your financial future? The power of compounding is that it multiplies your money over time, where your earnings generate even more earnings. Start early, and let compounding work its wonders on your investments, paving the way for financial prosperity.

Referral Link:

Tax-Saving Mutual Funds in India

In India mutual funds that provide tax-free benefits to investors are referred to as tax-saving mutual funds. A few of the most popular types of tax-saving mutual funds that are available in India are:

| NO. | Type of Mutual Fund | Description | Tax Benefits |

| 1 | ELSS (Equity linked Savings Scheme) the funds | Mutual funds are invested in a variety of stocks | Funds invested in ELSS accounts up to the limit of INR 1.5 lakhs per year can be tax deduction as per Section 80C in the Indian Income Tax Act |

| 2 | Fixed income tax saving fund | The mutual fund invests in a range of fixed-income securities like government bonds, corporate bonds and | They may also provide tax advantages, contingent on the specifics of the fund |

| 3 | NPS (National Pension System) funds | They are a way to aid investors in saving to fund their retirement. | The investments made in NPS funds can be eligible to deduct tax in accordance with Section 80CCD in the Indian Income Tax Act |

| 4 | ULI (Unit Linked Insurance Plan) money | Mutual funds are tied to insurance policies. | Funds invested in ULIP funds can be eligible for tax deductibility according to Section 80C in the Indian Income Tax Act |

Note:It’s crucial to remember the tax benefits offered by mutual funds may changes, so investors must seek advice from a financial adviser or tax expert for advice regarding how they can maximize the tax advantages of the funds they invest in.

Best Tax-Saving Mutual Fund

When it comes to the most savings on taxes Mutual Fund, it must be the ElSS.

ELSS (Equity linked Savings Scheme) is a form of mutual fund which permits investors to cut back in taxes, while making money from the investments they make. ELSS funds are invested in an investment portfolio that is diverse and come with the same risk and benefits similar to any other equity-based mutual fund.

- One of the biggest advantages for ELSS funds is the fact that earnings are tax-free once they have been held for three years of holding.

- In addition, investment into ELSS accounts in excess of INR 1.5 lakh per calendar year can be tax deduction as per Article 80C in the Indian Income Tax Act.

Want to know the basics of Mutual Funds? Here are some things to be aware of:

- What happens when the mutual fund company goes under?

- What will happen if my mutual funds is shut down?

- What happens to mutual funds after you are NRI?

- Do mutual funds pay dividends?

- Are mutual funds return taxable?

- Five of the best mutual funds specifically designed for seniors

Final Roadmap

Mutual Funds or Stocks?

It’s difficult to determine what is “better” between mutual funds and stocks, as the best approach to investing is determined by the individual’s goals in terms of finances as well as their risk tolerance and time horizon. Each of mutual funds as well as stocks possess their unique features and are ideal for different types of kinds of investors.

Here are a few major differences that exist between mutual stocks and funds:

Mutual funds These are investment instruments that collect money from several investors, and then use the funds to acquire a collection of investments. The funds are managed by experienced portfolio managers however, they typically charge greater charges.

StocksShares that are owned by the public company. It can potentially yield higher profits, however it comes with a higher risks.

In the case of an example, if one is averse to risk and looking for an investment that will last for a long time to save money for retirement, a fund called a mutual funds or index funds could be an appropriate choice since they provide diversification as well as skilled management, at a lesser price.

In contrast the investor who has an excessive risk-taking tolerance and seeks an opportunity to earn higher yields over a short duration, investing in individual shares could be an ideal choice.

In the end, the most effective method of investing is determined by the individual’s financial objectives and tolerance to risk. It is crucial to look at these elements and talk to an experienced financial advisor prior to making any investment decision.