Credit cards are among the most efficient and lucrative methods of paying for purchase. But, picking the Best Credit Cards in India is an overwhelming task as there are numerous credit card choices available in the Indian market. All of them have distinct benefits, features such as rewards, fees, and charges. Which one is right for you in light of your spending patterns, income preference, goals, and preferences?

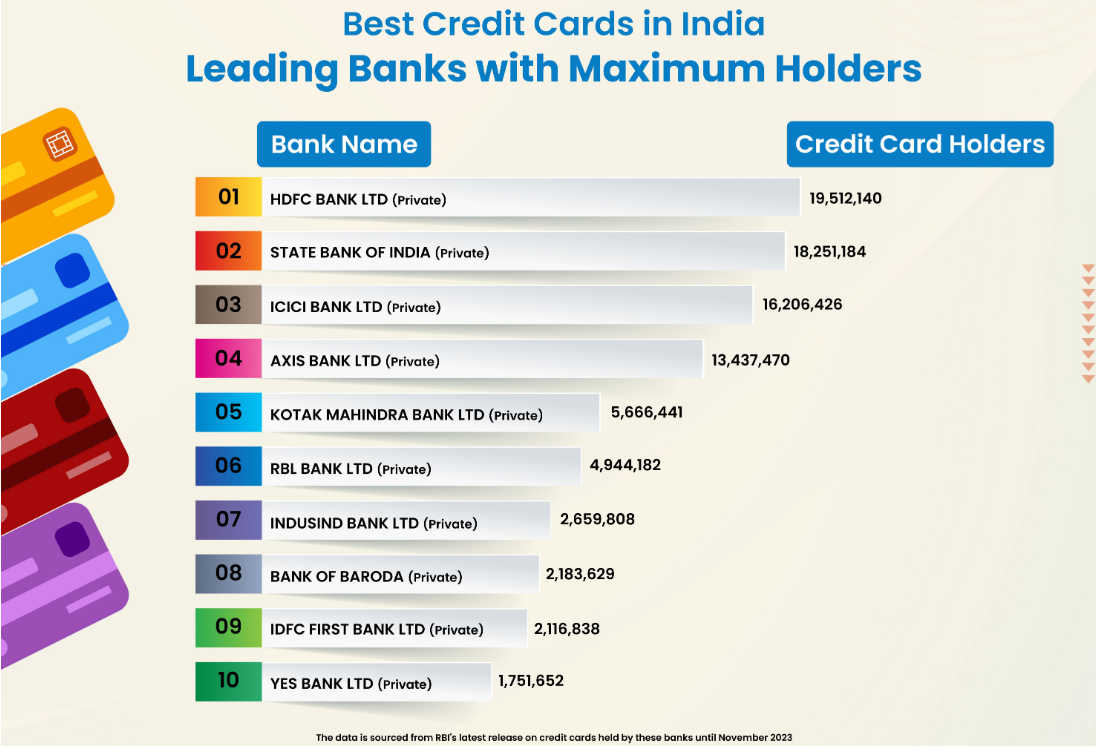

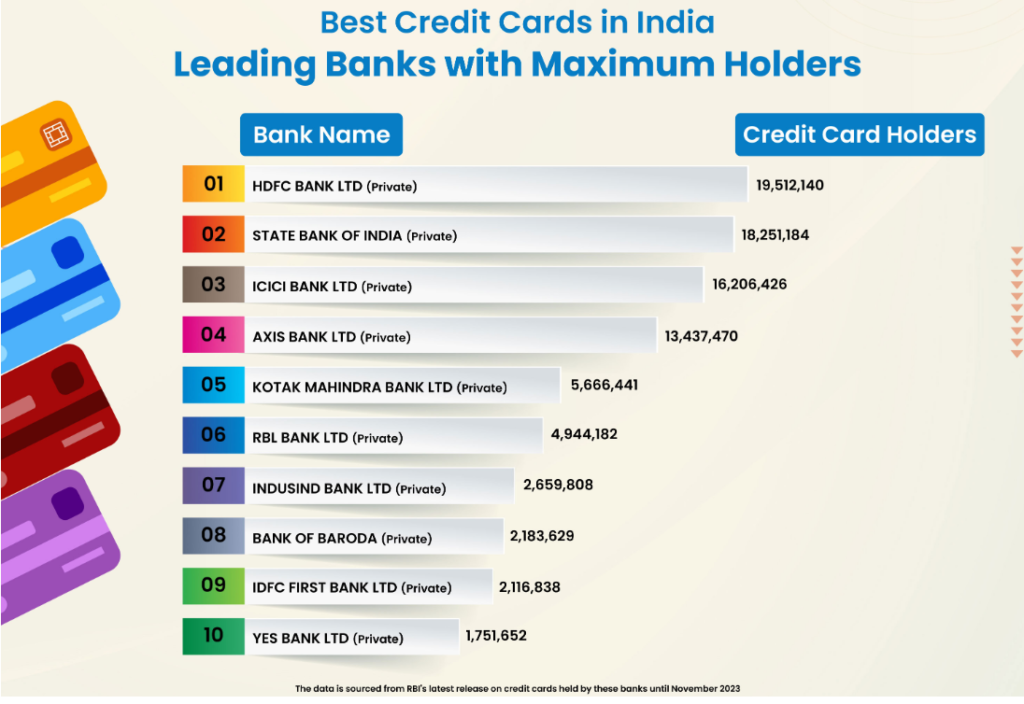

In this article in this blog post, we’ve made lists of the top credit card firms in India as well as their most popular credit cards based upon the people who are currently enrolled in credit cards as per the statistics provided by RBI. It is easy to compare the most reliable credit cards for a salaried people, the top credit cards for online purchases and the most reputable student credit cards and pick the most suitable one to meet your needs with credit.

The Best Credit Cards available in India Best Banks in India with maximum credit card holders

The Best Credit Cards for India The top banks in India with Highest holder

The information has been gleaned from the most recent data is published by RBI for credit cards issued by these banks until November 2023.

Overview of Top 10 Credit Cards in India

1. HDFC Bank Pvt Ltd

HDFC Credit Cards help you manage your costs easy, no matter if you’re planning a hotel stay, or taking a flight making payments on bills, buying online or at a store. They are dependable to cover both large and small costs.

The process of signing to get an HDFC Bank Credit Card comes with special benefits for newly registered cardholders. In addition to additional benefits on annual expenditures that exceed an amount that is specified The card also offers SmartEMI that lets users transform purchases that exceed the amount of Rs2,500 into easy Equated Monthly Instalments that come with attractive interest rates. It also allows quick and secure contactless transactions on the internet and in stores that can be activated using MyCards. For purchases abroad, the selected HDFC Bank Credit Card offers favorable foreign currency markups guaranteeing more savings.

We’ll examine some of the most desirable credit cards available to salaried people as well as students.

Millennia Credit Card

It is believed as one of the most popular credit cards for students from India. The card offers numerous benefits including 5% Cashback for Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber, and Zomato. You can also get gifts worth Rs1000 in the event you spend Rs.1,000,000 or more during each quarter of the calendar, as well as 8 complimentary access at Domestic Airport Lounges every year.

Paytm HDFC Bank Digital Credit Card

Up to 2% Accelerated Cashback on Scan & Pay.

You can earn up to 2% Cashback for Swiggy & Uber spends.

Personalize your card in the way you want.

Credit card with instant issue or virtual credit.

MoneyBack Credit Card

2 reward points per $150 spent. 2x reward points for buying on the internet.

Rewards points redemption can be redeemed as cashback on credit card fees special gifts, cashback, as well as air miles.

Up to Rs250 savings every bill cycle, with a 100 percent fuel surcharge reduction.

2. SBI

The second spot on our top list of credit cards available in India; SBI has some distinct credit card offers:

SBI Card ELITE

Welcome Gift Voucher for at least Rs. 5,000 on joining.

Film tickets are free and valued at around Rs. 6000 per year.

Get Up to 50,000 Bonus Reward Points that amount to the amount of Rs. 12,500/year.

Free membership in Club Vistara and Trident Privilege program.

SBI Card PULSE

- You will receive a Noise ColorFit 2 Max Smartwatch worth the price of Rs. 5,999 after payment of joining fee.

- You can get a 12 month membership to FITPASS and Netmeds FirstPass upon the paying the joining fee and the activation of your card.

- Earn 5X Rewards Points for shopping on Chemists, Pharmacies, Dining and even at the movies.

- Receive an E-Voucher valued at the amount of Rs. 1500 by making retail purchases in the amount of more than Rs. 4 Lakh over the course of a single year.

Doctor’s SBI Card (in conjunction with IMA)

- Professional Indemnity Coverage of insurance worth the amount of Rs. 20 Lakhs.

- Electronic Gift Voucher for the amount of Rs. 1,500 on joining.

- 5X Reward Points on Medical Supplies, Travel Bookings, International Spends, and Doctors’ Day.

- Electronic Gift Voucher for the amount of Rs. 5,500 on annual spendings that are the amount of Rs. 5 Lakhs.

SBI Card ELITE Advantage

Welcome Gift Voucher for at least Rs. 5,000 on joining.

Movie tickets for free valued at the amount of Rs. 6000 per year.

Get Up to 50,000 Bonus Reward Points that amount to the amount of Rs. 12,500/year.

Free membership for Club Vistara and Trident Privilege program.

Doctor’s SBI Card

Professional Indemnity Insurance coverage of 20 lakhs. 20 Lakhs.

Electronic Gift Voucher for the amount of Rs. 1,500 on joining.

5X Reward Points on Medical Supplies, Travel Bookings, International Spends, and Doctors’ Day.

Electronic Gift Voucher for around Rs. 5,500 on annual spendings in the amount of the amount of Rs. 5 Lakhs.

Union Bank Simply SAVE SBI Card

Earn 10 reward points for every rupee. 150 you spend on dining, Movies, Departmental Stores and grocery purchases. Also, get an annual charge reversal once your spend is more than Rs. 100,000 or more. This card is intended to increase your reward points and to make your expenditure more satisfying.

3. ICICI Credit Cards

Find the top credit cards provided by ICICI Bank

Platinum Credit Card

Zero Joining and Annual Fees.

Earn 2 Rewards Points per Rs. 100 you spend, excluding gasoline.

Get 1% fuel Surcharge exemption at HPCL petrol stations.

Coral Credit Card

Take advantage of a discount of 25% for movie tickets two times a month with BookMyShow as well as Inox.

Get One Complimentary Railway and Domestic Airport Lounge Access each quarter.

Enjoy 1% Fuel Surcharge reduction on HPCL Petrol Pumps.

Sapphiro Credit Card

Welcome vouchers worth Rs. 9000+.

Enjoy a Buy One, Get Rs. 500 off the second film ticket, once every month on BookMyShow.

Get Two Complimentary International Airport Lounge accesses each year.

Enjoy four complimentary domestic airport Lounge Accesses each quarter.

Joining Fee: Rs6500+GST, Annual Fee: Rs3500+GST.

The ICICI Bank Credit Card is designed to satisfy your varied requirements. Enjoy exclusive discounts promotions, discount rates, and low costs. With attractive interest rates and a range of EMI options that can be tailored to your personal preferences These cards will help you to enjoy your finances. Make the most of your money-making experience apply now to enjoy the benefits.

4. AXIS BANK LTD

Axis Bank offers various types of credit cards to meet the various financial requirements of consumers, which include films, entertainment traveling, and more.

Many of its most well-known credit Cards for Salaried Class:

- Flipkart Axis Bank Credit Card Buy online with welcome rewards in the amount of Rs 600, along with a fees for joining and an the annual cost of 500 Rs each.

- Neo Credit Card with zero fees for joining or annual charges (limited deal available through selected channels) as well as Indian Oil Axis Bank that gives cashback up to Rs 250 per petrol purchases. The card also comes with a membership and annual charge of 500 rupees each.

5. KOTAK MAHINDRA BANK LTD

Credit cards issued by Kotak Mahindra will not result in extra charges. If however, the bill for credit card cannot be paid on the date due the late payment charge and any applicable GST are imposed. Additionally, interest is added to any unpaid transaction until a payment in part is accepted, and on any balance that remains until the following statement date.

The top Credit Card offers include:

Myntra Kotak Credit Card

Joining Fee: INR 500 | Annual Fee: INR 500

Instant Discount of 7.5%* on Myntra

Cashback of 5%# on our Exclusive Partners – Swiggy, Swiggy Instamart, PVR, Cleartrip, Urban Company

Unlimited Cashback up to 1.25 percent for all other expenditures*

PVR INOX Kotak Credit Card

Joining Fee: Rs 0 | Annual Fee: INR 499

Unlimited* Cinema Tickets One ticket per INR 10,000 that is spent with the card.

20% Instant Discount* on Food & Beverages

5 % Instant Discount* for movie tickets

Kotak UPI RuPay Credit Card

Joining Fee: Nil | Annual Fee: Nil

Earn 3 Reward Points* per Rs100 spent

Benefit from the ease of UPI Card payment using Credit Card

Virtual Lifetime Free Credit Card

Mojo Platinum Credit Card

Joining Fees: INR 1000 | Annual Fee: INR 1000

Earn Unlimited 2.5 Mojo points for every rupee. 100 you spend online, as well as 1 Mojo point for each one rupee. 100 spent on other purchases.

Earn 2500 Mojo points each quarter for spending of 75000.

6. RBL Bank

RBL Bank offers over 25 credit cards in a variety of areas, such as cashback, entertainment, rewards that are rapid as well as travel and lifestyle. The most popular credit cards are one called the ShopRite credit card that offers a discount of 10% for movies and The World Safari card with 0 marksup charges on transactions made in foreign currencies and the Platinum Maxima Plus Credit Card which offers luxurious living and an attractive bonus of 10,000 points, in addition to other options.

The most readily available choices are those that offer LazyPay Credit Card (lifetime free) as well as The Movies and More Credit Card (with 500 rs in rewards for spending a minimum of 15,000 dollars per month) Then there’s The Blockbuster Credit Card, offering four free visits to the domestic airports. Take a look at the top credit cards for Indialounges every year.

7. IndusInd Bank Credit Cards

IndusInd Bank provides various credit cards to satisfy different requirements and financial preferences in India.

IndusInd Bank Nexxt Credit Card

The first in India to have an interactive credit card that allows users to choose from three payment options at point of sale. EMI, Rewards, or Credit. Press a button on the card and the light on the card will illuminate your selected option.

IndusInd Bank Platinum Visa Credit Card

The exclusive lifestyle credit card provides top quality advantages in dining out, traveling as well as shopping. When you spend Rs150 on purchases of all kinds you will get 1.5 rewards points. The idea behind this reward system is to increase the experience overall.

IndusInd Platinum RuPay Credit Card (Enabled on UPI)

The card is compatible in conjunction with UPI and is referred to in the United States as Platinum RuPay Credit Card.

Legend Credit Card

When you use the Legend Credit Card, you get 1 reward point each $100 you pay.

8. Bank of Baroda

Bank of Baroda offers a wide range of cards for credit. Let’s look into a few the options:

Bank of Baroda Vikram Credit Card

specifically made to cater to Defence Personnel and veterans, the BoB VIKRAM Credit Card provides exclusive benefits such as 5X Reward (5 Reward Points with every 100 rupees that you spend) for Grocery, Movies, and Departmental retailers. Furthermore, you will receive three months of free Disney Hotstar subscription upon card registration.

IRCTC BoB Credit Card:

Improve your travel experience through your train journey with the IRCTC BoB Credit Card, providing as much as 40 reward points for every $100 paid on booking tickets for trains via the IRCTC Website as well as the Mobile Application. In addition, you can get 4 reward points every $100 spent on food or departmental purchases, and two reward points when you shop in different types of purchases.

Easy Credit Card

The Bank of Baroda EASY Credit Card is the perfect partner for saving money daily buying. You can earn 5X Rewards (5 Reward Points per 100 rupees spent). 100 you spend) for Departmental shops and movies as well as an 1% fuel surcharge All fuel stations throughout India.

The Bank of Baroda’s credit Cards offer more than just an increased credit limit, however they also give up to 50 days free credit with no interest and amazing rewards points.

9. IDFC First Bank

IDFC FIRST BANK LTD has a range of credit cards crafted for different needs. These are some of the most popular one:

First Wealth Credit Card

- Earn as much as 36 Rewards Points when you shop online per INR 200 you spend.

- Lounge Access Lounge Access: 6 visits a quarter to the international lounges, as well as unlimited visits to international lounges.

- Purchase a Buy One Get 1 Movie Free with booking via BookMyShow.

RESERVE Credit Card

- Earn as many as 24 Rewards Points for every $200 paid.

- Lounge Access 3 visits per quarter to international lounges. six visits per year to international lounges.

- Take advantage of a 25% discount on Movie Tickets that you purchase via BookMyShow (formerly the YES First Exclusive).

ELITE Premium Card

- Up to 12 Rewards Points for every $200 that you spend.

- Lounge Access: Two visits each quarter to local lounges. 3 visits a year for lounges in international locations.

- Get a discount of 25% on movie Tickets that are booked via BookMyShow (formerly YES Premia).

10. YES Bank

Credit cards offered by YES Bank were designed to provide different rewards and benefits to cardholders. There are various types of credit cards including FinBooster RuPay Credit Card and First Corporate Credit Card as well as the YES Prosperity Purchase Credit Card that can be adapted to the different requirements and tastes.

Lifetime-Free Credit Card

Get a credit card that has zero annual or joining costs all the time.

Power of UPI Payments:

Enjoy the ease of making UPI payment directly through the credit card you have.

Accelerated Reward Points:

Get reward points for accelerated purchases not just for UPI transactions, but also on diverse other categories of spending.

Instant EMI and EMI on Call:

Access Instant EMI and EMI On Call options with transactions starting as low as INR 1500. It gives you the an opportunity to manage your costs with ease.

First Wealth Credit Card

Up to 36 Reward Points on Online Spends per INR 200 Spent.

Lounge Access: Domestic – 6 per Quarter, International – Unlimited.

Buy One Get One Free Movie Ticket when you book through BookMyShow.

RESERVE Credit Card

The reward points can be as high as 24 for every Rs200 that you spend.

Lounge Access: Domestic – 3 per Quarter, International – 6 per Year.

25% discount on Film Tickets that are booked via BookMyShow (previously the YES First Special).

ELITE Premium Card

You can earn up to 12 reward points for every Rs200 that you spend.

Lounge Access: Domestic – 2 Per Quarter, International – 3 Per Year.

25% discount on movie Tickets purchased through BookMyShow (previously YES Premia).

Best Credit Cards for Students in India

There are many credit cards specifically made for students from India or with lower or no income or for the intention of traveling overseas. These are the top credit cards designed for students you should look into based on your requirements and your eligibility

1. IRST WOW! Credit Card

- Eligibility Criteria:

- Particularly designed for students who have zero credit score or income proof requirement.

- Exclusive Benefits:

- Get an appealing 7.5 percent interest rate on Fixed Deposits (FD).

- Get 4X Rewards Points for every credit card transaction.

- The ability to access a large credit limit, with no membership or annual fee.

- In the immediate future, 100 100% ATM cash withdrawal amount.

- Security and Bonus Features:

- 811 #DreamDifferent Shield that provides security against theft and fraud.

- A bonus for activation of 500 reward points following the purchase of more than Rs. 5,000.

- Financial Flexibility:

- Cash withdrawals that are interest-free up to 48 hours.

- Credit limit is extended up to 90 percentage of the deposit amount fixed.

- Credit limit details that are transparent and clear when you apply.

2. ICICI Student Forex Prepaid Card

- Enrollment Perks:

- Benefit from a significant membership benefit totaling INR 5,00,000.

- Included is the International Student Identity Card (ISIC) membership worth INR 999.

- You can get a free international SIM card to make international travel.

- You can avail a 20% discount on DHL delivery services.

- Security and Insurance Coverage:

- Complete Card Protection Plus insurance worth INR 1,600.

- Protection for counterfeit or lost cards. Includes liability coverage as high as INR 5,00,000.

3. Kotak Mahindra 811 #DreamDifferent Credit Card

- Unique Features:

- Set up a credit or debit card by making an account that is fixed at Kotak Bank without any annual costs.

- Customized for students, removing the requirement for credit background or proof of income.

- The cashback offers are impressive on your annual expenses.

- Financial Benefits:

- Cash withdrawals with no interest within 48-hour intervals.

- Credit limit of high amount, which is disclosed prior to the date of application, ranging upwards of the amount of Rs. 16 lakhs.

Best Credit Cards for Online Shopping in India

A few of the top HDFC credit cards that are ideal for online shopping include HDFC Millennia Credit Card, HDFC Moneyback+ Credit Card, HDFC Diners Club Privilege Credit Card, as well as HDFC Regalia Credit Card. The cards provide rewards points, cashback discount, as well as other advantages on several internet-based platforms like Amazon, Flipkart, Myntra, Nykaa, etc.

A few of the top SBI credit cards to use for shopping online are Cashback SBI Card Amazon Pay ICICI Credit Card, SBI SimplyCLICK Credit Card and IRCTC SBI Credit Card. They offer reward points, cashback discounts and more for various platforms online including Amazon, IRCTC, BookMyShow, Cleartrip, etc.

A few of the top ICICI credit cards that are ideal for online purchases include Amazon Pay ICICI Credit Card, ICICI Bank Sapphiro Credit Card, ICICI Bank Rubyx Credit Card and ICICI Bank Emeralde Credit Card. The cards provide rewards, cashback points discount, as well as other advantages on many internet-based platforms like Amazon, MakeMyTrip, BookMyShow, Swiggy, etc.

The top Axis credit cards to use for online shopping include Flipkart Axis Bank Credit Card Axis Bank ACE Credit Card, Axis Bank Buzz Credit Card as well as Axis Bank Neo Credit Card.

https://cutt.ly/Kw9iWNET* KOTAK MAHINDRA BANK LTD

The top Kotak credit cards that are ideal for shopping online are Kotak PVR Platinum Credit Card, Kotak Indigo Ka-Ching 6E Rewards Credit Card, Kotak White Credit Card and Kotak Cookies Credit Card. They offer discount points, reward points vouchers, as well as other advantages across a range of platforms, including PVR, IndiGo, Amazon, BookMyShow, Uber, Myntra and more.

The top RBL credit cards to use for online purchases are ShopRite Credit Card, c Icon Credit Card, and Platinum Maxima Plus Credit Card. The cards provide rewards points, discounts vouchers, as well as other advantages across a range of platforms, including Myntra, Nykaa, Marks & Spencer, Reliance Digital, Disney Hotstar, etc.

The top IndusInd credit cards to use for online shopping include IndusInd Bank Legend Credit Card, EazyDiner IndusInd Bank Credit Card, IndusInd Bank Platinum Credit Card as well as IndusInd Bank Avios Visa Infinite Credit Card.

A few of the top Bank of Baroda credit cards that allow online shopping include those offered by the Bank of Baroda Vikram Credit Card, IRCTC BoB Credit Card Some that are specifically designed to be used by army personnel such as the Indian Army Yoddha BoB Credit Card and many more.

The top IDFC FIRST credit card that are ideal for online purchases are the FIRST Millennia Credit Card the FIRST Credit Card for Private Use First Select Credit Card and the FIRST WOW! Credit Card.

A few of the top credit cards from YES Bank to shop online are the The YES FIRST Preferred Credit Card the one of the most exclusive credit cards, YES FIRST Credit Card and the YES Premia Credit Card and the YES Prosperity Edge Card. Card.

Key Features to Consider Before Applying for the Best Credit Card in India

Credit cards offer different benefits which can impact the amount you have to pay as well as the advantages you receive. A few of the things to look out for when making a decision on the right credit card for India include:

* Credit Score:

It is the number that indicates how effectively you’ve made use of credit in the recent past. It could range from 300-900. The higher your score on credit is, the higher your chances are approved to get a credit card, and receive more attractive offers and rewards. It is possible to check your credit score without cost via websites like CIBIL, Experian, or Equifax.

* Annual Fee:

There are credit cards that do not have an annual fees, while other could charge an expensive fee. Be sure to evaluate the cost of the annual fee to the benefits the credit card provides. Sometime, a card that charges a high annual cost may provide greater rewards, discounts or cashback than a card that charges a low or no annual fees.

Limit of credit:

It is the highest amount you are allowed to borrow with your credit card in any moment. It is based on your income as well as your credit score and other aspects. It is important to select the right credit card that has the right credit limit for your lifestyle and spending habits. If the credit limit you have isn’t enough it could mean you aren’t in a position to purchase the things you desire. If the credit limit you have is excessively high it could be tempting to spend more than you can afford and end up in the debt.

* Interest Rate:

This is the cost of interest you are required to pay for the funds borrowed through the credit card. The most common form of expression is an annual percent amount (APR). The rate of interest can differ according to the type of credit card, nature of the transaction and the way in which you pay. Some cards have an interest-free or low rates for a specific amount of time, like six months or twelve months. This could help you save the cost of paying off the balance in that time. If you fail to not settle your debt on time each month and you do not, you’ll be required to pay high interest on the balance.

* Rewards:

The benefits you can enjoy when using the credit card you have. These can be points or miles, cashback vouchers, discounts or additional perks. The rewards you earn can be used in a variety of ways, including travel entertainment, bills, and payment. Certain credit cards provide different kinds of rewards, as well as various ways to earn and redeem these rewards. Choose a credit card that has rewards that fit your interests and life style.

Here are a few things to look out for prior to applying for the perfect credit card for India. Compare different credit cards on the basis of these characteristics and select the one that fits you most.

FAQs | Best Credit Cards for Salaried Persons and Students:

What is the most reputable present credit card for India?

In order to determine which is the top credit card for India take a look at the offerings of Top banks including HDFC, SBI, ICICI such as HDFC, SBI and Kotak Mahindra. Make sure you look into aspects like bonuses, charges, and rewards when looking at the list of the top 10 credit cards, as mentioned in the previous paragraph.Which card has you the greatest benefits when traveling?

The ideal travel credit card differs depending on your preferences and spending patterns. The most popular choices that are available in India are Club Vistara IDFC FIRST, HDFC Superia Credit Card, Axis Atlas, Citi PremierMiles, Niyo Global, etc. But, they aren’t restricted; it is possible to explore other banks to get the best options to meet the needs of your business.What Are The Primary Benefits Of A Credit Card?

Credit cards offer a variety of benefits such as bonuses, credit with no interest security, convenience fraudulent activities, as well as the chance to boost the credit rating. A responsible use of credit and prompt bill payment help to build up a favorable credit rating.